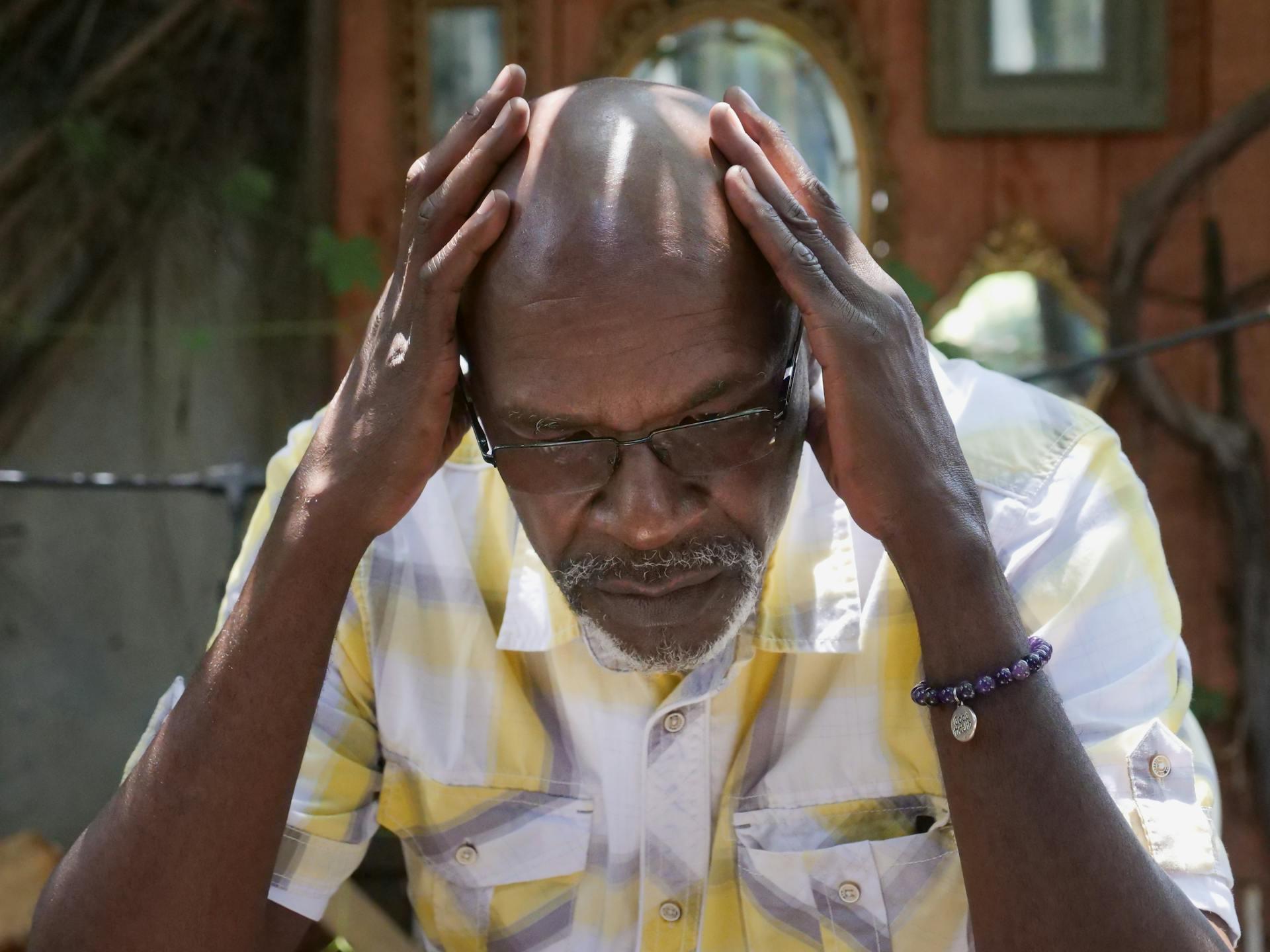

America is facing a retirement crisis: many older Americans don’t have enough savings to live out their lives without a job.

