Gen Zers have a reputation for avoiding tedious and unfulfilling jobs in an attempt to find their passion in life.

While this doesn’t always lead to a long-term paycheck, there are still ways for the younger generation to get rich if they listen to the experts.

Experts Share Advice with Gen Zers

Founder and CEO of Alloy Wealth Management, Mark Henry, recently went out of his way to share several tricks and tips that could help Zoomers stack cash in their bank accounts.

Speaking in an interview with GOBankingRates, he offers several examples to help all Gen Zers (and everyone else) make a positive change in their finances and begin to save money.

Start by Practicing Loud Budgeting

According to Henry, a straightforward way for Gen Zers to increase their overall wealth is to practice fiscal discipline.

For Gen Zers, the best way to do this is by practicing loud budgeting, which was named “2024’s First Big Money Trend” by BuzzFeed.

2024’s Big Money Trend

Essentially, loud budgeting ensures that financial boundaries are upheld without worrying about what others think. In simple terms, stick to the monthly budget.

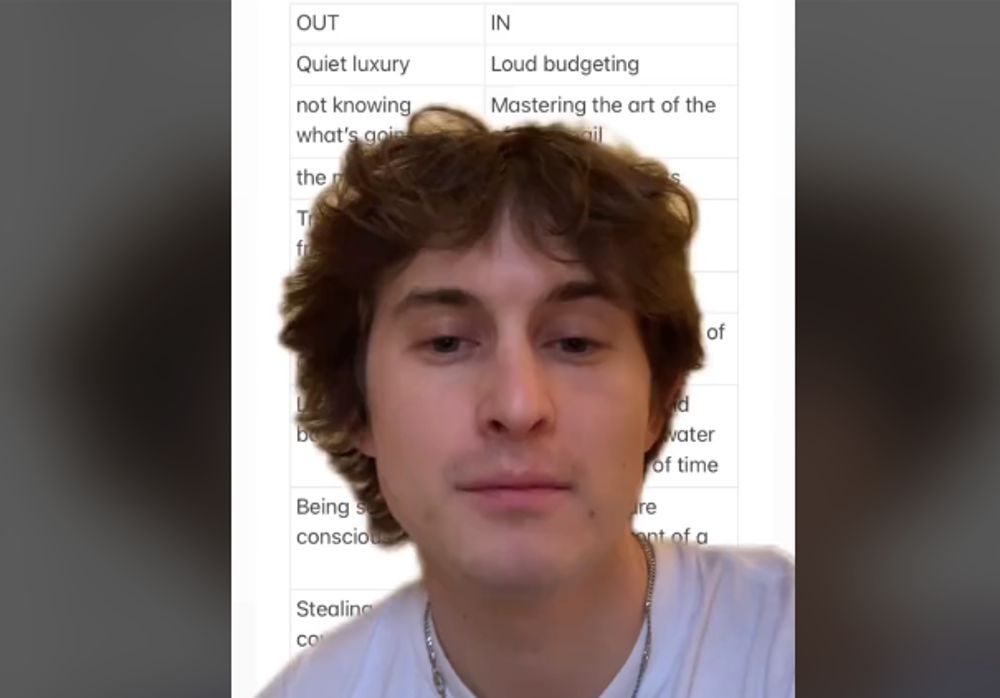

The trend began with @Lukasbattle, a popular TikToker. In one of his videos that garnered over 1 million views, he says, “Out: quiet luxury. In: loud budgeting. Sorry, can’t go out to dinner. I’ve got $7 a day to live on.”

Go Open a High-Yield Savings Account Today

While it can be all too tempting to blow half a paycheck on the first day, Henry suggests sticking to step one and building upon it by opening a savings account.

Opening a high-yield savings account is one of the best ways to begin building wealth as a member of Gen Z. While a traditional account will only offer around 1% APY, a high-yield account could give a 5% APY return.

Saving Money in the Long Term

According to Henry, a high-yield savings account can earn you hundreds of dollars per year when compared to its traditional counterpart.

“If you put $5,000 in a high-yield account with 4.5% APY in January, you’ll have more than $200 in interest by the end of the year versus just a few dollars in a traditional account,” he said.

Begin Saving for the Future

Gen Zers love to live in the moment. But spending a little time thinking about the future can help anyone increase their overall wealth.

One easy way Gen Zers can begin to load up on savings is by thinking about maxing out their 401(k) plans.

Match Your Employer

Henry recommends Gen Zers take advantage of employers’ contributions to 401(k) accounts by matching what they put in.

If this is a struggle in the beginning, he then suggests contributing at least the bare minimum, as this will still help build wealth in the long term.

Set Aside an Emergency Fund

Life can be pretty unpredictable at times and seldom does anyone see a financial tragedy coming.

This is why Henry places importance on prioritizing an emergency fund even if you have debt such as car payments or student loans.

Financial Safety Net

While it may seem daunting for Gen Zers to leave aside up to six months of living expenses and not touch them, this acts as a strong safety net.

Henry argues an emergency fund is one way to ensure you stay out of debt in the future, as when an unexpected bill arrives, you have the savings to cover it.

Take a Risk and Invest

According to the CEO of DebtHammer, Jake Hill, investing in real estate could drastically increase a Zoomer’s chance of getting rich.

Speaking to Yahoo Finance, he said, “Gen Z individuals who have been able to secure loans and purchase homes, then market those residences through third parties such as Airbnb or Vrbo have seen a huge influx in cash.”

Learn First: Invest Later

Hill suggests that Gen Zers first educate themselves before jumping into the retail market, as it can be unforgiving to those who are underprepared.

“I advise people to read books, take classes, and educate themselves on the risks before diving into any purchases, but if possible, they will see their wealth increase throughout the year,” he said.