When it comes to saving money, most people think of cutting back on superfluous spending, such as eating out at restaurants or buying brand-name items.

However, experts report that there’s another way to save up to $80 every month without cutting back on anything.

It’s Possible to Save Money Just by Improving a Credit Score

Here’s the secret: The average person could save anywhere from $80 every month by simply having a better credit score.

And financial experts want people to understand that raising one’s credit score is not nearly as challenging as they think it is.

Understanding Credit Scores

Before diving into the tactics they say can help increase a credit score in no time, it’s important to understand how credit scores work.

A FICO credit score can range from 300 to 850; the number is calculated based on a consumer’s credit accounts, including payment history, length of credit accounts, amounts owed, and types of credit used.

What Is a Good Credit Score?

The higher one’s score, the more likely they are to get a better rate on a loan, including for cars, houses, and businesses.

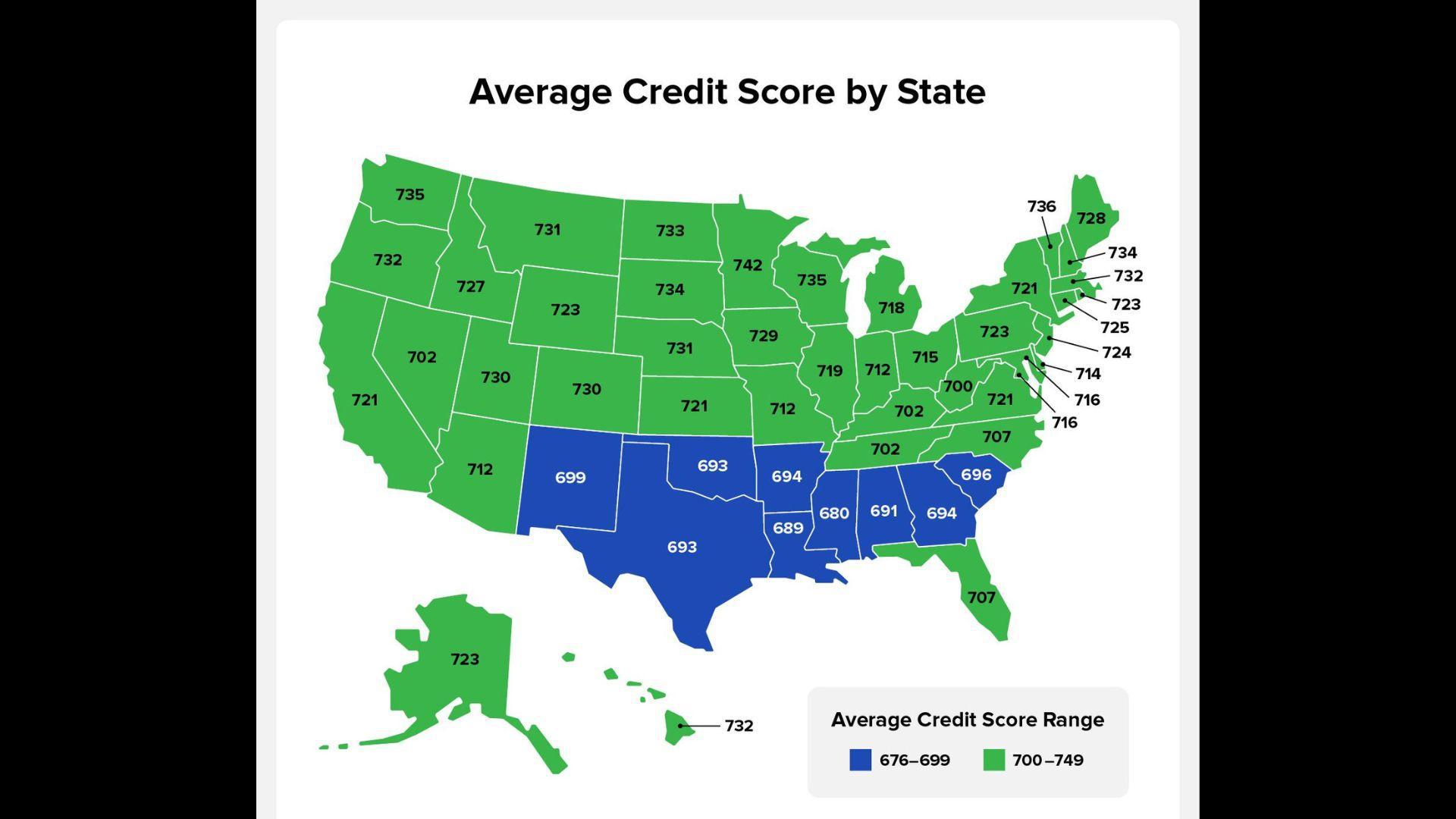

The general understanding is that a solid credit score is anywhere between 720 and 760, but the average American score is only 718.

Why Are Credit Scores Important?

Although there are some financial gurus who don’t believe that FICO credit scores are important, they are the minority.

Most agree that credit scores are incredibly important, especially for lower- and even middle-class people, because companies use these scores to decide whether or not someone is eligible for a mortgage, credit card, loan, or insurance.

Low Credit Scores Can Lead to Higher Payments

A credit score will also affect the type of loan once it is offered, as well as the interest and specific terms of the loan.

Therefore, someone with a lower score will actually pay more for the same items as someone with a high credit score.

How Much Can Someone Save by Improving Their Credit Score

A credit score between 300 and 579 is considered very bad, 580-669 is fair, 670-739 is good, 740-799 is great, and 800 or more is fantastic.

