On Thursday, the Supreme Court ruled to uphold a Trump-era tax law that imposed taxes on foreign income.

This ruling prevents what could have been a significant loss of federal tax revenue, estimated to be in the hundreds of billions or even trillions of dollars, according to the federal government’s statements during the case.

Implications for Future Tax Policies on the Wealthy

While the case had broader implications regarding a possible wealth tax, the Supreme Court explicitly stated that this ruling does not address those concerns.

“Those are potential issues for another day,” wrote Justice Brett Kavanaugh for the majority, leaving the subject open for future consideration.

Reactions to the Ruling from Tax Advocates

Adam Green, co-founder of the Progressive Change Campaign Committee, perceived the court’s decision as a step forward for taxing wealth and limiting billionaire power.

He expressed optimism about the ongoing efforts, stating, “Today’s Moore decision means the fight to tax wealth and rein in billionaire power is alive and well, and political leaders should make that a priority in the 2025 tax fight.”

Conservative Perspective on the Wealth Tax Issue

Thomas Berry from the conservative Cato Institute reacted by expressing disappointment that the Supreme Court did not more definitively close the door on a wealth tax.

However, he noted the ruling’s neutrality on the issue: “But it is important to recognize that it has not opened that door either,” said Berry.

The Case of Charles and Kathleen Moore

The case involved Charles and Kathleen Moore, a retired couple from Washington state, who challenged a $14,729 tax bill on an investment in a company based in India.

This bill stemmed from tax changes enacted by the GOP-controlled Congress in 2017, targeting U.S. shareholders of certain foreign companies.

GOP’s 2017 Tax Overhaul Explained

The 2017 tax changes significantly altered how U.S. companies were taxed on foreign earnings. Previously, companies could indefinitely defer U.S. taxes on foreign profits if those profits remained overseas.

The new law imposed a one-time tax on the earnings of U.S. shareholders in foreign companies, aiming to bring these profits back under U.S. tax jurisdiction.

Constitutional Arguments Presented by the Moores

The Moores contended that the tax was unconstitutional under the 16th Amendment, which allows the government to tax income.

