The 2 Biggest Economies in the World are Moving In Different Directions

The economic policies and growth trajectories of the United States and China are markedly diverging. This shift is reflected in their respective stock markets, highlighting different approaches and outcomes in their economies.

According to Business Insider, experts have analyzed the economic and market outlooks for these two superpowers, underscoring the contrast in their paths.

US Experiences Significant Growth

The United States has reported a robust quarter of economic growth, with real GDP reaching 3.3% in the last three months of 2023, surpassing expectations. This follows a remarkable 5% growth in the preceding quarter, challenging the recession narrative.

Source: Nextvoyage/Pexels

The International Monetary Fund has responded by raising its global GDP outlook from 2.9% to 3.1%, reflecting the strength of the US economy, Business Insider reports.

The U.S. Economy Did Shrink

The U.S. economy shrank around 30 percent at the end of last year, which means that the U.S. dollar’s value fell 3 percent, according to Financial Times.

Source: Karolina Grabowska/Pexels

Despite all of its issues, the U.S. economy is still the largest in the world. China, however, is failing to catch up despite its growth.

The U.S. Trade Solution

The U.S. is pivoting its trading relationships as it turns toward Mexico. In 2023, Mexico did more trade with the U.S. than ever before.

Pixabay/Pexels

However, the balance of trade in the U.S. has been concerning. For the first time since 2019, the ratio between exports and imports is 40% of exports.

China’s Economic Growth

Currently, China is maintaining one of the highest economic growth rates in the world, lifting over 800 million people out of poverty. Based on the market exchange rate, China has the largest purchasing power.

Source: China Photos/Getty Images

While the U.S. dollar still reigns supreme, China’s growth could threaten the dollar’s dominance in the global market.

China Faces Economic Challenges

China, conversely, is encountering significant economic challenges as it emerges from pandemic lockdowns.

Source: Hanny Naibaho/Unsplash

Issues such as mounting debt, deflation, and a troubled real estate market have led to a decrease in foreign investment in the country’s financial markets, according to Business Insider.

US-China Economic Imbalance

Arthur Laffer Jr., president of Laffer Tengler Investments, discussed with Business Insider the imbalance between the US and China, noting its impact on both nations.

Source: Andy Li/Unsplash

He said, “A strong US economy buys more foreign goods from China with a stronger US dollar,” which helps sustain China’s manufacturing and exports. However, he also pointed out that China’s policy initiatives are more like “Band-Aids” that fail to address the root causes of its economic issues.