New reports say that if someone could raise their score from around 600 to 750, they could save at least $80 a month on credit card and auto interest. Plus, this could save someone more than $320 every month on a mortgage of $300,000.

Understanding Credit Utilization

Now, the first and arguably most efficient way to improve a credit score quickly is to pay bills in full and on time.

It’s called credit utilization, and it’s one of the largest factors in determining a credit score. After just one month of paying down any lingering credit card debt, the credit score may already improve.

Don’t Miss a Payment

In addition to paying off as much credit card debt as possible, to have a solid credit score, it’s also crucial to never miss a payment or a bill.

Missing just one scheduled payment can supposedly stay on a credit report for over seven years. Most financial experts recommend scheduling reminders to make sure every bill is paid on time.

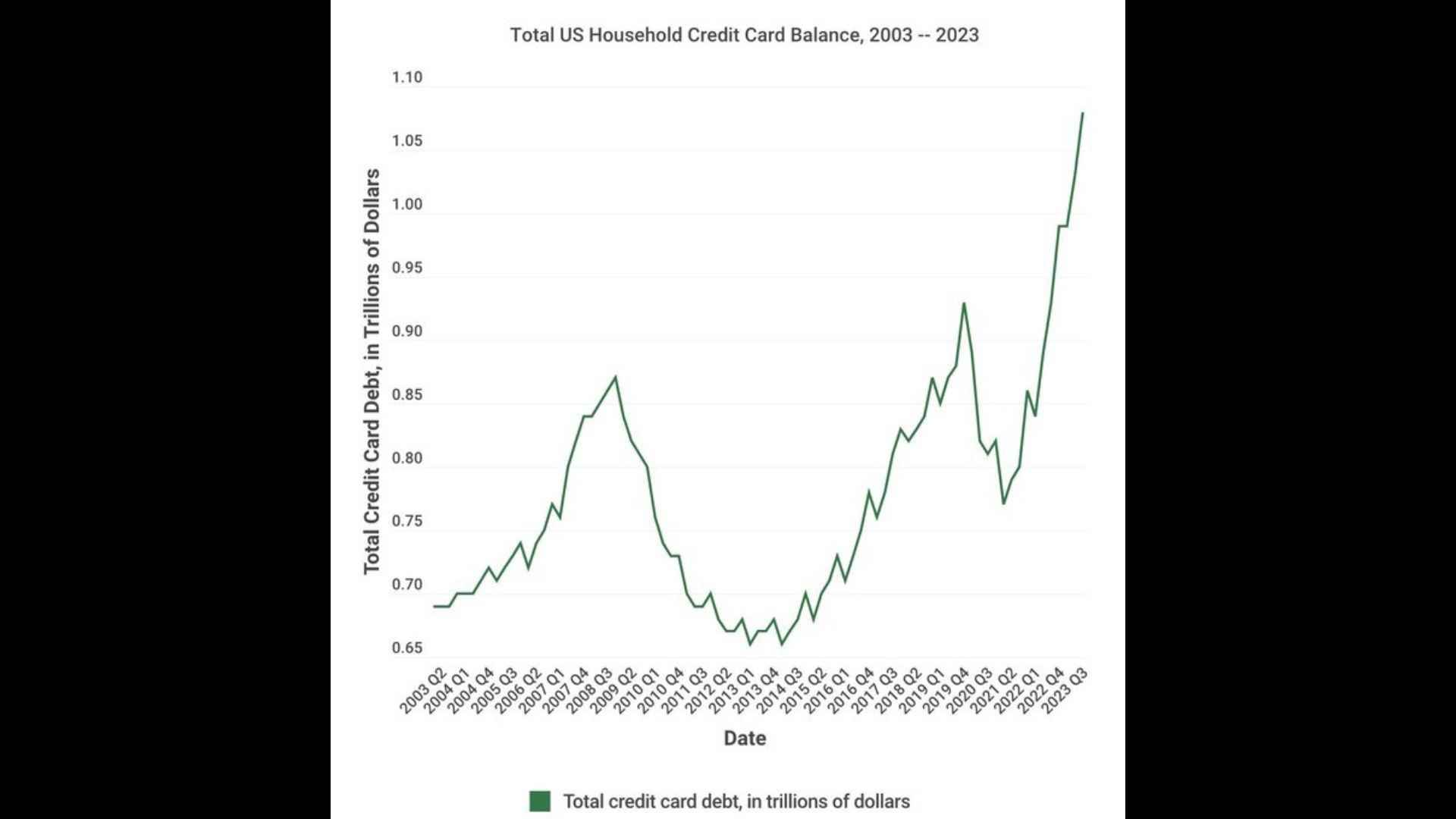

Americans Have a Real Debt Problem

According to The Motley Fool, as a whole, Americans owe an almost unbelievable $17.29 trillion in debt, and the average American household has a debt of $103,358.

And there is no doubt among financial experts that Americans, in general, need to make some serious changes in how they spend.

Living Debt-Free Is Best

In fact, the most common advice they give to anyone is to try their best to live completely debt-free.

That doesn’t mean not using credit cards or getting a mortgage, but it does mean paying them off as quickly and efficiently as possible.

Getting Credit Scores Down Is Helpful for Many Reasons

The bottom line is that paying off debts, loans, mortgages, and credit cards will not only save the average American money every month, but it will also ensure they receive better loan terms in the future.

And, of course, living without debt makes life a whole lot easier and less stressful. So there’s really no reason not to pay off those pesky balances.