Several years ago, the idea of the top 1% of Americans owning the majority of the country’s wealth became a nationwide complaint.

However, the protests of the American people did nothing to change the country’s wealth gap. In fact, as of 2024, that 1% has more money than they ever have before, and they officially control more money than the entire middle class combined.

The Top 1% of American Earners Have $38.7 Trillion

According to USA Today, “The top 1% holds $38.7 trillion in wealth,” which means they control 26.5% of all wealth in the United States.

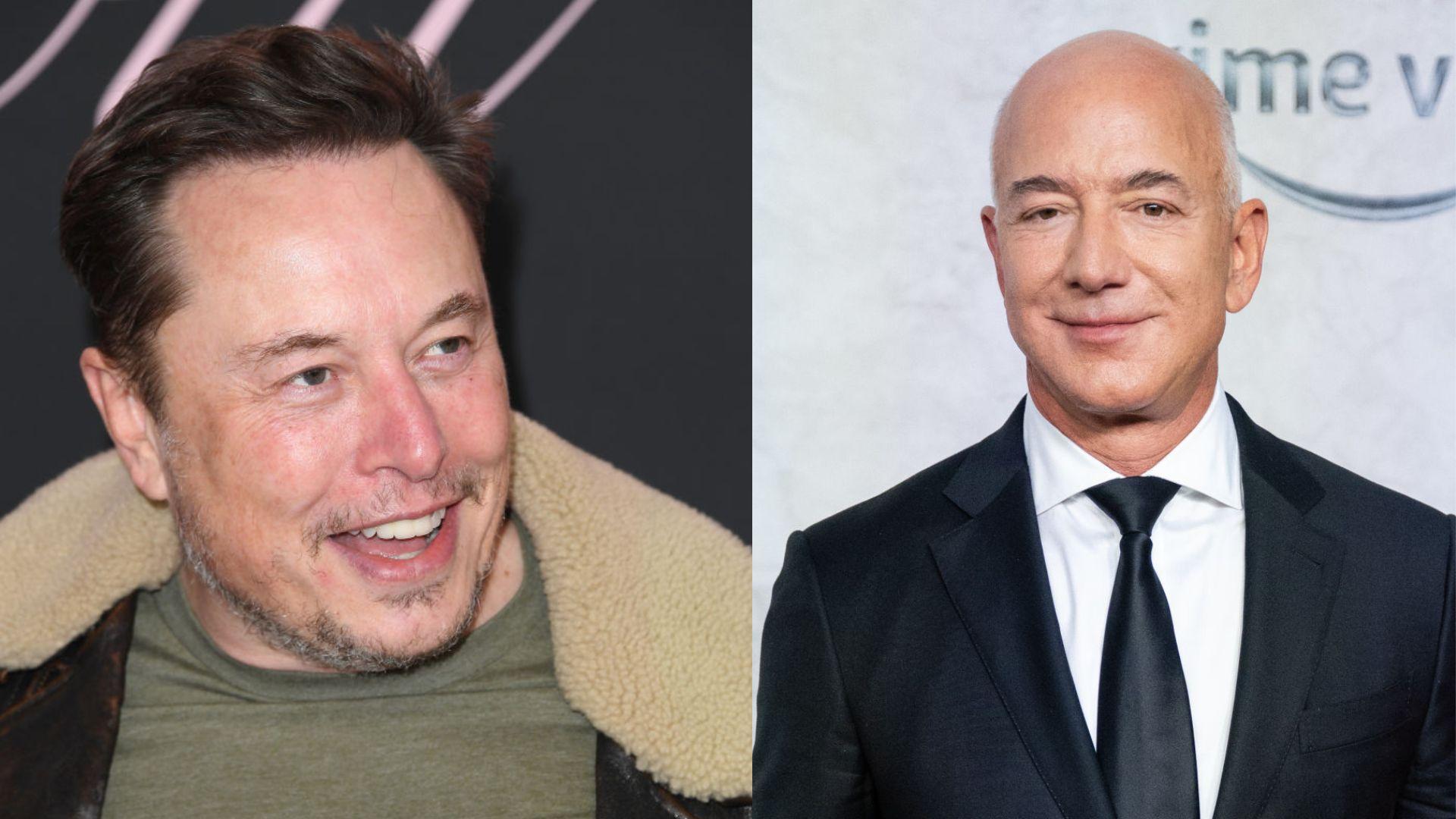

Of course, a large percentage of this wealth is held by multi-billionaires such as Elon Musk and Jeff Bezos, who are worth an almost unbelievable $100 billion and $192 billion, respectively. However, many of the 1%ers are just regular millionaires.