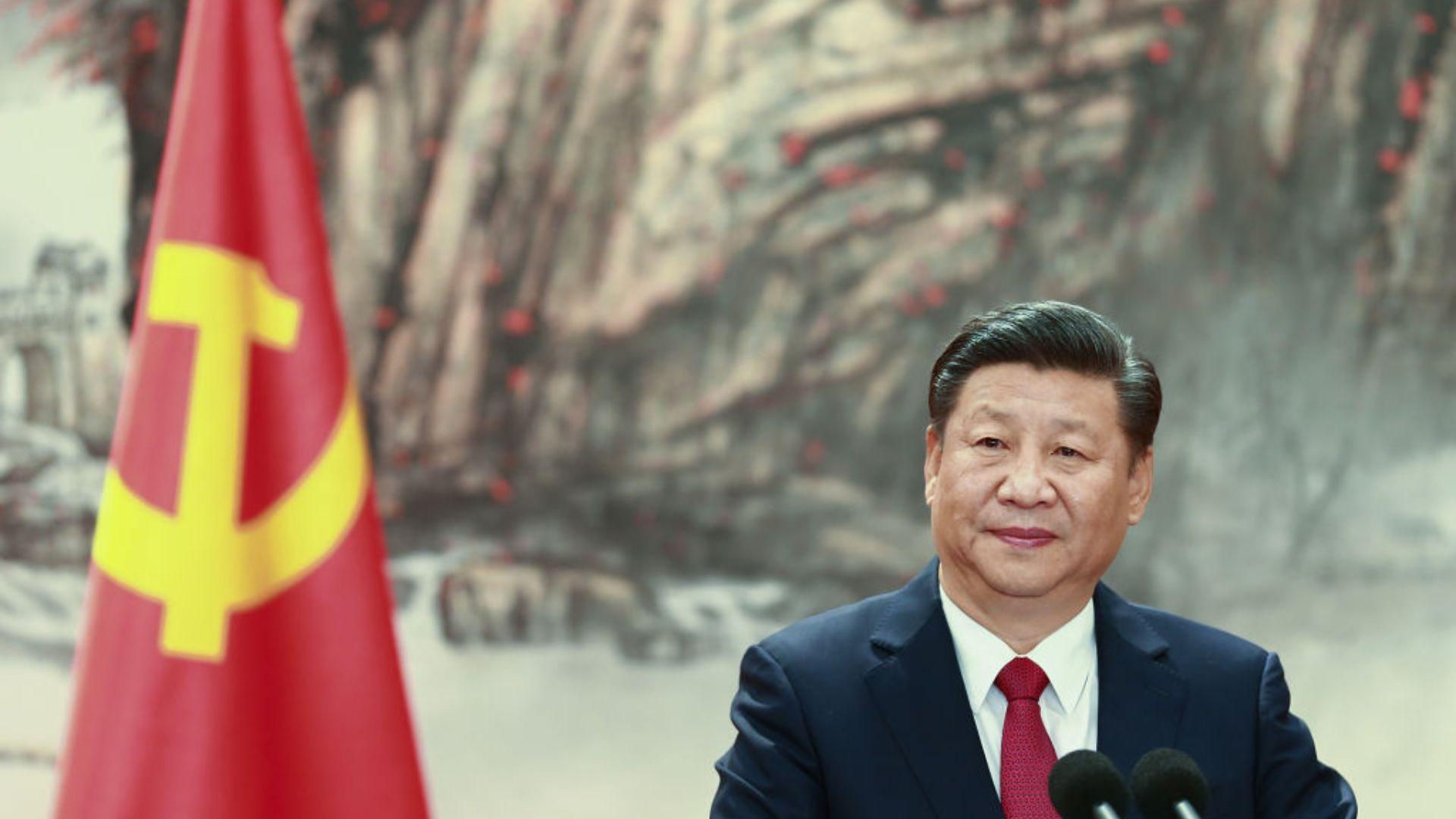

Xi Jinping's Growth Ambitions

According to Business Insider, under President Xi Jinping’s leadership, China is striving to achieve its growth ambitions despite facing internal challenges and the external economic strength of its biggest rival, the United States.

Source: Getty Images

This situation places Beijing in a delicate position as it navigates through its domestic issues and the comparative economic performance of the US.

China’s Economy Hits a Rough Patch

However, as the Chinese economy hits a rough patch, the U.S. could see the economy grow if inflation rates cool down. The Chinese government surprised investors by not cutting important interest rates that influence mortgages.

Source: Yan Ke/Unsplash

Economists say that the move will make China’s real estate sector tougher, decelerating the GDP. “All else equal, a flagging Chinese economy may be one of several catalysts that could lead to [a] recession later this year or early next,” wrote Jason Pride and Michael Reynolds, strategists at investment management company Glenmede, in a note Monday (via CNN).

China’s Disinflation Could Cause Problems

“It seems China’s disinflation problem is coinciding with the European and US struggle to significantly bring down inflation,” said Edward Moya, senior market analyst at data and analytics firm OANDA.

Source: Pixabay/Pexels

Moya continued: “Overall this is going to lead to a much weaker demand for European and US goods. That will help bring down inflation for a lot of the advanced economies that have been aggressively hiking interest rates.”

Diverging Consumer Bases

Joseph Seydl, a senior markets economist at JPMorgan Private Bank, highlighted to Business Insider the stark differences between the consumer bases in the US and China.

Source: Precious Madubuike/Unsplash

The US has seen strong consumer spending, aided by pandemic stimulus checks and unemployment benefits, in contrast to China, where policymakers have been more cautious, focusing on export growth over domestic consumption.

