A Wells Fargo customer is suing their bank after they lost more than $30,000 to scammers. The lawsuit alleges that the bank does not have the right security and anti-fraud measures in place to adequately protect its customers.

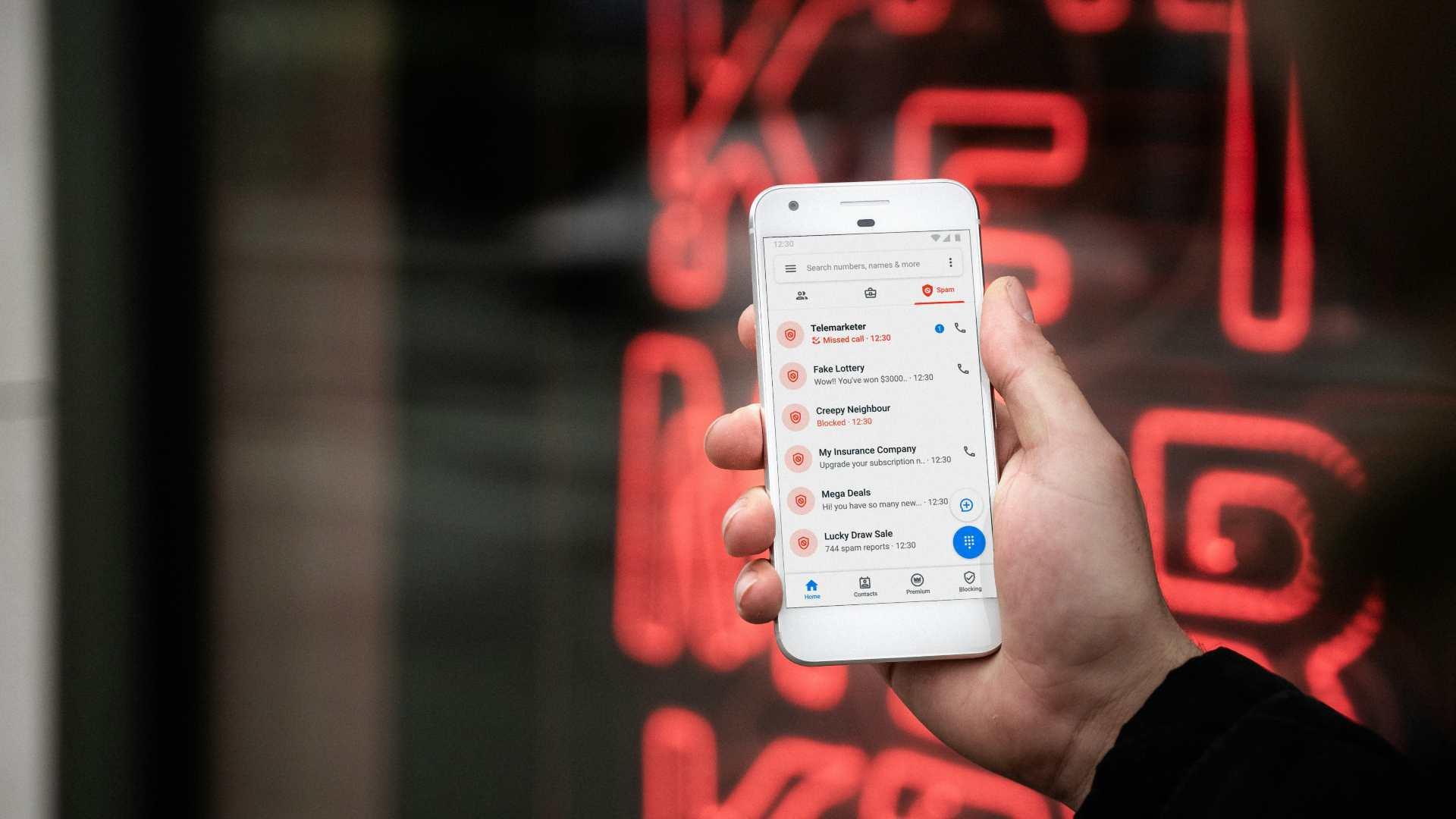

The customer was tricked by scammers into handing over personal details, which allowed the scammers to access their accounts with a phone call to Wells Fargo.

