Caleb Hammer is a YouTuber who helps people understand why they are in financial trouble and, more importantly, how to get out of it.

In a recent episode of his show, “Financial Audit,” he spoke to Rachel from Texas, who helps others as a spiritual coach, even though she can’t seem to figure out her own issues.

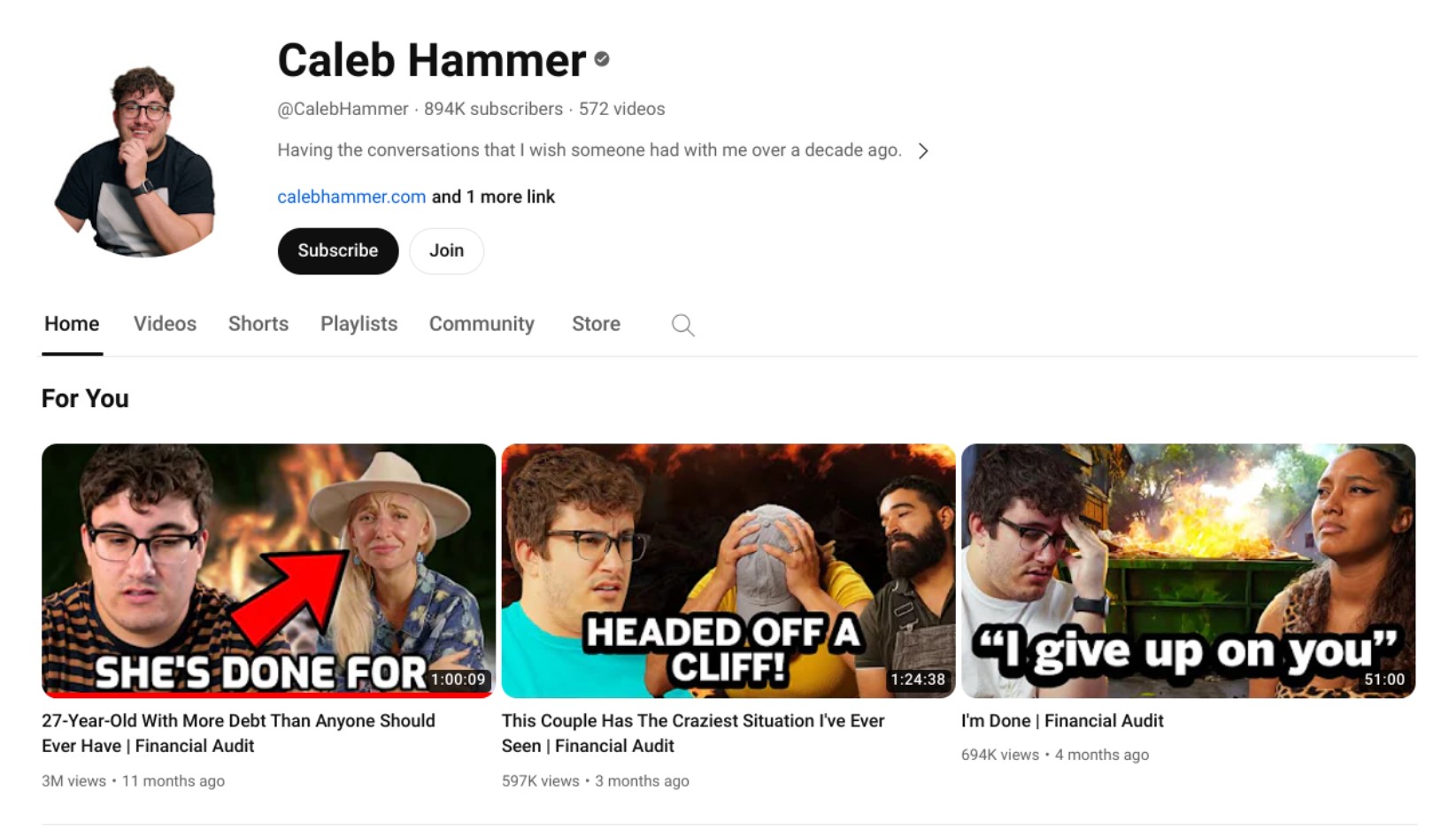

Who Is Caleb Hammer?

It’s first vital to know a little bit about the interviewer, Caleb Hammer. Caleb has a successful YouTube channel with almost 1 million subscribers.

In his popular videos, Caleb interviews people who are in debt, goes through their bank accounts, and gives real tactical solutions to save their finances.

Helping People Get Out of Debt

People sign up for the show to get help, and Caleb wants the world to understand that while it may be easy to judge them for their financial mishaps, asking for help is something to be proud of.

He wants everyone to know that, like him, people can actually get out from under student loans and credit card debt with the right mentality.

Caleb’s Newest Guest: Rachel the Spiritual Coach

One of Caleb’s most recent guests on the show was Rachel, a 27-year-old entrepreneur and online life coach from Austin, Texas.

But Rachel’s episode has caused quite a stir on the internet because while some people support her decision to make a change, others wonder how someone could give life advice to others but be in so much trouble.