Consumer Spending Is Highest in the U.S.

Despite the high prices and unwavering high inflation rates, consumer spending is still high. In September 2023, the U.S. government reported that consumer spending rose by 0.4 percent.

Source: Freepik

However, economists believe that this spending isn’t likely to continue in the coming months as many households are no longer eating out, traveling, or visiting entertainment venues.

Stimulus Measures in the US and China

The approach to stimulus measures varies greatly between the US and China, reflecting their differing economic strategies. The US has actively supported its population through financial aid, which has helped maintain consumer spending and economic momentum, as per Business Insider.

Source: Getty Images

In contrast, China has prioritized export growth, wary of stimulating domestic consumption too much for fear of affecting exports or causing inflation.

The Real Estate Sector in China

China’s real estate market is currently facing significant challenges, with efforts to deleverage and reduce risks.

Source: Henry Chen/Unsplash

The downturn in this sector has had a substantial impact on consumer sentiment and spending, as a large portion of Chinese citizens’ wealth is tied to real estate. Business Insider reports that tumbling property values have led to decreased confidence and increased savings among consumers.

Liquidation of China Evergrande

A Hong Kong court ordered the liquidation of China Evergrande, the world’s most indebted real estate developer, as reported by Business Insider.

Source: Getty Images

This development complicates the government’s efforts to support the sector and affects over a million people who have paid for homes that have not been built, highlighting the severe challenges in China’s real estate market.

US Real Estate Market Faces Different Challenges

The real estate market in the US, both commercial and residential, faces its own set of challenges, albeit not as severe as those in China.

Source: xb100/freepik

Business Insider reports that high interest rates have affected home buying activity, and the shift towards work-from-home trends has impacted the commercial market. However, experts do not foresee these issues as a systemic threat to the US economy.

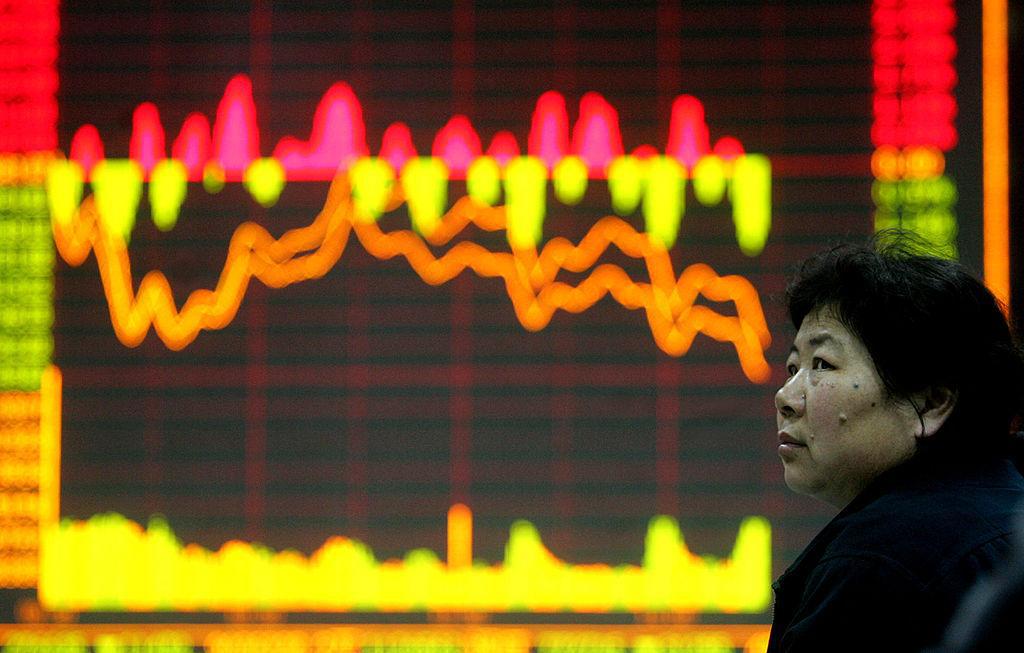

Stock Market Performance Reflects Economic Fortunes

The differing economic fortunes of the US and China are evident in their stock market performances.

