Most of us don’t typically think of frugal living when we imagine how millionaires spend their fortunes.

28-year-old Lucy Guo bucks this trend and offers advice on how to do just that.

Who is Lucy Guo?

Born in October of 1995, Lucy Guo is an entrepreneur and venture capitalist who is currently one of the world’s wealthiest women under 40.

Guo co-founded Scale AI, an artificial intelligence platform that enables developers to create application programming interfaces to automate repetitive human tasks. She is also the current CEO of Passes.com. Guo has a (perhaps) unusual knack for living frugally, a way of life she promotes to others.

A Frugal Childhood

The self-made millionaire learned to live frugally because she grew up in a very economical household.

Guo has related in interviews that her parents were sparing. They would send her outside if she complained about the house being too cold due to them not utilizing their heater to save on utility costs. They also purchased her very cheap clothing and made her eat everything on her plate, whatever it was, telling her that others were not so fortunate.

Carrying a Thrifty Mindset Into Adulthood

Guo remained a spendthrift into her adulthood, and lived as cheaply as she could until she made her first $10 million.

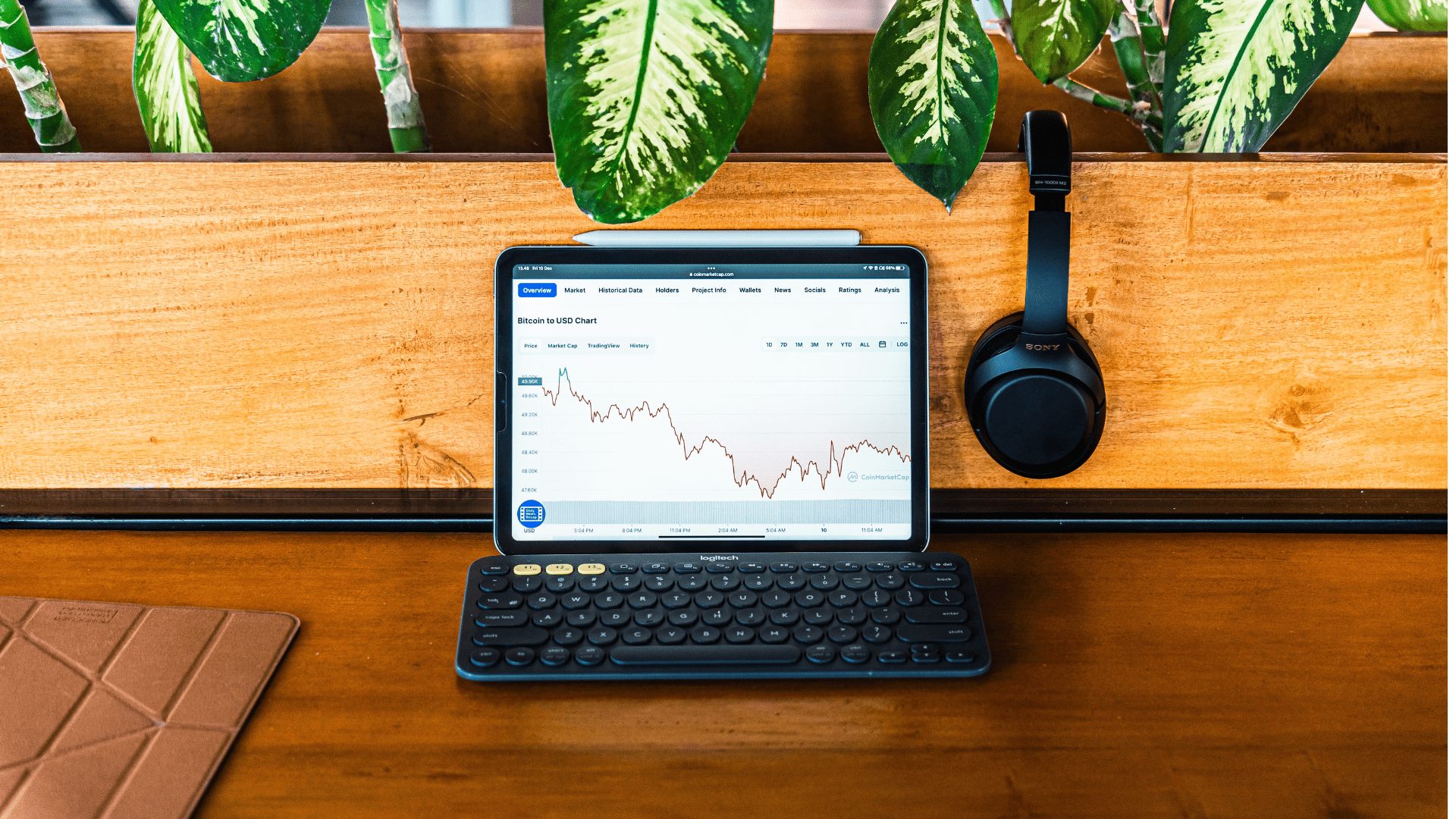

She notes that there is a tendency for people to increase their spending as they make more money, which significantly cuts down on their savings. What you should really do, she says, is save more than you spend, invest and look into compound interest opportunities whenever you can.

A Millionaire Who Eats Fast Food

Guo has cut down on food costs by disregarding the stigma around those who eat fast food.

For her, this is nothing to be ashamed of, but rather a useful way of keeping more change in the bank. She is just as content eating at McDonalds as she is eating at a fancy, high-class restaurant. And she isn’t alone here. People much richer than her, including Warren Buffet and Mark Zuckerberg, have both been known to frequent fast food joints.

Utilizing Buddy Passes to Fly for Free

Buddy passes are vouchers airlines give to their employees that allow their friends and family to essentially fly for free. You can get onto a flight at no cost if there are empty or available seats.

Guo took advantage of this to avoid paying the high costs of confirmed tickets. She also used this to eat for free, by booking cancellable flights, going through airport security, eating at the AmEx lounge, and then exiting the airport.