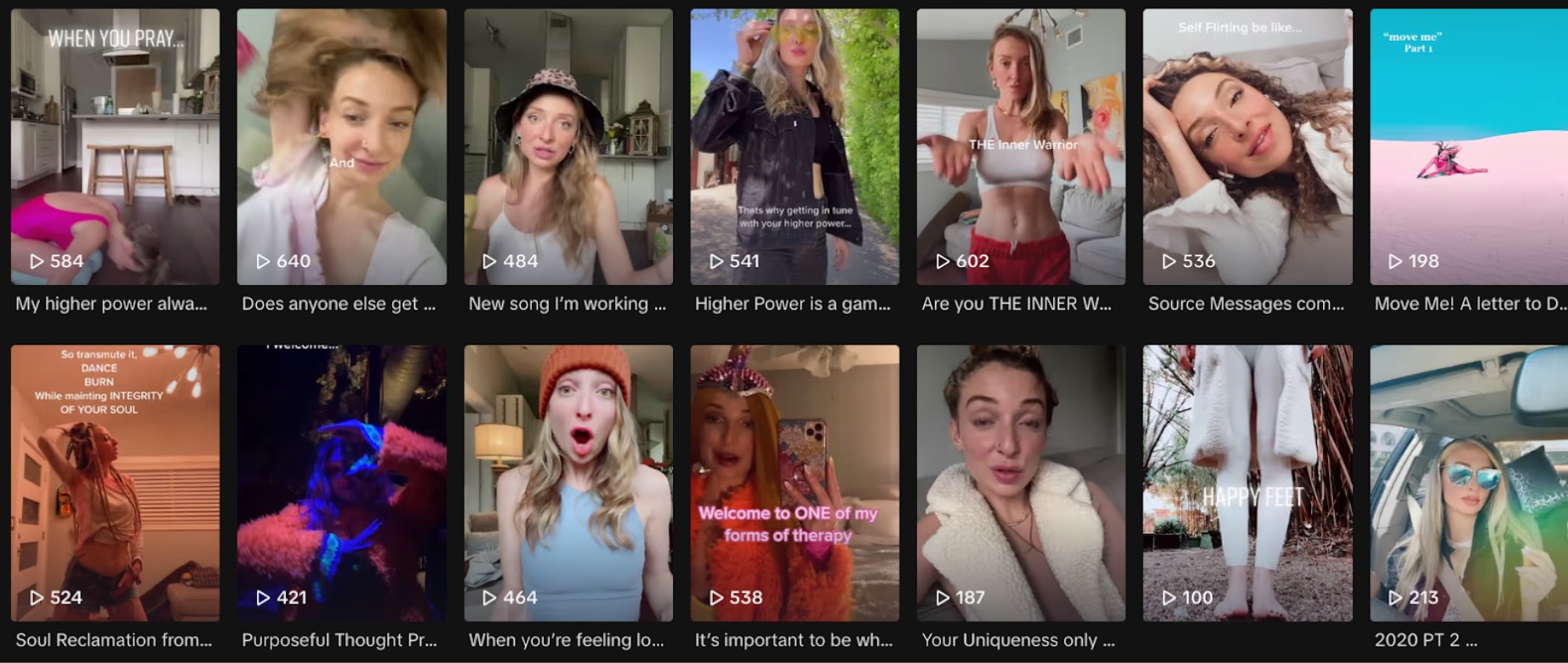

What Exactly Does Rachel Do?

On the show, Rachel tells Caleb that she is a spiritual coach, though she struggles to explain exactly what she does in the day-to-day.

Typically, a spiritual coach, or a life coach as they are often called, helps people work through difficulties in their lives. And Rachel seems to offer online sessions doing exactly that.

Digging for Details

Caleb, of course, wanted a little more information from Rachel. He found out that she only works about five hours a day, makes around $6,500 a month, and is in a serious amount of debt.

As Caleb listens to Rachel’s description of her job and finances, he is immediately concerned that she is making good money, but still maxing out credit cards.

Caleb Reports Rachel Is Overspending Across the Board

Some of the key issues in Rachel’s decision-making that Caleb points out are that she is simply spending more money than she is making.

He notes that she pays a whopping $2,100 every month for rent and has a $29,000 car loan. Caleb said that her “stupid expensive rent” and fancy car are a big part of the problem.

Tactical Ways to Save

Although Caleb is certainly stern with Rachel, he also gives her real, hands-on advice on how to consolidate and get out of debt before it’s too late.

He said that she desperately needs to cut back on superfluous spending immediately and use any cash not being used for the essentials to pay down her credit card debt. He also told her to sell her car and get a more affordable option.

Rachel’s Interview Has Sparked Quite the Debate Online

What’s iterating about Rachel’s interview on “Financial Audit” is that it has sparked an intense debate online.

While some people supported her decision and courage to go on the show, others are wondering how she could have gotten herself into this situation in the first place.

Her Lack of Awareness Surprised Many

Making about $78,000 a year in gross income means Rachel makes more money than the majority of Americans. However, she doesn’t seem to work all that hard or understand how saving works.

Caleb and others on the internet said that if she really wants to spend the big bucks on expensive cars, going out to eat, and a fancy apartment, she really needs to work more than five hours a day.

Giving Advice but Not Taking Advice

As well as questioning her financial intelligence, many have wondered why someone who so desperately needs advice feels that they deserve to get paid to help others with their life choices.

However, others argue that Rachel never claimed to be a financial expert, just a spiritual one.

Caleb’s Message Is for Everyone

According to PYMNTS, an incredible 48.7% of Americans who make more than $100,000 each year are living paycheck to paycheck, so Rachel is certainly not alone.

Caleb’s advice is really for everyone: Cut back on spending, skip the fancy car, and pay off debts as soon as possible. It seems simple, but it could drastically change anyone’s financial issues.