Source: Getty Images

US stocks have seen significant gains, whereas Chinese and Hong Kong stocks have experienced a sharp decline, reflecting the exodus of foreign investors and the underperformance of China’s benchmark indexes compared to those of the US and other large economies, as per Business Insider.

Market Predictions for 2024

Market analysts predict that the disparity between the American and Chinese stock markets may narrow in 2024.

Source: David Jones/Unsplash

Laffer Jr., told Business Insider “I expect that the Chinese market will bounce around, but that the bias is towards more pain since the problems are systemic, in my opinion. The US, on the other hand, should do well for the 2024 period — strong economy, strong employment, strong earnings, strong dollar.”

China's Rapid Rise

According to data from the World Bank, China’s GDP increased by an average of 9 percent per year since it opened up its economy in 1978.

Source: Manuel Joseph/Pexels

Between 2000 and 2021, the size of the Chinese economy grew tenfold. In the year 2000, China had a $1.2 trillion economy and in 2021 it had grown to almost $18 trillion.

China's Growing Pains

Some economists are placing the blame on China’s recent economic struggles as the consequences of its rapid economic expansion that was continually pushed by the government at great cost.

Source: Nuno Alberto/Unsplash

According to Econofact, China owes its growth to market reforms and globalization. However, this reliance on the global economy guaranteed that it was bound to come to a halt with an event like the COVID-19 pandemic.

How Bad is the Debt?

Bloomberg reported in January that China’s debt-to-GDP ratio has reached a record high. In the fourth quarter of 2023, this ratio reached 286.1%.

Source: Towfiqu BarbHuiya/Unsplash

This is at a ratio in 2023 that even exceeds the debt ratio of the United States, which reached 124.2% in December 2023 according to CEIC Data. This debt has been exasperated by overbuilding and overdevelopment of real estate in the country.

China's Debt is Owned by the State

According to Reuters, China’s debt crisis can be blamed on many of the state-owned firms in the country.

Source: Alexander Schimmeck/Unsplash

The country’s leadership was keen to keep economic growth going ahead at breakneck speeds, which resulted in many companies continually taking out debt to fund the expansion. Now these Chinese companies are unable to make their debt payments as the economy is starting to stall.

The Health of Chinese Companies

A data analysis by Reuters found that the number of mid-to-large-sized companies with a healthy amount of debt fell drastically in just 8 years.

Source: atlascompany/freepik

In 2008 the number of companies with healthy levels of debt they could pay back was 845. Just a short time later in 2016, that number had dropped to 577, representing a 31.7% decrease.

Companies With Unhealthy Debt Quickly Grew

The Reuters analysis also found that the number of larger debt-holding companies, with an unhealthy debt ratio, ballooned during the same time.

Source: XYZ NFT Gallery/Unsplash

In 2008, only 262 of these companies had an unhealthy level of debt. This number changed to 395 in just 8 years. The data suggests that two-thirds of corporate debt in the country belongs to Chinese state-owned companies.

The Pandemic's Effect On China

According to the China Research Center, the pandemic was one of the major contributors to the country’s recent economic downturn.

Ketut/Pexels

They also place blame on the 2018 trade war and the real estate decline of 2021. In response to the outbreak of COVID-19 China instituted harsh public health protocols that severely affected the country’s economy, causing it to slow tremendously.

China's Public Health Policies

China Research Center estimates that there were hundreds of cases of COVID-19 initially discovered in December 2019 in Wuhan, China.

Source: Edwin Hooper/Unsplash

The country became the epicenter of the pandemic and decided to launch a Level 1 Provincial Response to Public Health Emergency. This is the highest level of response and requires not just patients but suspected patients and any close contacts to be held in quarantine.

The Cases Didn't Stop

Despite China’s “Zero-Covid” health policy measures, the virus continued to spread to other areas of the country. The country implemented harsh measures that included preventing people from leaving high-risk areas.