Buying Cheap and Profitable Real Estate

Guo purchased a low-cost home in Las Vegas near the airport for around $75,000.

It was so close to the airport, in fact, that she even saved money on transportation by riding her skateboard there. This compounded with her use of buddy passes for no-cost flights and free eats at the AmEx lounge.

Investing in Cheap Real Estate

One of the best ways for people to invest without paying huge upfront costs is by purchasing cheap real estate, Guo says.

For people looking to make their first million, Guo has advised buying cheap property in Las Vegas that you can easily AirBnB year round. The compounding value of real estate will also likely help you build up wealth over time.

Reducing Your Spending to Almost $0 Per Month

Guo has attempted to reduce her monthly spending to nearly nothing over time. Though this might seem extreme, she’s not the only one.

Charlie Ergen, the co-founder and chairman of Dish Network and EchoStar is a notoriously frugal billionaire. He says he inherited this trait from his mother, who lived through the Great Depression. He doesn’t own too many pieces of bling, has continued packing a sack lunch for himself through a decades-long career, and, for many years, shared hotel rooms with colleagues during travel.

Guo is Very Intentional With Her Spending

Instead of spending her wealth on flashy things like supercars or luxurious jewelry, Guo only spends with the greatest intention.

Instead, she uses her money to buy investments like stocks, real estate, and bonds that offer her future financial advantages.

The Most Expensive Thing Lucy Guo Ever Bought

Despite her great frugality, there is one thing that Guo says she splurged on–her home.

However, she says that she has viewed this as an investment more than anything. Though she turned her home into a piece of art, it’s gone up quite a bit in value since her purchase. She says that she could sell it and make a few million dollars right now.

What We Can Learn From Lucy Guo

The biggest takeaway from Guo’s lifestyle is that, while we might not be millionaire tech startup owners, we can reevaluate our spending habits and check our impulses.

By thinking through our purchases and our monthly budgets, we can find ways to save money as well as better ways to spend money. Focusing on how to best invest and build wealth with what we do have will help us remove unnecessary, fleeting spending habits from our lives.