Based on the 2021 tax return report of Americans released by the Internal Revenue Service (IRS), there is a significant shortfall of approximately $688 billion in unpaid taxes.

As a result, the IRS is tightening the noose on defaulters to address this issue and recover all outstanding funds. To achieve this, the IRS is adopting new mechanisms to facilitate tax collection and conduct comprehensive financial statement audits.

The Highest Non-Compliance of Its Kind

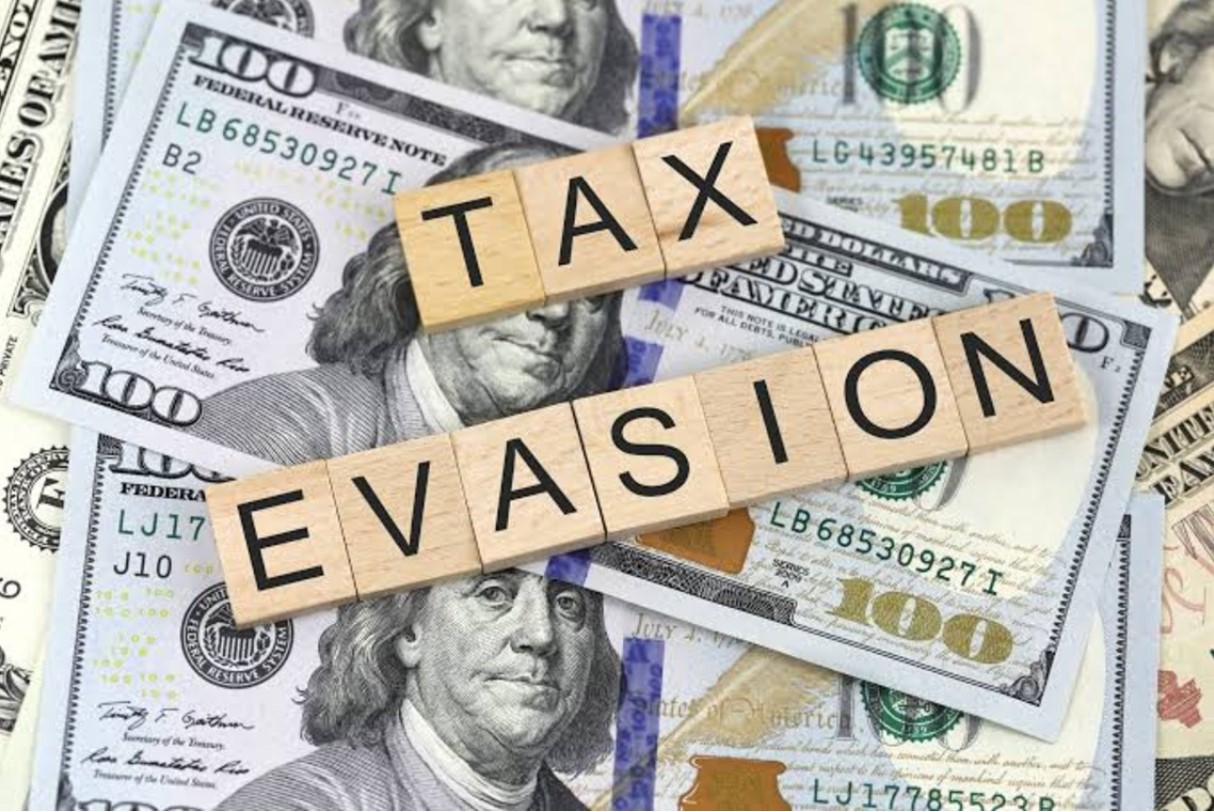

The IRS report of the huge tax shortfall from 2021 has exposed deliberate efforts by many Americans to avoid settling their pending taxes.

For instance, the IRS highlights that over 70% of the estimated tax shortfall from 2021 results from late bill payments, income falsification, and outright tax evasion.

COVID and Tax Remittance

Between the 2017 and 2021 fiscal years, the IRS reported a striking increase in the tax shortfall, amounting to nearly $140 billion!

Notably, this trend aligned with the marked growth of the U.S. economy during that timeframe. Also, there has been a surge in gig jobs since the COVID lockdown. Unfortunately for the IRS, they have been largely unsuccessful in taxing these freelance workers.

Social Justice vs. Social Responsibility

Traditionally, a significant number of Americans willingly remit their taxes without being compelled. Thanks to the amenities provided by authorities, many citizens see tax remittance as a patriotic responsibility.

However, there still remains a significant percentage of Americans who find ways to avoid paying taxes. Despite the various tax enforcement measures and income audits carried out by the IRS, their collection rate for 2021 stood at 86.3%, indicating that a portion of payable taxes still needed to be collected.

Plumbing the Tax Pipeline

Some of the many strategies Americans use to avoid tax remittance are shell corporations, tax havens, and undisclosed businesses.

Many business owners do not report the earnings of their small-scale businesses and other entrepreneurial endeavors. In 2021, all such tax loopholes cost the IRS $182 billion.

Appropriate Motivators for Taxpayers

Senior IRS officials noted the increasing tax compliance gap and have promised to leverage every available resource to address the issue.

Danny Werfel, commissioner of the IRS, emphasized the significance of the 2021 shortfall in a recent briefing. Consequently, he and his team will intensify efforts to enhance taxpayer compliance nationwide.

High-income Earners Are Likely Evaders

To achieve the highest possible remittance of all payable tax, the IRS has decided to go for the low-hanging fruits. They plan to conduct more detailed audits of taxpayers with high incomes.

Such initiatives will make it less likely for entities to falsify their income statements or default on tax remittances. Likewise, retaining the Inflation Reduction Act will equally help with tax compliance.

Strengthening the Taskforce

With a resolve to increase internal efficiency, the IRS has initiated an extensive wave of recruitment for senior-level roles, hoping a fresh set of eyes will bring valuable insights to the team.

Melanie Krause, the head of the Data and Analytics department of the IRS, is confident the new executives will introduce more efficiency into the tax collection process.

Tax and the Digital Nomad

Freelancers may have observed a growing trend among popular gig marketplaces like Fiverr, Upwork, and Freelance, in which the platforms are starting to harp on the necessity of providing your tax details as a condition of using their services.

Starting with the 2023 fiscal year, freelancers and entrepreneurs must report all income earned on these freelance marketplaces.

When Your Income is Public Knowledge

The consequences of freelancers disclosing their tax details on third-party apps are multifaceted. First, the agency may require these apps to make the earnings of their subscribers available.

Additionally, according to Natasha Sarin, a law professor, taxpayers (including freelancers) are unlikely to give a false income report when they know the IRS has the information available at the snap of a finger.

How to Compel a Taxpayer

After serving notices to tax defaulters, taking steps to ensure compliance, and calculating the payments made by late remitters, the 2021 shortfall was down by $63 billion.

However, the remaining $625 billion is an outrageous amount to be owed by the taxpayers of any country.

Stabilizing American Finances

Professor Sarin believes that an improved effort by the IRS in collecting revenues could make US fiscal policies more sustainable.

Yet, while the IRS is doing its best to draw closer to the 100 percentile of remittance compliance, it is aware that some tax holes are quite difficult to plug. A prime example is using cryptocurrency for business transactions.