The Scamming Incident

The man, Thomas Murrer, received a phone call from scammers claiming to be Wells Fargo’s fraud department. He was tricked into providing some personal information which they used to impersonate him in a call with the bank.

After gaining access to his account, they were able to drain his life savings and max out all his credit cards. Murrer claims he tried to get a refund from the bank after discovering the scam, but they refused to refund him.

What the Lawsuit Claims

The Daily Mail reported that they have seen court documents alleging that Wells Fargo’s systems had flagged the scammers because they had called from a different number than Murrer. Despite this red flag, Wells Fargo approved all the transactions anyway.

If the allegations are true, this would mean the bank’s anti-fraud measures are falling woefully short for its customers, which may make them liable for future lawsuits.

Scammers Strike Again

Another explosive claim from the lawsuit alleges that those scammers called from the same number again just three months later for a different scam. Despite the past history of this number, the bank granted account access to the scammers a second time.

The Daily Mail reported that Wells Fargo is reviewing these allegations.

Adding Insult to Injury

In addition to Murrer’s loss of his life savings and credit card limits, he was further damaged by the bank slapping him with an additional $450 in transaction fees. He was also forced to pay monthly interest on those maxed-out credit cards.

Another injury he suffered due to this scam is that the ordeal dropped his credit rating, making it more difficult for him to recover.

Suspicious Transaction Notes

Notes from the bank’s case management show that the scammers made outrageous purchases, claiming they were for Murrer’s wife. However, Murrer is not even married and has never made a transaction to the supposed account for the entirety of his eight years as a Wells Fargo customer.

One would think that a man transferring something for the first time to an account that was supposedly his wife’s would be a red flag.

Punished for T-Mobile?

Documents sent by Wells Fargo seem to show that bank employees did not directly contact Murrer at first. The reason for this lack of contact seems to have been that Murrer was a T-Mobile customer.

This is a strange reason for failing to follow up on customer fraud and it’s unclear why Murrer’s choice of cellphone service provider would have any bearing on his case.

Murrer’s Bank Visit

On November 14, 2022, Murrer visited his bank to seek answers about his account and confirm to the bank that he had not authorized the transactions. Reportedly, Wells Fargo identified the fraudulent activity at the time but initially denied Murrer a refund for the ordeal.

