IRS Collects More Than $500M from Fraudulent Millionaires

The Internal Revenue Service (IRS) has successfully collected more than $500 million in back taxes from delinquent millionaires.

This comes as the IRS intensifies its enforcement efforts toward tax compliance among high-earning individuals and businesses.

Breakdown of Recovered Taxes

The IRS’ recent enforcement activities have yielded substantial results. Officials reported collecting an additional $360 million from millionaire households with tax debts exceeding $250,000.

Source: Tima Miroshnichenko/Pexels

MarketWatch reports that this follows an earlier announcement in October, where the IRS disclosed having reclaimed $160 million from wealthy households. Cumulatively, these efforts have brought in a total of $520 million, demonstrating a strong return on recent investments in tax enforcement.

2022 Upgrade Boosts IRS Enforcement

The IRS’ enhanced capability to enforce tax laws on high-level delinquents has been significantly strengthened by a system upgrade in 2022, as reported by MarketWatch.

Source: Getty Images

This upgrade has enabled the agency to focus more effectively on businesses and superwealthy individuals who have been evading taxes. Danny Werfel, IRS Commissioner, highlighted this development, saying, “We are seeing significant early indicators that our increased scrutiny … is having immediate impact.”

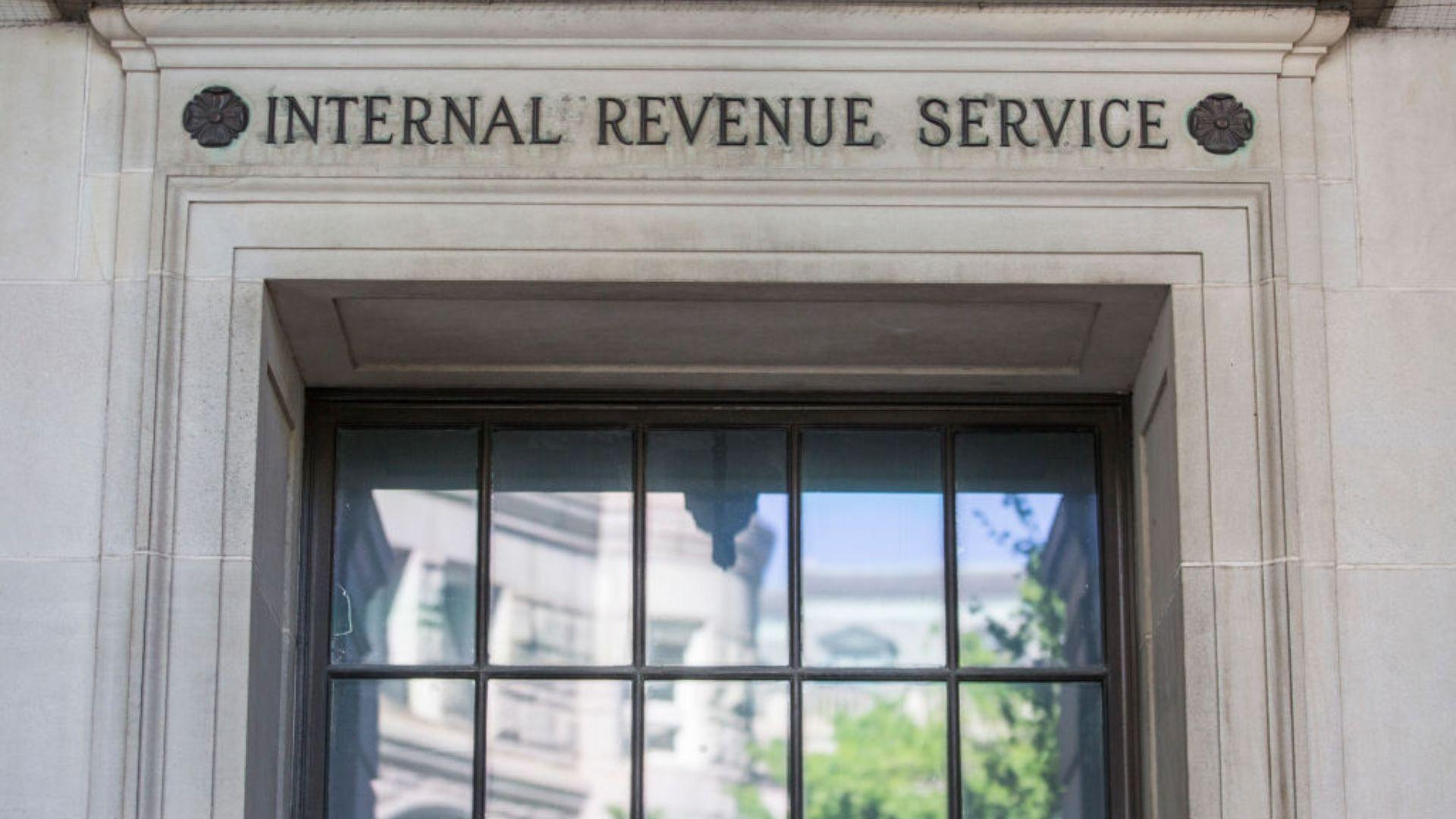

Funding from the Inflation Reduction Act

The Inflation Reduction Act of 2022 has played a pivotal role in building up the IRS’ enforcement capabilities.

Source: Miikka A./Unsplash

MarketWatch details that the act authorizes $80 billion for the IRS over a decade, with a significant portion allocated to enhance enforcement on corporations, partnerships, and affluent households. However, there’s uncertainty regarding a portion of this funding due to political negotiations that might redirect $20 billion to other areas.

Audit Rate Commitment for Households Earning Less Than $400K

Commissioner Werfel and the Biden administration have pledged to maintain the current audit rates for households earning less than $400,000 per year, as reported by MarketWatch.

Source: Kuncheek/Pexels

This pledge comes amid negotiations with House Republican negotiators to redirect $20 billion of IRS funding.

Challenges and Future Funding Questions

The Associated Press reports that the IRS faces challenges regarding long-term funding, alongside immediate concerns. Commissioner Werfel emphasized the need for consistent funding to sustain their enforcement and customer service improvements.

Source: Getty Images

He said, “For this progress to continue, we must maintain a reliable, consistent annual appropriation for our agency, as well as keeping Inflation Reduction Act funding intact.”

