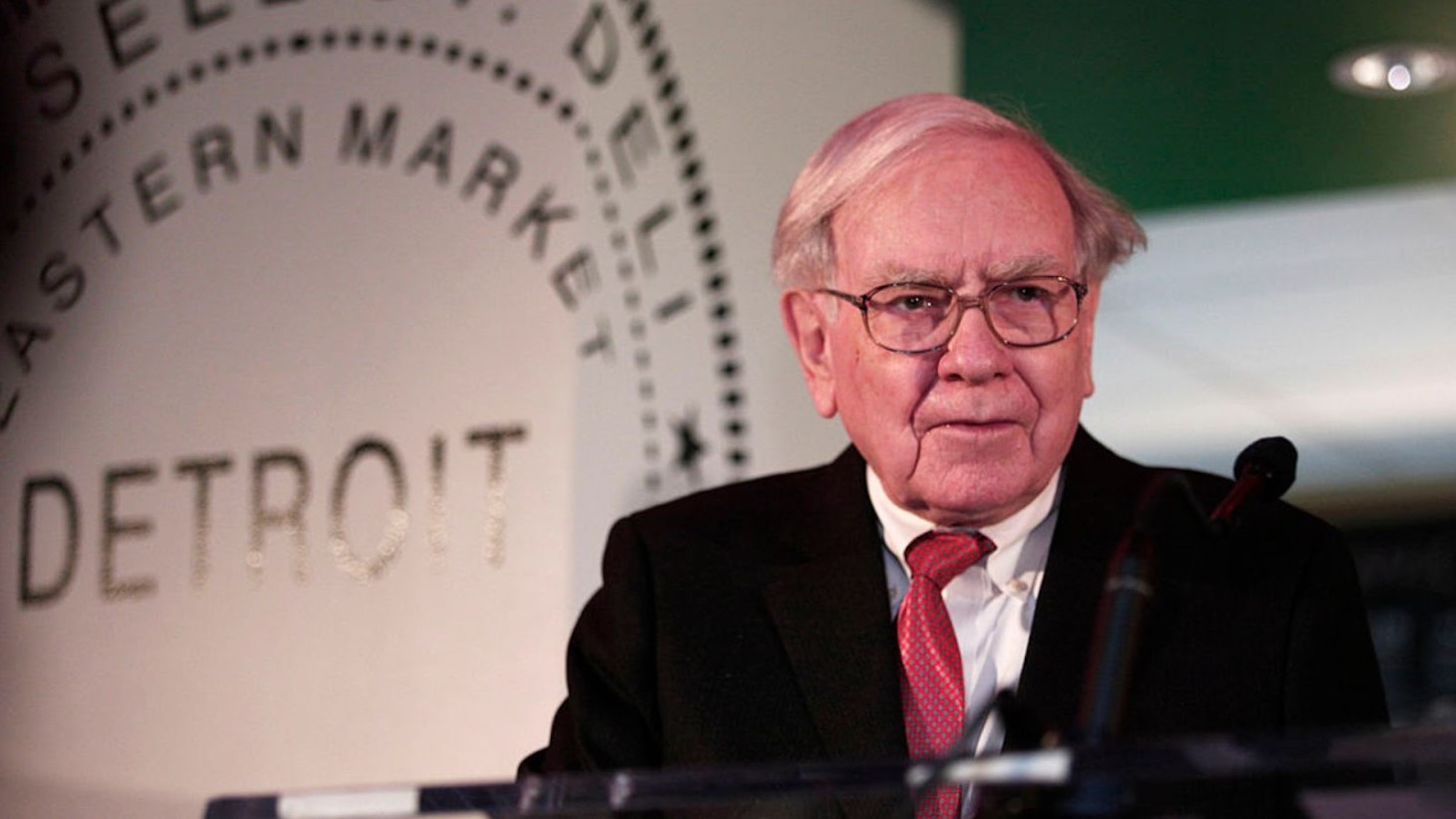

Warren Buffett’s investment firm, Berkshire Hathaway, has made a significant move by selling $28.7 billion of its stock holdings in the first three quarters of 2023.

This decision has raised concerns among some economists regarding the health of the American economy. Buffett, known as the Oracle of Omaha, is often watched for his investment decisions, which many consider to be indicators of broader economic trends.

First Quarter Sales

In the first quarter of 2023, Berkshire Hathaway sold a net amount of $10.4 billion in stock. This substantial sale represents a notable change in the firm’s investment strategy.

Berkshire’s actions in this quarter have drawn attention due to Buffett’s reputation as a savvy investor, leading to speculation about the implications for the economy.

Second Quarter Activity: Increased Sales

During the second quarter of 2023, Berkshire Hathaway escalated its stock sales, reaching close to $13 billion.

Contrastingly, the firm purchased less than $5 billion in shares. This shift toward a net selling position is significant, indicating a possible strategic change in Berkshire’s investment approach.

Third Quarter Trends Continue

In the third quarter, Berkshire Hathaway maintained its trend of selling stocks, with about $5.3 billion worth of shares sold.

The consistency of these sales over three quarters highlights a deliberate strategy, which has become a focal point for economic analysts trying to interpret Buffett’s market expectations.