The Rich Among Us

Princeton University economist Owen Zidar told the press, “The number of deca-millionaires has more than doubled since 2000, and the number of centi-millionaires has quadrupled.”

And continued, “[Millionaires are] more and more these private business owners. And a lot of them are boring businesses. Auto dealers. Beverage distributors. People who own seven Jiffy Lubes.”

How Are the Rich Getting Richer?

And while many of the country’s millionaires and multi-millionaires are entrepreneurs and business owners, there are other tactics that the 1% have taken to ensure their wealth grows every year.

First, they buy property. According to Federal reports, the top 1% owns 12.9% of all real estate wealth, and since the price of real estate increases every year, that means their net worth is steadily growing without any effort at all.

Investments Have Paid Off

The top 1% are fantastic and avid investors. In fact, the Federal Reserve noted that the top 1% hold almost half of all mutual fund shares and corporate equity. And these investments have allowed many millionaires to become multi-millionaires in recent years.

Financial expert Zidar explained, “People who owned homes, who owned stocks, who owned retirement accounts, they did very well.”

Salaries for the Top 1% Have Grown by 206%

Not to mention the fact that from 1979 until now, the annual salary of the top 1% has grown by a whopping 206%.

So, the bottom line is that the rich are getting paid more, making money from their investments, and reaping the benefits of increasing real estate prices more than ever before.

Who Are the Middle Class?

Now, understanding the uber-wealthy and how they got there is crucial, but it’s also important to understand America’s middle class, including who they are and why they’ve been surpassed by their millionaire neighbors.

The Pew Research Center defines the middle class: “as households that earn between two-thirds and double the median U.S. household income,” and in 2024, 42% of Americans fall within this category. And those 42% reportedly control 26% of the country’s wealth, which is .5% less than what the 1% owns.

Middle-Class Americans Are Struggling to Buy Property

When learning that the middle class now officially owns less wealth than the top 1%, many people wonder why this is happening when it never has before. And there are essentially three reasons: Property, salary, and investments.

The first important aspect of the ever-growing wealth divide in the United States is the country’s tumultuous housing market. Those in the middle class can no longer afford homes, as the average cost for a house has skyrocketed to $412,000.

Middle-Class Income Has Grown Too, But Not as Much

Another noteworthy aspect of the middle class is that while annual incomes for the top 1% have increased by 206%, the middle class has only seen a 29% growth.

This stagnation of income growth is certainly ensuring that the middle class makes far less than the 1%. But along with the ever-increasing cost of living across the county, it also means that those with median incomes are seriously struggling to save for the future.

The Top 1% Are Getting Rich Much Faster than the Middle-Class

Scott Hoyt, the senior director for Moody’s Analytics, explained why the disparity between the growth and opportunity for the wealthy versus the middle class is undoubtedly a problem.

Hoyt said, “If a rising tide is lifting all boats, but just lifting some boats more than others, that’s one thing, [but] if the playing field is tipping, and some people are getting more wealthy, and some are getting less wealthy, that’s another story.”

The Wealth Divide Could Prove Problematic

To put it simply, the nation’s economy is not benefiting the entirety of the population; it’s only of use to the 1%. And that reality could cause the middle class to become increasingly frustrated.

Chair of the economics department at Brown University, John Friedman, explained, “When people feel like they don’t have a chance, or perhaps even more dangerously when they feel like their kids don’t have a chance . . . that inequality of opportunity is what really gets people upset.”

How Can the Middle Class Join the Race to the Top?

The final aspect of the middle-class crisis is that many, thanks to rising housing prices, the cost of living, and stagnant salaries, don’t feel as though they can afford to invest.

However, economists and financial experts have made it clear that in order for the middle class to recover, they absolutely have to find ways to do so. Investments will not only increase their personal net worth. But even more importantly, it will provide their children with the means to buy a home or start a business and maybe even become part of the 1% themselves.