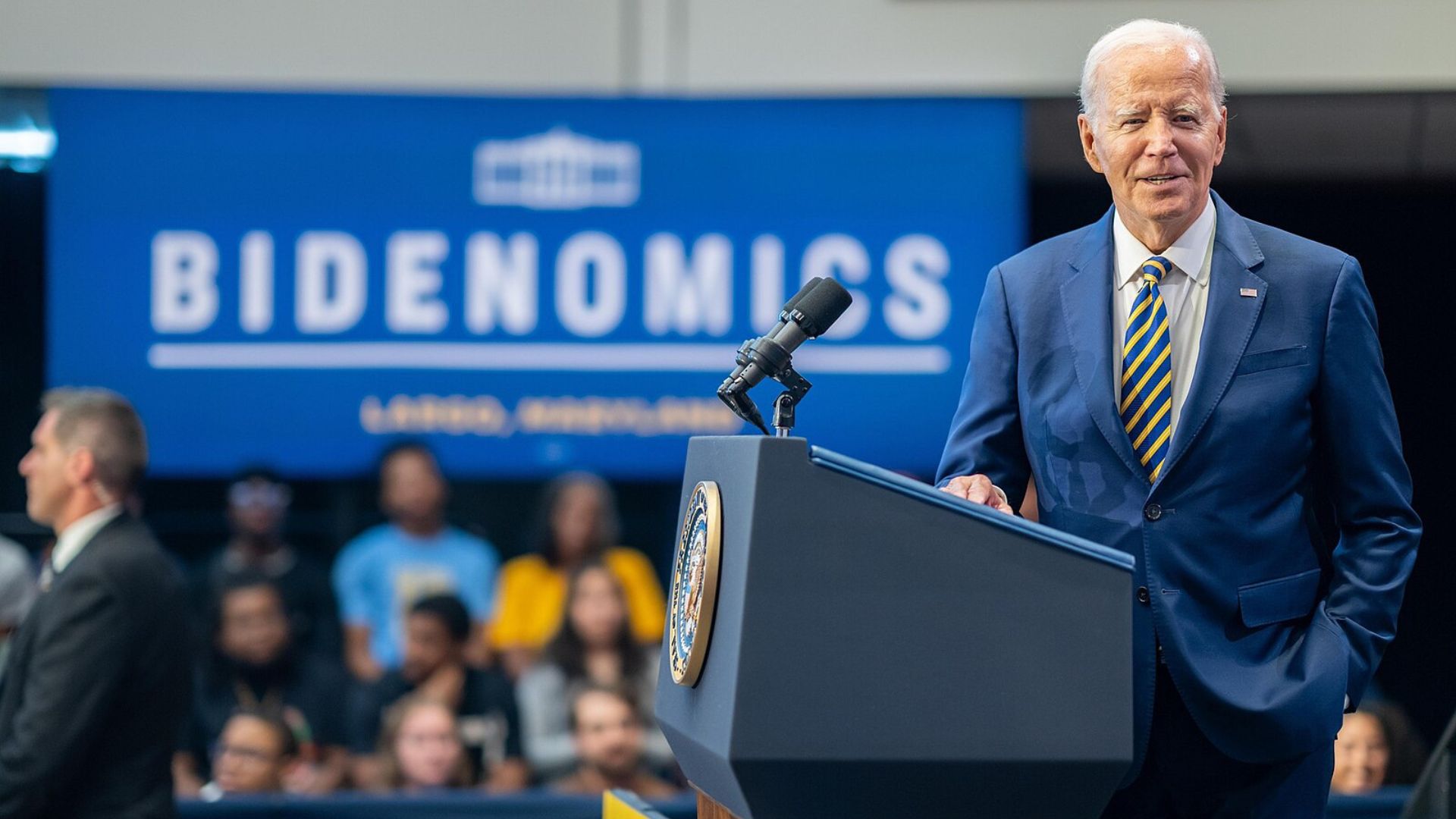

They argued that since their dividends were reinvested and not distributed, these should not be considered income for tax purposes. The Biden administration defended the tax provision, emphasizing its importance for maintaining federal tax structures.

Judicial Decisions Supporting the Tax

Ultimately, the Supreme Court, along with lower courts, found the tax to be constitutionally valid.

They determined that the dividends, though not distributed, constituted income that Congress could tax, thus siding with existing legislative and judicial interpretations of tax laws.

Justice Kavanaugh’s Rationale in the Ruling

Justice Kavanaugh reinforced the legislative prerogative in his ruling: “Consistent with this Court’s case law, Congress has long taxed the shareholders and partners of business entities on the entities’ undistributed income,” he wrote.

This reflects a longstanding practice by Congress that aligns with judicial precedents supporting such taxes.

Potential Consequences of Overturning the Tax

Justice Kavanaugh elaborated on the potential disruptions if the Supreme Court had ruled otherwise.

He said, “The logical implications of the Moores’ theory would therefore require Congress to either drastically cut critical national programs or significantly increase taxes on the remaining sources available to it—including, of course, on ordinary Americans.”