Berkshire’s Growing Cash Reserve

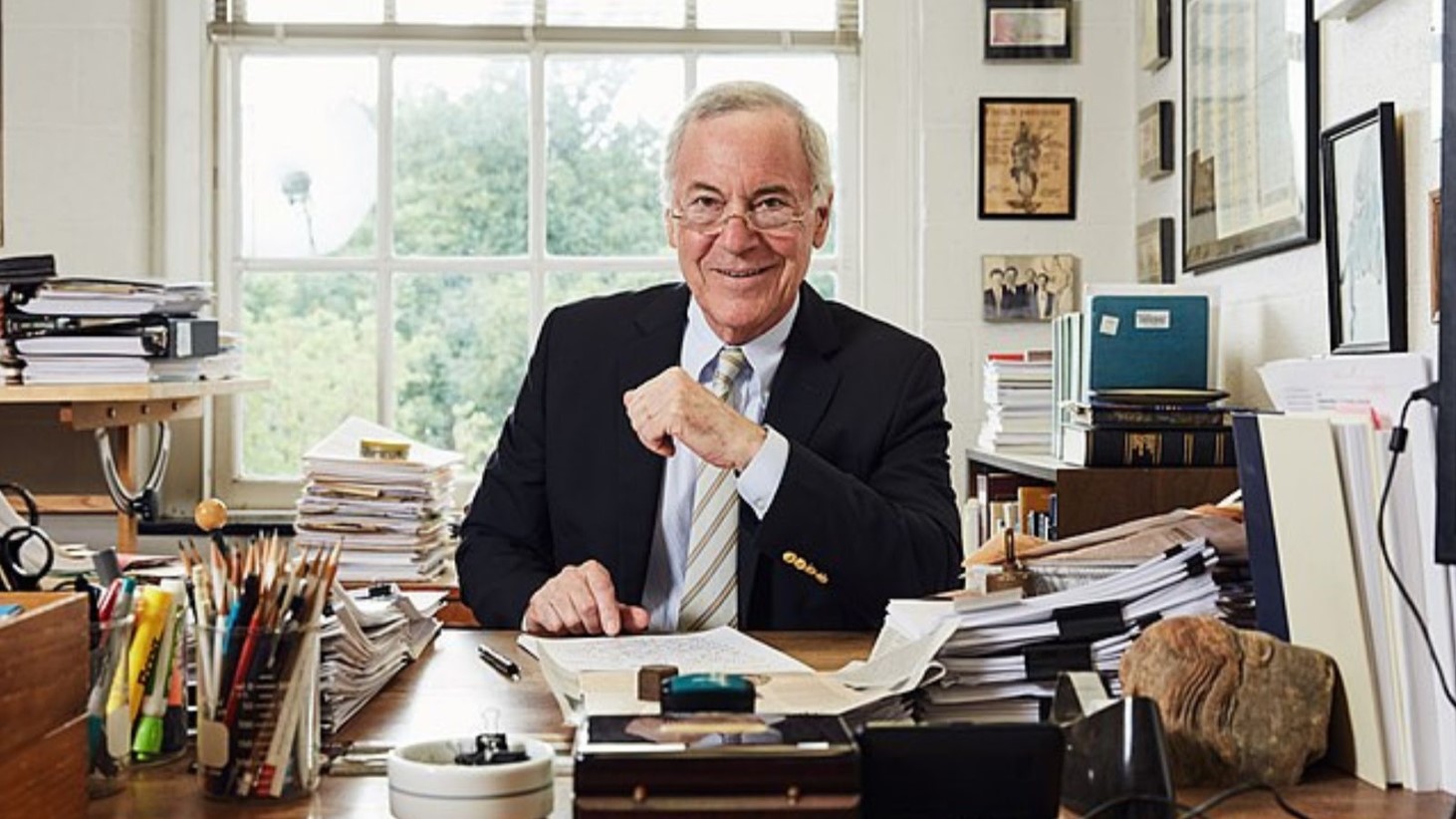

Speaking to Newsweek, Steve H. Hanke, an economist and professor, notes that Berkshire Hathaway’s actions, including accumulating a cash reserve of $157 billion, align with the current high stock prices.

Hanke suggests that this significant cash reserve could indicate a cautious approach from Buffett given the market conditions.

Predicting an Economic Recession?

Hanke expressed concern that the United States might be heading toward a recession.

He bases this on the contraction of the U.S. money supply by 3.3% since last year, a historical indicator often followed by recessions.

Lessons from History: Money Supply and Recessions

Historical data shows that significant contractions in the U.S. money supply have previously led to serious recessions. This pattern has occurred during four distinct periods in U.S. history.

The current monetary contraction, according to Hanke, is likely to result in a similar economic scenario, which could explain Berkshire Hathaway’s cautious stance.

Buffett’s Strategy in Economic Uncertainty

Hanke suggests that Buffett’s recent moves are characteristic of his investment style, particularly in times of economic uncertainty.

By accumulating a large cash reserve, Buffett may be preparing to take advantage of opportunities that arise in a troubled economy, a strategy he has successfully employed in the past.

