In a significant development for California’s insurance market, The Hartford Financial Services Group Inc. has decided to stop offering new personal property insurance to homeowners.

The company stated, “The homeowners’ insurance environment in California has unique challenges that have required us to reconsider the viability of writing new homeowners’ business in the state.”

State Farm and Allstate Preceded The Hartford’s Exit

Prior to The Hartford’s decision, major insurers like State Farm and Allstate had already ceased writing new policies in California, Newsweek revealed.

They attributed their withdrawal to the heightened wildfire risks in the state. The Hartford echoed this sentiment in a statement reported by Newsweek, saying, “Based on these challenges and our analysis of the trends, we have decided to stop offering new homeowners policies starting Feb. 1, 2024.”

Proposition 103 Influencing Insurance Rate Decisions

California’s Proposition 103, a regulatory measure requiring approval for rate changes, is impacting insurers’ ability to respond to risks.

The Hartford highlighted this issue, stating to The San Francisco Chronicle, “Rate adequacy and regulatory reform are both critical to bringing stability back to the market.”

The Hartford’s Strategic Shift in California

The Hartford is adapting its operations in California in response to the evolving insurance landscape.

While it will not offer new homeowners insurance policies, the company assures that they “will continue to renew existing homeowners’ business consistent with our underwriting guidelines.” They also confirmed their ongoing commitment to other insurance products in the state, per information from Newsweek.

Limited Insurance Options for California Homeowners

Newsweek explained that the exit of insurers like State Farm, Allstate, and now The Hartford is leading to fewer choices for California homeowners seeking insurance.

This trend is a direct response to the challenging conditions in the state’s insurance market, particularly concerning wildfire risks and regulatory constraints.

Commissioner Lara’s Sustainable Insurance Strategy

Responding to the crisis, California Insurance Commissioner Ricardo Lara has introduced a new strategy.

The Hartford acknowledged these efforts, telling Newsweek, “We appreciate and support efforts like Commissioner Lara’s Sustainability Insurance Strategy to help bring stability to the market.” This strategy aims to ensure that insurers maintain a significant presence in areas with high wildfire risk.

Insurance Premiums: California vs. Florida

Insurance premiums vary significantly between California and Florida, with Florida having the highest average premiums in the U.S. at $4,218 annually, according to data from Insurance.com.

California’s average is much lower at $1,380, partly due to the effects of Proposition 103. This contrast highlights the differing impacts of state-specific regulations on insurance costs.

National Trend of Increasing Insurance Rates

Forbes reports that insurance premiums are rising nationally, with companies like Farmers Insurance and USAA leading the trend.

“Farmers raised rates by 14.8% as of September 1, slightly exceeding USAA’s 14.7%,” according to S&P Global Market Intelligence’s RateWatch.