Investment firm BlackRock’s CEO, Larry Fink, has a shocking solution, but one that may be worth thinking about. He says older workers should just keep working.

65 Is Early for Retirement

Fink’s annual shareholder letter suggested that the strain put on US Social Society benefits could be alleviated if people worked longer.

“No one should have to work longer than they want to. But I do think it’s a bit crazy that our anchor idea for the right retirement age — 65 years old — originates from the time of the Ottoman Empire,” Fink wrote.

Reality Check

But the real world reality for older workers may not be ideal for that idea to come to fruition. Mature workers face plenty of problems, too.

According to AARP in 2022, mature workers faced age discrimination at work. Poor health and unexpected situations also forced people to take an early retirement. In fact, most Americans retire at the median age of 62, as one survey revealed.

Not Easy to Save

Independent Senator from Vermont, Bernie Sanders, also published his own report about American retirees.

Part of the problem with retirement savings is that 57 million Americans can’t easily save for retirement. Workers are more likely to save for retirement via payroll deduction or if their workplaces already have a built-in retirement plan. The senator’s report suggested these options were not available.

Crushing Numbers

As a result, according to the report, nearly half of Americans over the age of 55 don’t have savings for their retirement.

Meanwhile, 52% of Americans aged 65 and older live on less than $30,000 per year. Around 5 million retirement age Americans live in poverty at the ratio of 1:10 seniors.

Smash the Cap

Sanders’ solution is different from Fink’s. His idea is to “smash” the income tax cap. Many experts agree with him.

A mid-range salaried worker with less than a $160,200 cap must pay a higher tax rate than a millionaire’s, noted Sarah Rawlins of the Center for Economic and Policy Research. If the tax cap is eliminated or lifted, Social Security’s trust fund could be stabilized.

Retirement Age Not the Solution

Another expert, New School of Research’s Teresa Ghilarducci, can’t find fault in what Fink is saying with regards to some retirees. But she doesn’t agree that raising the retirement age is the right solution, either.

The problem, once again, lies in the limited saving options. “After a 40-year-old experiment of a voluntary, Do-It-Yourself based pension system, half of workers have no easy way to save for retirement,” she said.

The Method Problem

Fink himself is not blind to the method problem. He praised Australia in his annual letter where employers are required to put a percentage of the income of workers aged 18 to 70 into a fund.

“As a nation, we should do everything we can to make retirement investing more automatic for workers,” his letter stated. Thanks to this method, Australia currently stands as the country with the 4th largest retirement system.

Old System Benefits

Fink cited his mother’s own experience to set an example. California’s state pension system, CalPERS, was the reason for Fink’s own mother’s success in retirement savings as a state employee.

But the numbers are much reduced today, with only about 15% of employees having access to benefit plans in 2021. Four decades ago, the access was much greater at 30%.

It’s All Promotional

An economist from Boston University, Laurence Kotlikoff, said that Fink’s retirement age raise idea is not entirely altruistic.

“A lot of people who talk about Social Security reform on Wall Street want to privatize it in some manner and make money,” he suggested. Naturally, Fink would want Americans to boost their retirement assets as long as possible. After all, BlackRock is planning to roll out a new target-date fund called LifePath Paycheck in April.

A Good System

Then, what’s the solution? Ghilarducci simply says the solution is a good pension system that allows retirees to gather enough money, allow them to invest, and spend them wisely to last for the rest of their days.

She endorses the Retirement Savings for Americans Act 2023, comprising those three elements, for the 80 million Americans without employer-sponsored pensions.

Life After Retirement

Much has been said about the correct solution to deal with this retirement savings crisis. But one thing’s for sure, if Social Security funds are about to dry up in 2033, something must be done.

President Joe Biden’s current “no-plan” policy is not going to help matters. Industry experts like Fink and Ghilarducci have a stronger voice on the issue and retirees will likely be willing to listen more to these voices.