Strategic Patience and Returns on Cash

Warren Buffett’s strategy involves not just holding cash but also earning returns on it while waiting for the right investment opportunities.

This approach reflects a balance between caution and readiness to act when favorable conditions emerge in the market.

Varied Interpretations Among Investors

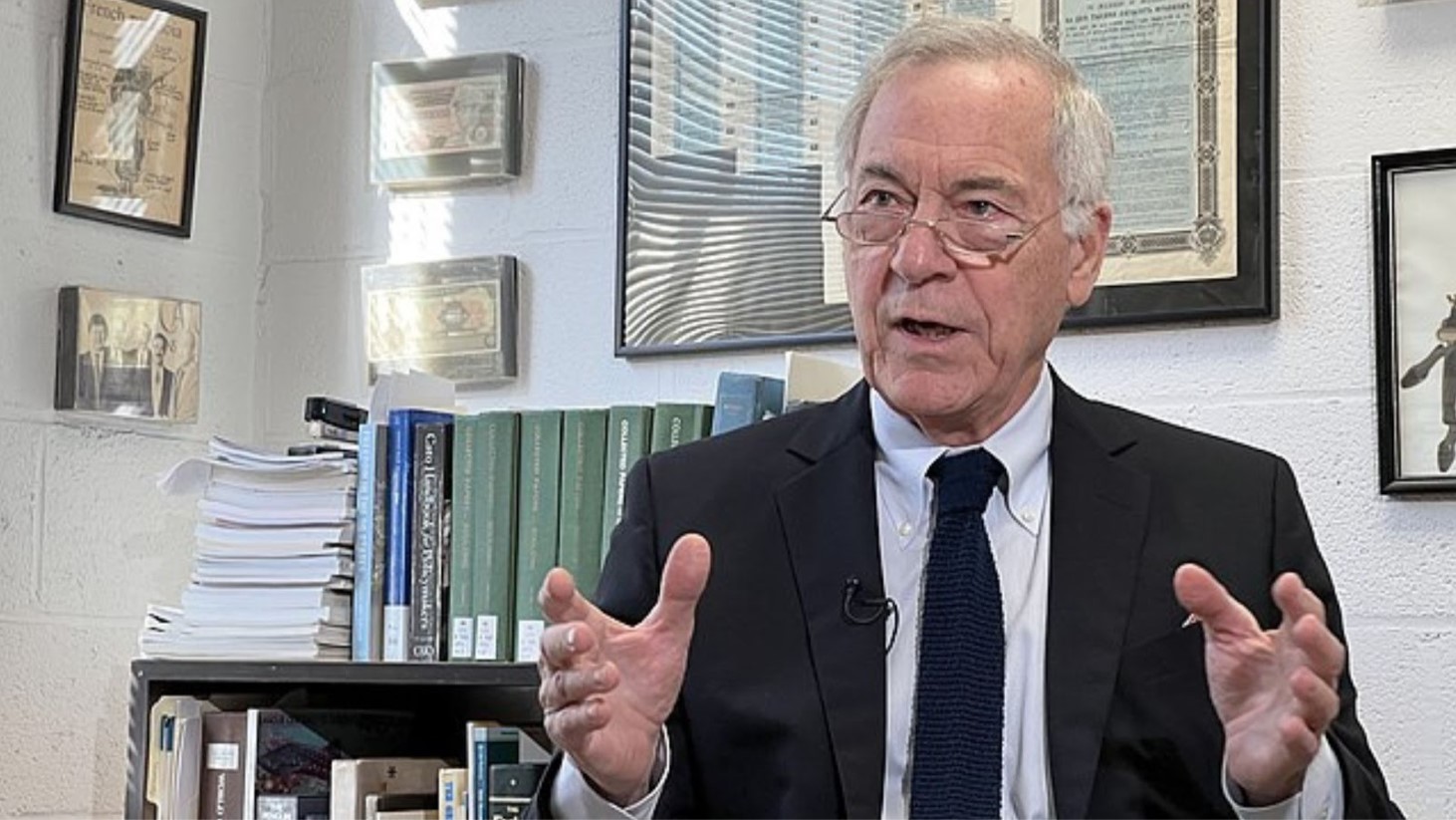

Other investment experts, like David Wagner, a portfolio manager, offer different perspectives on Berkshire Hathaway’s stock selling.

In a conversation with Newsweek, Wagner suggests that increased insurance costs and a desire for financial flexibility could also be driving factors behind Buffett’s decision to hold more cash.

Considering Insurance and Market Opportunities

Wagner posits that Berkshire Hathaway’s increased cash reserves might be a response to higher insurance costs, as well as a strategic move to remain flexible in the face of potential market downturns.

This viewpoint suggests that Buffett’s actions may be more about prudent financial management than a direct response to economic forecasts.

Buffett’s Approach to Market Fluctuations

Buffett has a history of capitalizing on market downturns, such as during the 2008 financial crisis.

His current cash reserve positions him to take similar actions should the market experience a significant decline. This tactic reflects Buffett’s long-term investment philosophy and his ability to navigate through various market conditions.