On Wednesday, the US Supreme Court denied an emergency request by the Biden administration that sought to revive an effort to forgive federal student loan debt in America.

During the 2020 election cycle, Biden made a campaign promise to forgive $10,000 of federal student loans per person. However, efforts from the administration to broadly cancel student loan debt have been repeatedly rejected by the nation’s courts over the years.

Brief Order

The Biden administration sent a brief to the Supreme Court’s emergency docket that asked the court to lift a nationwide injunction on its latest plan to forgive student loans imposed by a federal appeals court.

However, the Supreme Court denied the request from the Biden administration with no noted dissents.

Campaign Promise

In 2020, then-presidential candidate Joe Biden took the issue of student loan debt as a major part of his platform, promising relief for all the nation’s student loan borrowers.

“We should forgive a minimum of $10,000/person of federal student loans, as proposed by Senator Warren and colleagues. Young people and other student debt holders bore the brunt of the last crisis. It shouldn’t happen again,” read an X post posted to the official Biden account in March 2020.

Making Good on the Promise

In 2022, the White House announced a three-part plan to make good on that $10,000/person promise as well as other ones.

“Department of Education will provide up to $20,000 in debt cancellation to Pell Grant recipients with loans held by the Department of Education, and up to $10,000 in debt cancellation to non-Pell Grant recipients,” said a White House statement.

Blocking the Plan

However, in December of that year, the Supreme Court blocked the plan over legal questions around whether Biden had proper authority to cancel student loans in such a broad way.

The student loan plan was challenged by conservative states, who felt the cost was too much. A Congressional Budget Office analysis of the Biden loan program found that it would cost more than $400 billion over three decades.

New Plan

While the previous effort was blocked by the Supreme Court, the Biden administration put together a new intiative to make good on its promises known as the Saving on a Valuable Education (SAVE) plan.

In July of 2023, the Biden administration finalized the plan, which would reduce some borrower payments down to $0 per month and would go into effect in July 2024.

Blocked Again

However, before the SAVE plan could fully go into effect, parts of it were blocked by lower courts while they ruled on legal issues.

In July of this year, a federal appeals court blocked its implementation completely by stopping the remaining parts not previously blocked by the lower courts.

Hurting Students

In response to the SAVE plan being blocked, Education Secretary Miguel Cardona in July spoke out against the ruling.

“Today’s ruling from the 8th Circuit blocking President Biden’s SAVE plan could have devastating consequences for millions of student loan borrowers crushed by unaffordable monthly payments if it remains in effect,” Cardona said in a statement. “It’s shameful that politically motivated lawsuits waged by Republican elected officials are once again standing in the way of lower payments for millions of borrowers.”

