The stocks for former president Donald Trump’s social media company, Truth Social, rose to nearly 50 percent by Tuesday afternoon on its first day on the stock market.

The parent company of Truth Social–Trump Media & Technology Group–went public on Tuesday morning under the ticket DJT (short for Donald J. Trump). After Trump Media merged with Digital World Acquisition, a special-purpose acquisition company (SPAC), Truth Social was able to make a public listing and sell stocks to the public. Digital World’s shareholders voted in favor of the merger Friday, and Trump Media took Digital World’s place on the Nasdaq.

Truth Social’s stock was initially priced at $24 per share on Tuesday morning but surged to $74.32 per share by 2 pm E.T. Before trading commenced on Tuesday, Trump Media held a market value of approximately $6.8 billion. This figure experienced a substantial increase. This remarkable debut has not only increased the value of Trump’s substantial holdings in the company, which accounts for nearly 60 percent of ownership stakes, but has also rewarded Trump supporters who purchased shares with a share of the success.

It seems that Trump’s supporters were so eager to get their hands on a stock in Trump Media that Nasdaq had to pause trading two minutes after it began (via Associated Press). AP reports that many of the investors are either small-time investors trying to support Trump or cashing in on the mania of a mildly successful social media company’s stocks becoming available.

Truth Social launched in February last year after Trump was banned from major social platforms like Facebook and X (formerly known as Twitter) following the Jan. 6 insurrection in the U.S. Capitol. Despite experiencing glitches initially, the app swiftly ascended to Apple’s list of most downloaded free apps. It quickly established itself as a right-leaning echo chamber for conservative political commentary.

A day before, Trump Media CEO Devin Nunes, a former House Republican, said, “As a public company, we will passionately pursue our vision to build a movement to reclaim the Internet from Big Tech censors.” However, investors are betting on a company that lost $49 million in the first nine months of 2023, brought in $3.4 million in revenue, and then had to pay $37.7 million in interest expenses. Despite these losses, Trump told reporters that “Truth Social is doing very well. It’s hot as a pistol and doing great.” On Tuesday, he posted “I LOVE TRUTH SOCIAL, I LOVE THE TRUTH!” on the platform.

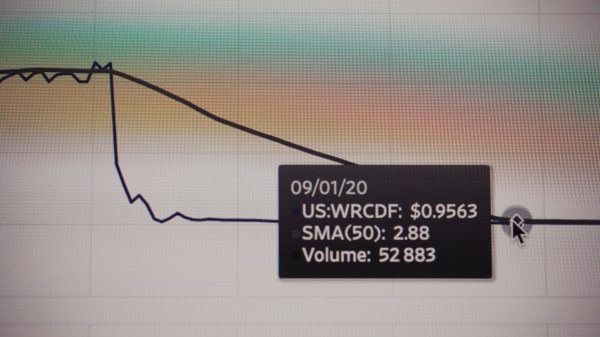

The buzz around the stock might not last very long, with skeptics estimating that Trump Media, which has far fewer users than its rivals in the business, and investors will see the stock price fall by 95 percent, especially as these U.S. tycoons sell a large number of their stocks. “I think there is a possibility of, sooner or later, the stock price falling by 95%,” said Jay Ritter, a professor and expert on initial public offerings of stock at the University of Florida’s Warrington College of Business (via AP). Trump’s involvement in several legal proceedings and his history of voting in his interest rather than the interest of the shareholders could be potential risks to the stock of Trump Media and Truth Social.