Any financial expert will say that investing in stocks is key to setting up and establishing long-term wealth. But investing in stocks isn’t the hard part. What’s hard is knowing and investing in the right stocks at the right time. So, is investing in stocks lucrative?

The short answer to that question is yes! But understanding the art of investing the right way is hard to accomplish. Watching the market, looking at their day-to-day fluctuations, knowing what to invest in, and predicting future values can be almost impossible to do.

Stocks are a critical part of an investor’s portfolio. Stocks are listed and publicly traded at stock exchanges. What kind of stock you hold, what percentage of stocks you invest into, and how long you hold them all depend on various factors like how much risk you are willing to take and the overall financial goals you may have set.

There Are Two Ways Stocks Can Be Lucrative

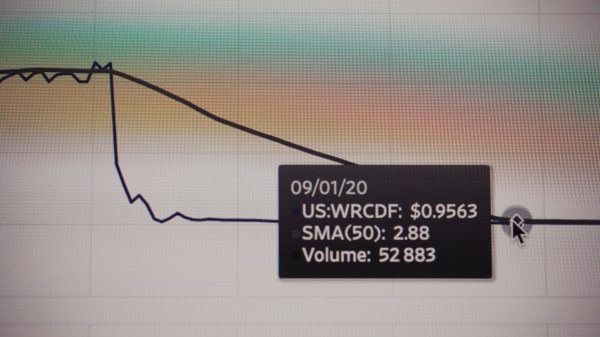

The first way stocks can make you money is to appreciate their value, which is when a stock’s value rises above the value you had initially paid for a stock. Share values increase and decrease based on the particular companies’ performances. Maybe the company you bought stock in has had a great year, and their earnings are on the rise; this could, in turn, increase the value of your stock. Or, if the company you bought shares in is faltering in the market, this could make the value of your stock fall.

When you have a stock, and its value has risen, you have what is called ‘unrealized gains.’ If and when you decide to sell the stock, you have actually made some money off your stocks. This unpredictable fluctuating value of stocks makes investing and earning from stocks such a hard thing to get into.

The other way of earning money through stocks is through dividends. Dividends are payouts a company makes to its shareholders. They are a way for companies to share and distribute their profits with their shareholders. Dividends are paid once a quarter by the companies. One thing to keep in mind is that not all companies pay dividends. Some companies might reinvest their profits back into the company to grow.

Two Different Types of Stock

You can invest in two different types of stock or shares in a company. There are common shares or preferred shares. They both are very similar but have a few key differences.

Both common and preferred shares offer the benefits of capital growth. Capital growth is the profit you earn when you sell a stock after it has risen from the original price you may have bought it at. Then there are dividends; both these kinds of stocks will give you the option of earning through dividends. Also, both these stocks give you voting privileges in the company’s decisions.

The main difference between these stocks is that preferred stocks are guaranteed a fixed dividend amount paid to them before giving any money to people who hold common shares. Also, when compared to common shares, preferred shares are usually paid higher dividends. There are also different types of preferred stocks that you can learn about in detail later, like some preferred stocks allow you to accumulate your unpaid dividends and collect them later.