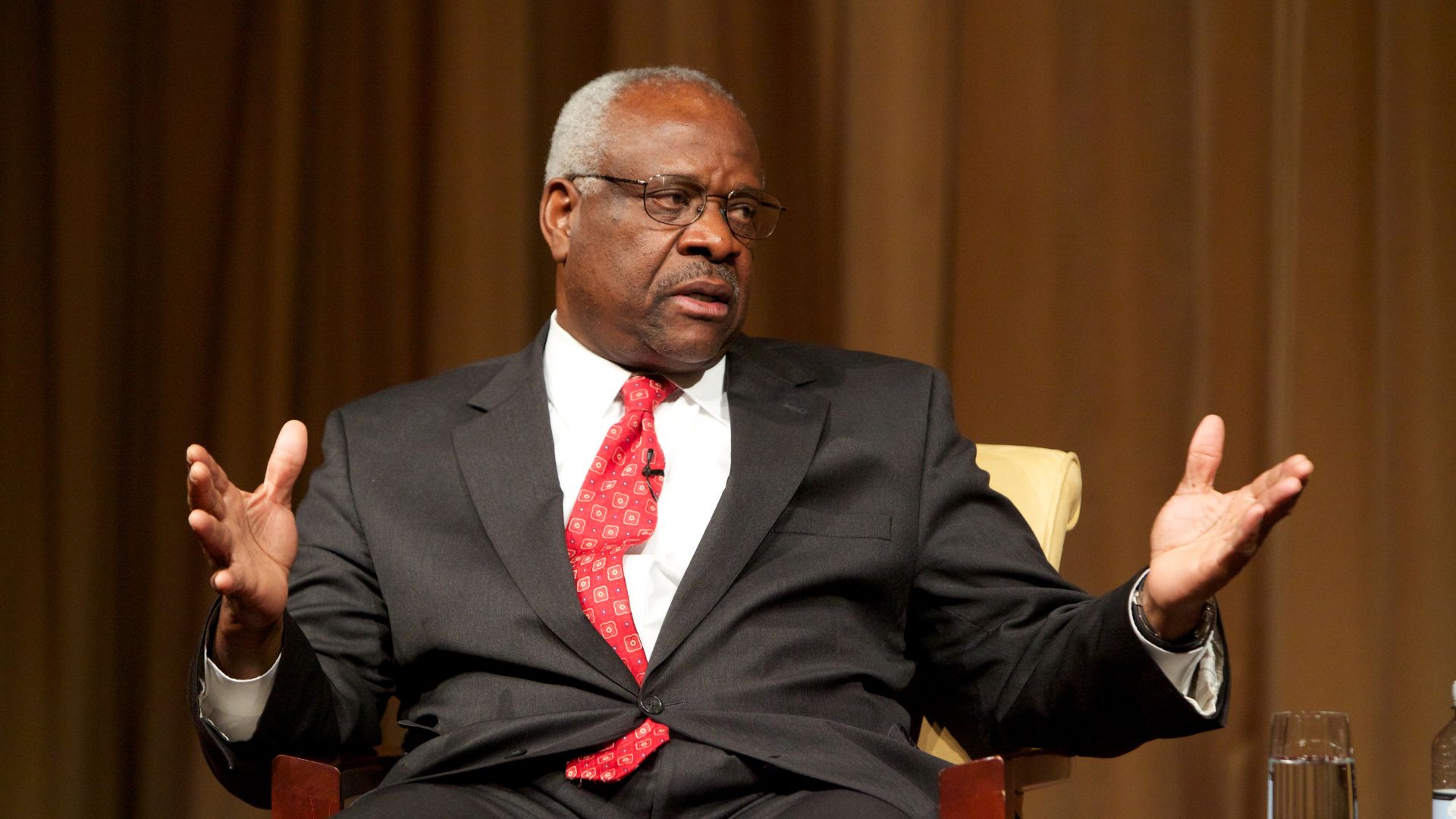

Why Do Conservatives Object?

Conservatives and critics of student loan forgiveness argue that the president is not authorized to make such board policies with huge $400 billion expenditures without approval from Congress.

In their view, a policy on student loan forgiveness falls under the responsibility of the legislature, and don’t think executive power should be part of the equation.

Supreme Court Out of Control

Democrats and supporters of student loan forgiveness feel this move by the Supreme Court is just another example of how the court has grown too powerful as the ideological balance shifted toward the right.

“They made themselves the most powerful branch of government, they are not elected, and no other branch can hold them accountable,” wrote a Reddit user.

Biden Versus the Supreme Court

Last month, Biden penned an opinion piece in the Washington Post where he called for substantive reforms in the Supreme Court in the wake of several unfavorable decisions he was against.

“What is happening now is not normal, and it undermines the public’s confidence in the court’s decisions, including those impacting personal freedoms. We now stand in a breach,” Biden wrote.

What Happens Now?

Although the Biden student loan plan is currently stopped, lower courts are still ruling on parts of the plan which may see it upheld or reinstated.

After the lower courts issue their rulings, it is likely that the Biden administration may try to petition the Supreme Court again and challenge any unfavorable rulings at a higher court level.