As Donald Trump emerges victorious in the Iowa caucuses, much speculation is in the air.

Many are wondering about the potential implications of another Trump presidency, especially for certain sectors in the stock market.

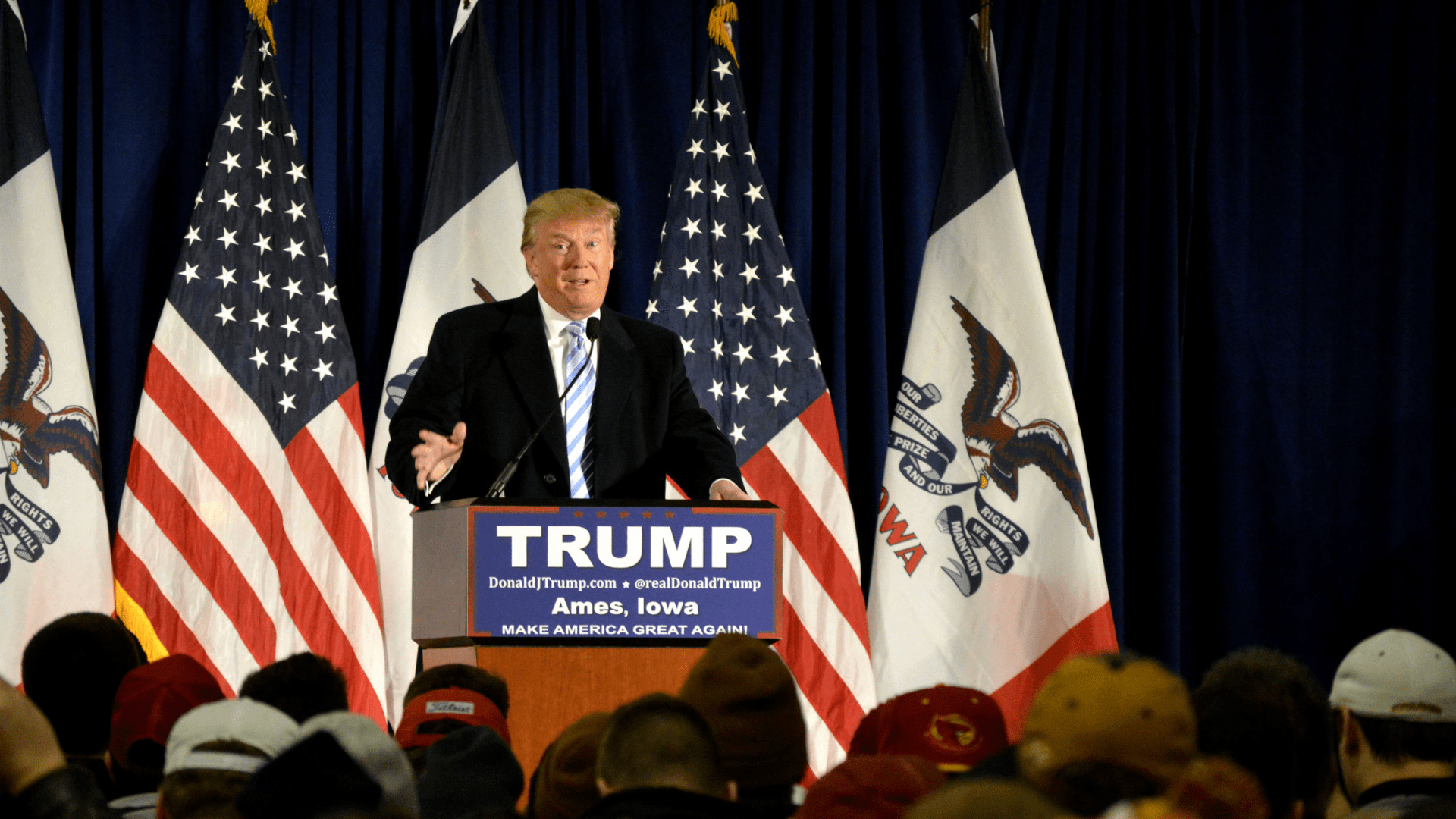

Trump’s Victory in Iowa

Securing 51% of the vote, Trump’s significant lead positions him as a strong contender for the GOP nomination.