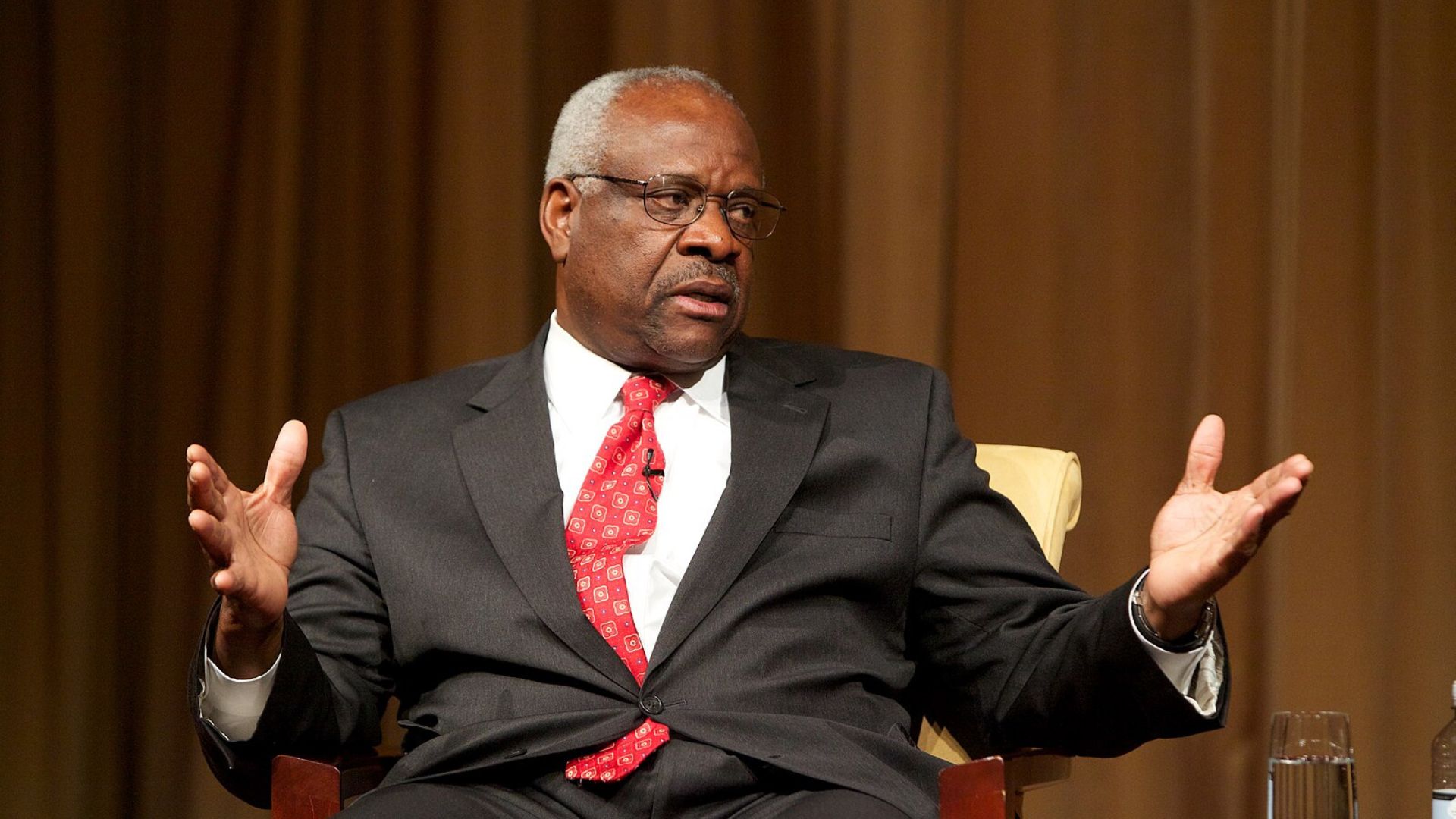

Dissenting Opinions Within the Supreme Court

Justice Clarence Thomas, joined by Justice Neil Gorsuch in dissent, argued that the Moores should not be taxed on gains they never received.

Thomas criticized the majority for avoiding a direct discussion on the wealth tax implications: “But, if the Court is not willing to uphold limitations on the taxing power in the expensive cases, cheap dicta will make no difference.”

Controversy Surrounding Justice Alito’s Participation

Justice Samuel Alito faced criticism and calls for recusal after his interactions with one of the Moores’ lawyers, who had previously written favorably about Alito.

Alito defended his decision to remain on the case, stating, “There was no valid reason” for recusal as his discussions with the lawyer did not pertain to the case specifics.