The Threat of a Government Shutdown During Tax Season

MarketWatch reveals that as the 2024 tax season approaches, the IRS faces a potential government shutdown, creating unique challenges.

Source: Nataliya Vaitkevich/Pexels

Commissioner Werfel warned, “Shutdowns are highly disruptive.” He further explained, “Encountering one now would increase the risk that we don’t have as smooth a filing season as we intend to have.”

IRS Intensifies Investigations into Major Financial Partnerships

The AP reports that the IRS, boosted by the Inflation Reduction Act funding, has launched 76 examinations into large U.S. partnerships, including hedge funds and law firms.

Source: Getty Images

Commissioner Werfel highlights the importance of this initiative, stating, “It’s clear the Inflation Reduction Act funding is making a difference for taxpayers.”

Nearly Half a Billion in Back Taxes Recovered

With the recent collections, the IRS has now recouped nearly half a billion dollars in back taxes from wealthy individuals, as reported by AP.

Source: Bradley Pisney/Unsplash

This substantial sum is a direct result of the Inflation Reduction Act, which has significantly enhanced the IRS’ enforcement capabilities. However, the agency is preparing for more severe funding cuts, as previously agreed upon by the White House and congressional Republicans.

Dealing with Budget Cuts and Future Funding

Facing imminent budget cuts, the IRS is preparing to strategically manage its resources. The AP reveals that despite the reduction of $20 billion in funding, Commissioner Werfel is confident that the current budget will not impact the agency’s efforts until later years.

Source: Getty Images

He stated, “The impact of the rescission that’s being discussed as part of the current budget will not impact our efforts until the later years.”

Werfel's Optimism for Future IRS Funding

The AP notes that Commissioner Werfel remains optimistic about the future of IRS funding.

Source: Getty Images

He hopes that the positive impact of the Inflation Reduction Act funding will encourage policymakers to restore IRS funding in the future. “My hope is that as we demonstrate the positive impact that IRA funding is having for all taxpayers, that there will be a need and a desire amongst policymakers at that time to restore IRS funding so that we can continue the momentum that’s having a very positive impact,” he said.

The Impact of Enhanced IRS Technology on Tax Compliance

In addition to the intensified enforcement efforts, the IRS has revealed that there has been a significant focus on upgrading its technology systems.

Source: Wikimedia Commons

These enhancements are aimed at improving efficiency and aiding in the detection of tax evasion among high earners.