According to MSNBC.com columnist Sarah Posner, Trump’s triumph in the Iowa caucuses wasn’t due to his GOP leadership but stemmed from being the “leader of the Christian right.” Posner contends that endorsements from faith leaders have lost significance, attributing Trump’s success to his grasp of the cultural and tribal influences shaping politics.

Trump’s Potential Nomination

There are already 20 delegates in his favor for the upcoming Republican National Convention. Isaac Boltansky, Director of Policy Research at BTIG, expresses confidence in Trump’s potential nomination.

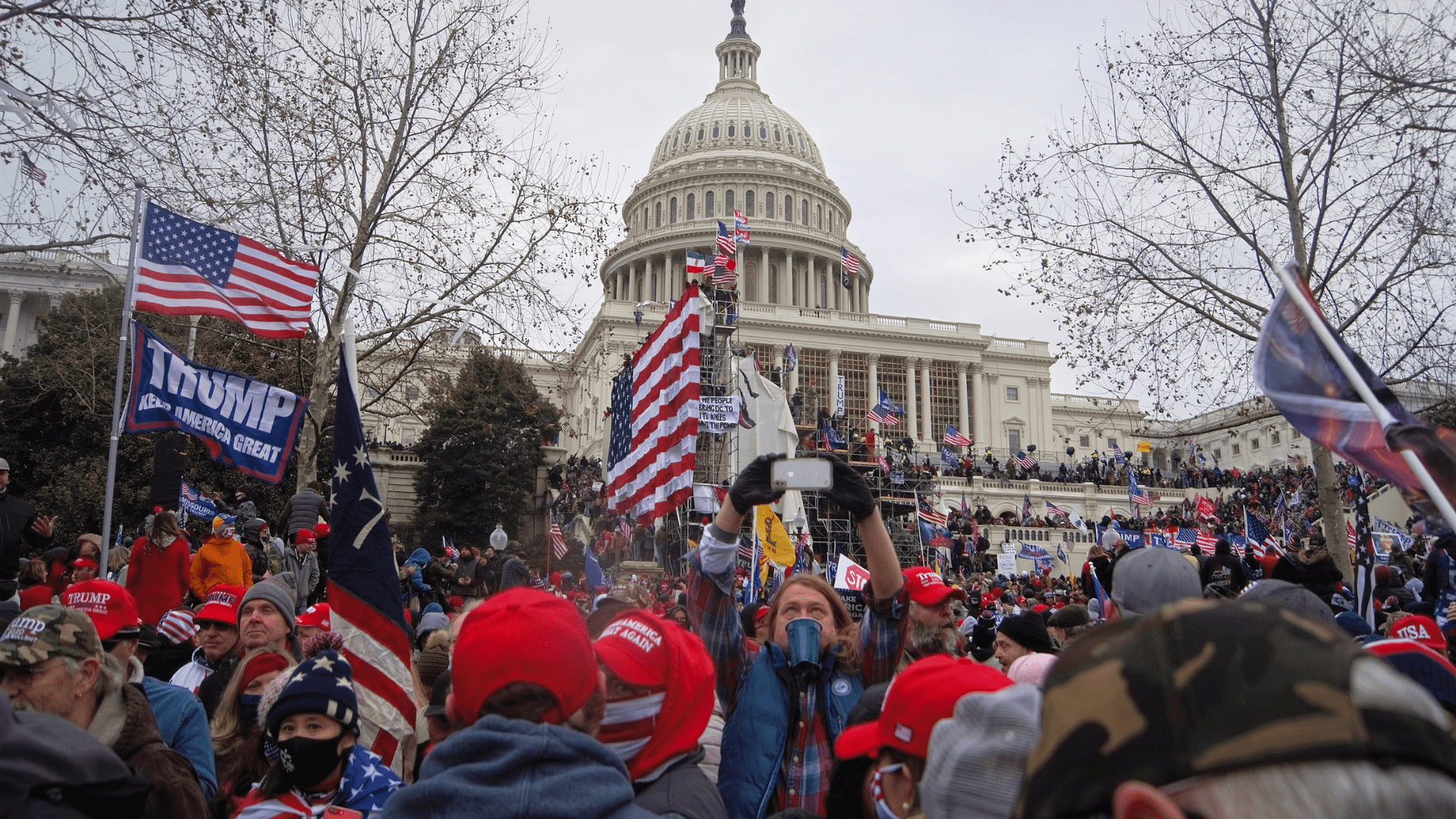

Trump is undertaking an unconventional campaign overshadowed by his turbulent term as president, culminating in the Capitol attack by his supporters. Facing criminal indictments linked to efforts to overturn the 2020 election, he denies any wrongdoing amidst 91 felony charges. Trump’s Republican campaign blends known culture-war themes with new complaints against prosecutors and judges in his cases. Despite controversies, he commands a substantial lead in the Republican race.

Why Might Trump Be Reelected?

Despite the Biden administration’s claims of a robust economy, many, particularly young and minority voters, disagree. They emphasize stagnant wages against rising costs for necessities like groceries, homes, and care services.

For Americans, economic discussions focus on affordability, not just statistics. Surveys reveal a majority sees Republicans as better economic managers, even though Trump’s proposals remain vague. The public’s concern lies in their wallets, challenging the narrative of economic success painted by the White House.

Trump Also Has an Ability to Appeal to Fear

Voters’ unease transcends economic concerns, delving into cultural shifts. Trump resonates with the apprehensions of many white Americans in an evolving, progressive society. There’s a prevailing sense of losing ground–homeownership, decent wages, and education feel increasingly unattainable.

Crime and border security amplify worries. Trump adeptly packages these fears, portraying himself as an outsider savior. He has a skill for navigating chaos, positioning himself as both arsonist and firefighter, tapping into anxieties. presenting himself as the remedy for a nation in turmoil.

Trump’s Second Term?

The ultimate outcome of the presidential race remains uncertain, though it seems Trump’s following is pushing him further and further ahead amongst the Republican camp.

While the balance of power in the House and Senate will shape legislative policies, some Wall Street observers are already contemplating the impact of a second Trump administration.