Source: Martin Sanchez/Unsplash

According to Chinese Research Center, political pressure eventually forced them to halt these measures, but another spike in cases in 2022 further depressed the economy. It wasn’t until 2023, nearly three years later, that China could begin to recover.

Linger Pandemic Effects in the U.S

The pandemic is still affecting the U.S. as well. Many businesses–from mom-and-pop shops to chain restaurants and stores–are filing for Chapter 11 bankruptcy.

Source: Usman Yousaf/Unsplash

NPR reports that the hundreds of companies that filed for bankruptcy this year are limping along despite the economy doing fairly well.

End of the China Miracle

China’s economic growth is often referred to by economists as the ‘China miracle’ because of how high the growth was and how long it was sustained.

Emil Kalibra/Unsplash

This growth suddenly halted after the outbreak of COVID-19, according to Chinese Research Center. Economic growth went from 6% per year in 2019 to just 2% in 2020.

What Is the “Chinese Miracle”?

The “Chinese Miracle,” or the Chinese economic reform, refers to a variety of economic reforms termed “Socialism with Chinese characteristics” and “socialist market economy” in China.

志涛 张/Wikimedia Commons

The reform has led to an annual growth rate of 10% for 30 consecutive years, which has defied the predictions of economists, according to the Global Development Policy Center.

China Can't Spend Its Way Out

According to Chinese Research Center, analysts think that the current rate of domestic consumption is too low to sustain the current Chinese economy.

Source: Igal Ness/Unsplash

This leaves the economy dependent on public investment from the government to rekindle and stimulate growth. However, a heavy-handed investment approach has its downsides. Mainly it hurts productivity which will further hinder the recovery.

China Diverging from the United States

When the United States had its own financial crisis in 2008, it resulted in an unprecedented public spending stimulus package in the country’s history.

Source: Karolina Grabowska/Pexels

According to Business Insider, the American Recovery and Reinvestment Act of 2009 delivered $831 billion in aid to jumpstart the economy. China so far has been resistant to a stimulus approach to economic recovery, taking lessons from the American experience and hoping to avoid more ballooning debt.

The Tariff Problem

However, the U.S. and China’s trade relationship could put the U.S. economy in a tough spot. China-U.S. trade fell by 14.5 percent in the first half of the year from a year ago, according to China’s ambassador to the U.S. Xie Feng blames the tariffs established by the U.S.

Source: Andy Li/Unsplash

“This is a direct consequence of U.S. moves to levy Section 301 tariffs on Chinese imports, abuse unilateral sanctions and further tighten up export controls,” Feng said (via CNBC).

U.S. Tariffs Could Hurt the Economy

According to the Tax Foundation model, the Trump-Biden tariffs will reduce long-run GDP by 0.21 percent, wages by 0.14 percent, and employment by 166,000 full-time equivalent jobs.

Source: Karolina Grabowska/Pexels

As the tariffs raise prices in the U.S., the available quantities of goods and services for U.S. businesses and consumers will be reduced. This will lower income, reduce employment, and, ultimately, hurt the U.S. economy.

The U.S.’s Heavy Debt

Since the Trump administration, the U.S. debt problem has gotten worse. The IMF reports that the increased government spending, growing public debt, and elevated interest rates in the U.S. have contributed to high and volatile interest rates on Treasuries.

Source: Pixabay

“Loose fiscal policy in the United States exerts upward pressure on global interest rates and the dollar,” Vitor Gaspar, director of the IMF’s fiscal affairs department, told reporters. “It pushes up funding costs in the rest of the world, thereby exacerbating existing fragilities and risks.”

China Beats the U.S. In One Area

As of 2023, both countries share 42.73 percent and 34.23 percent of the entire world’s GDP in nominal and PPP terms. While China has a vastly larger population compared to the U.S., it is unlikely that the country will overshadow the U.S.

Source: Freepik

However, China does beat the U.S. out in the Agriculture and Industry sectors, with the Agriculture Output of the U.S. only 17.58% of China and 77.58% for the Industry sector.