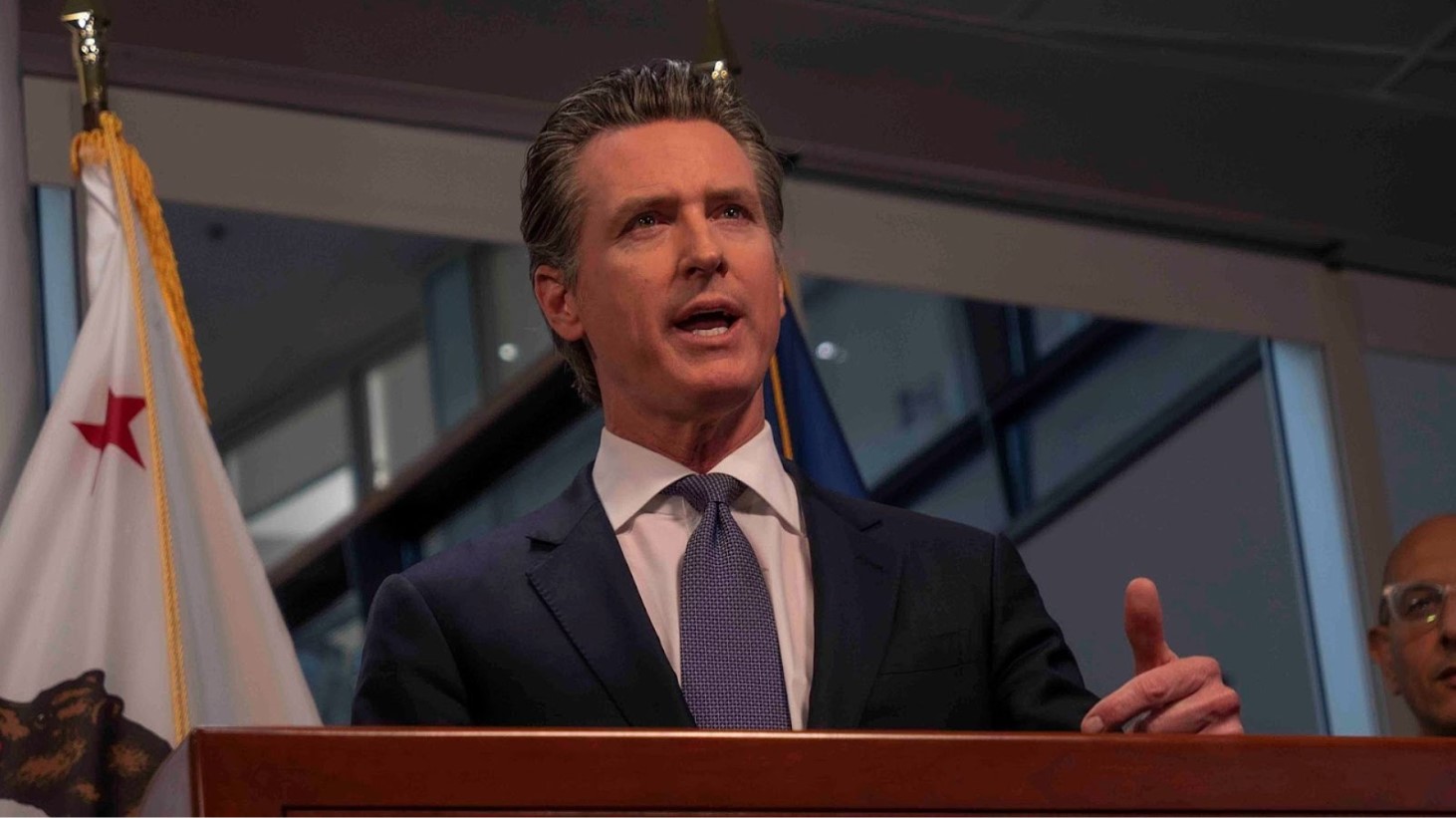

Governor Newsom’s Executive Action on Insurance

Governor Gavin Newsom has taken executive action to address California’s insurance issues.

Newsweek reports that he signed an executive order requesting the state’s insurance regulator to expand coverage options and improve rate approval processes.

The Enduring Effects of Proposition 103

Proposition 103, which was passed 35 years ago, continues to influence California’s insurance market today.

Newsweek explains that it keeps insurance rates lower but does not give authorities the power to stop private insurers from pausing coverage in the state.

The Crossroads of California’s Insurance Crisis

California faces a pivotal moment in its insurance industry, particularly due to increasing climate-related disasters.

Newsweek reports that Insurance Commissioner Ricardo Lara emphasized the urgency in a press release, stating, “We are at a major crossroads on insurance after multiple years of wildfires and storms intensified by the threat of climate change. I am taking immediate action to implement lasting changes that will make Californians safer through a stronger, sustainable insurance market.”

The Wider Impact of Climate Change on Insurance

Climate change is affecting the insurance industry, with increased extreme weather events like wildfires posing new challenges.

States such as California and Florida are particularly affected by these changes, highlighting the need for the insurance sector to adapt to the evolving risk landscape associated with climate crises, per information from Newsweek. Lara acknowledged this, stressing, “The current system is not working for all Californians, and we must change course.”