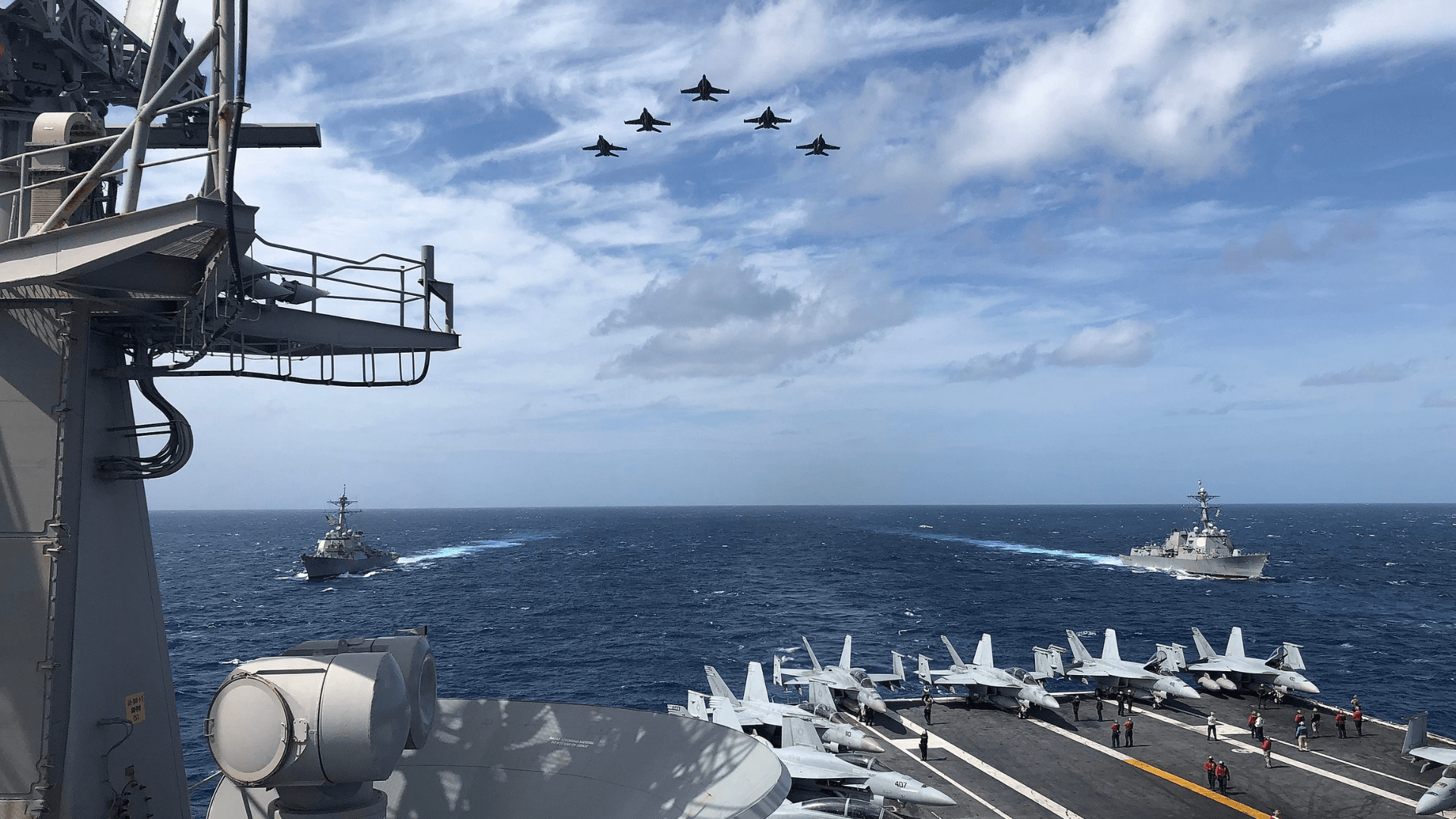

Potential Gains for the Defense Sector

One sector poised for potential gains is defense, where increased spending could be on the horizon. Amid escalating global tensions, additional military spending could be prompted by incidents such as attacks on shipping in the Red Sea and ongoing U.S.-China tensions, making the defense sector a potential winner in a second Trump presidency.

Although the specifics of Trump’s policies are yet to be revealed, defense, with its current budget of approximately $842 billion, could see a boost. This prospect bodes well for investors in military and defense contractors.

Military and Defense Contractors’ Projections

For instance, General Dynamics anticipates reaching $46 billion in sales this year, with an annualized growth rate of 3.7%, approaching $50 billion by 2026.

Lockheed Martin expects revenues of around $69 billion this year, projected to grow to $74 billion by 2026, representing a 3.6% annual growth rate. Similarly, Northrop Grumman and Raytheon Technologies are forecasted for annualized growth rates of 5.9% and 6.7%, respectively.

Regional Banks Might Benefit

Another sector that might benefit is regional banks, as Trump leans toward loosening

regulations, in stark contrast to President Biden’s push for more stringent capital requirements.

Basel III regulations, designed to bolster banks’ stability, could see increased stringency this year, requiring banks to maintain higher capital reserves. Trump’s stance, however, aligns with a rollback of these regulations, freeing up capital in the banking system for increased lending.

SPDR S&P Regional Banking Exchange-Traded Fund

The SPDR S&P Regional Banking exchange-traded fund is down approximately 5% this year.

However, it could experience a positive shift in market expectations for bank profits if regulations are relaxed. While regulatory changes are only one aspect influencing share prices, the prospect of looser regulations is generally viewed as a positive factor for the sector.

Keep a Watchful Eye

It’s essential to keep a watchful eye on these sectors as the campaign unfolds, considering how potential policy shifts could shape the investment landscape.

As the political narrative evolves, the defense and regional banking sectors may present unique opportunities for investors.