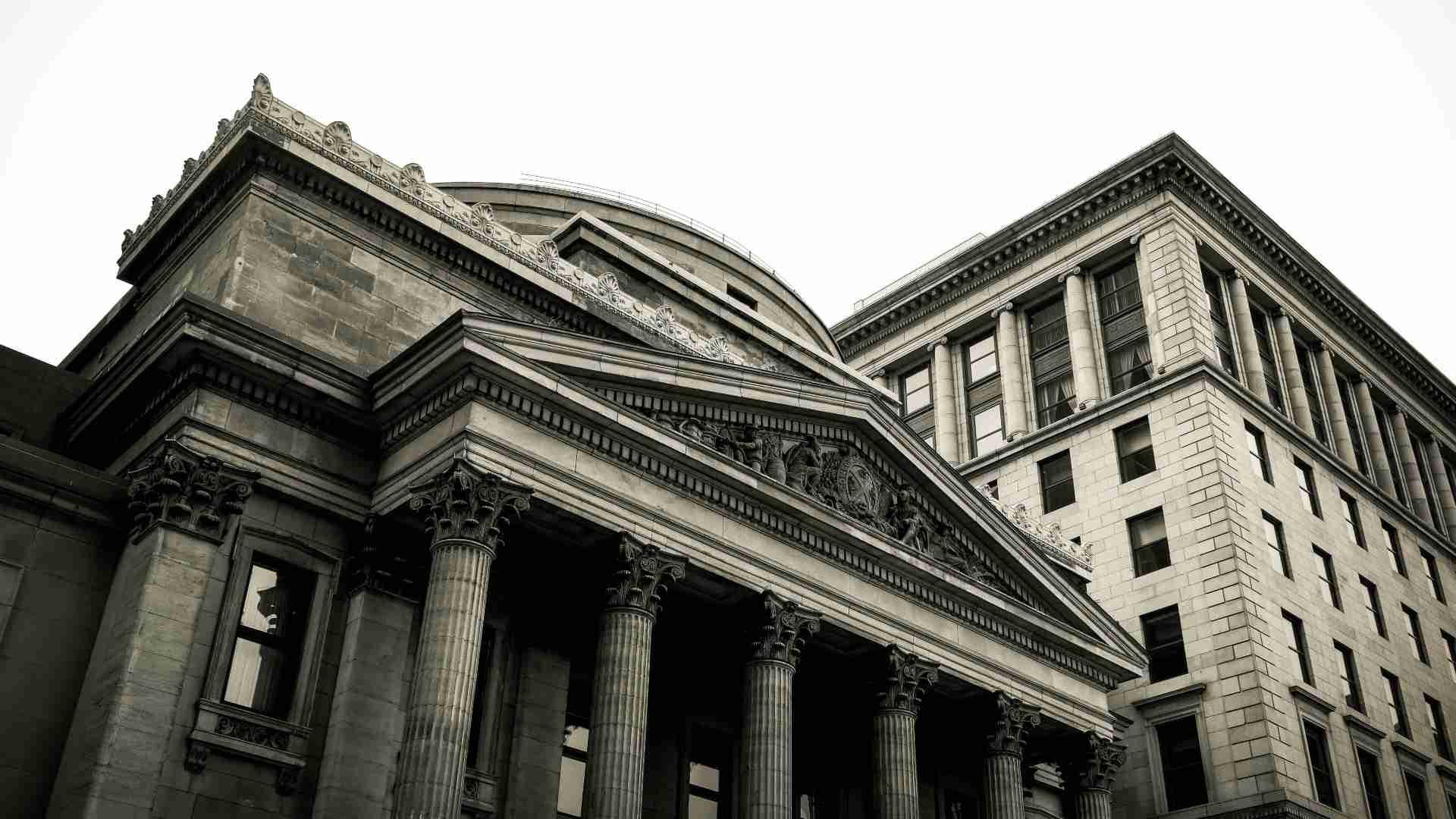

If the allegations are true, the bank may run afoul of consumer protection regulations that force banks to give refunds to fraud victims.

Consumer Protections for Customers

An agency called the Consumer Financial Protection Bureau (CFPB) is responsible for enforcing rules meant to protect customer discrimination and fraud in the banking system.

In addition to these responsibilities, they also take consumer complaints and investigate unfair or deceptive practices that companies may be participating in. The agency was created in 2010 so that customers had a single place to turn to instead of relying on several different agencies.

Wells Fargo’s Statement

A spokesman for Wells Fargo spoke to the Daily Mail to make a statement on the situation.

“Wells Fargo just received the complaint, and we are reviewing the allegations. Wells Fargo invests hundreds of millions of dollars annually to fight fraud and scams. We are committed to helping our customers avoid fraud and scams through various resources, including ongoing education efforts,” the spokesman said.

How Common is Bank Fraud?

The FTC reported that in 2022, 2.4 million customers sent fraud reports to the government agency. Scammers commonly employ social engineering techniques to convince customers to give them critical personal information, which allows them to access their accounts and quickly drain their savings.

The FTC report indicated a 30 percent increase in reported fraud losses compared to 2021, totaling almost $8.8 billion.

A Bad Week for Wells Fargo

Just the previous week, another Wells Fargo scam incident was reported by the Daily Mail. In that case, a group of fraudsters used the same ruse, claiming to be from Wells Fargo’s fraud department.

Their victim was Judith Anderson, a 74-year-old grandmother who lost $150,000 that was meant to pay for her husband’s hospice care. She eventually received a refund for the incident