Express Inc. was once a popular brand among Millennials seeking office wear and clubbing apparel. Its former beauty line is now a standalone brand selling perfumes and soaps all over the world.

And it’s about to go broke. The retailer is preparing to file for a Chapter 11 bankruptcy process. Oh, how the mighty has fallen. Follow the tale of Express’ drop from the heights of retail here.

Chapter 11 Bankruptcy

Express is close to filing for bankruptcy, possibly in the second week of April 2024. But the company’s reps are not forthcoming with details as “preparations aren’t final and plans could change.”

Bloomberg reported Express is filing for a Chapter 11. Companies under this code can function as a trustee, continue running its business, and, under court approval, borrow money for “reorganization.”

Burning Dollars

The clothing retailer reportedly burned through more than $200 million during the 2022 fiscal year. But it couldn’t compete with its rivals in keeping up with the trend or following the customer’s tastes.

Express shares dropped by more than 80% this year. Its current market cap is only at $5.3 million (against a debt load of almost $300 million). Clearly, this chain founded in Columbus, Ohio that runs 500 stores is in a lot of trouble.

Post-Covid Troubles

Launched in 1980, the chain was hit hard during the pandemic era. Demand for their customer’s business casual apparel dropped and the retailer was slow to respond. To offset their losses in 2022, they closed many stores.

The move, however, did not yield any results. Promotions like “Buy One, Get One at Half Price” did not work. But as of the end of 2023, experts have said to not be surprised “if they end up in Chapter 11 bankruptcy.”

Rising Cost, Plummeting Income

In 2023, Express’ net sales dropped to $435.3 million (6.4%). But the company’s expenses increased to $146.1 million, which is 33.6% of the net sales. Meanwhile, their debt also grew. Express’ total debt at the end of Q2 2023 was $220.8 million. It was $18.6 million higher than the previous year.

CreditSafe CEO of the Americas and Asia, Matthew Debbage, told The Street that it was unlikely that only one major cause was making the retailer fail. “That’s just not how bankruptcies work. Several things have been going wrong over a prolonged period,” Debbage said.

Bonobos Purchase

In April 2023, Modern Retail reported that Express and management firm WHP Global purchased Bonobos, a menswear brand, from Walmart.

While it was a sensical acquisition for WHP Global that would boost their portfolio, retail analysts wondered why Express would want to purchase Bonobox. “I wouldn’t really want Express to touch it, to be honest,” Neil Saunders of GlobalData Retail said. Conversely for WHP, the brand’s “a bit more custom, a bit more bespoke” character adds “another string to their bow.”

Outdated Everything

A senior research analyst for Jane Hali & Associates, Jessica Ramirez, agreed that Bonobox was a quality brand, but even its reputation would not be able to save Express, whose ducks had not been in a row for many years.

Ramirez told Modern Retail, “If you go into any [Express] store, it’s completely outdated. The website is outdated. The product itself is pretty outdated… I feel like Express just needs an overhaul completely. It’s not a retailer that’s relevant in any sense.”

Nearly Delisted by NYSE

Earlier in 2023, in March, Express had even come close to being delisted by the New York Stock Exchange. Its share prices fell to under 1% ($0.63 per share), and four months later, it announced a new strategy: lay-offs.

The plan was to cut 150 employees in 2024, reducing cost by $30 million. A bigger cost reduction was planned for 2024 ($120 million) that would follow 2023’s estimated reductions of $65 million. By 2025, Express hoped to heighten its cost reduction efforts to $150 million.

Reverse Stock Split

An effort Express made to increase its stocks’ values was to do a reverse stock split, a move many keep as a desperate measure. A company could consolidate the number of shares existing in the company to artificially increase the value of each share without affecting the overall value.

But there’s no stopping the fall. Express had lost 70% of its value from 2022 and operated on a $67.5 loss after spending $163 million on expensive traditional, physical stores. Keeping brick-and-mortar stores would indeed be a huge misstep.

Lack of Urgency

Macroeconomics in the years after Covid-19 might have put pressure on apparel brands’ bottom lines, but Express’ troubles seemed to be bigger and more all-encompassing than the US economy slowing down due to the pandemic.

CEO Tim Baxter didn’t seem to be treating the matter urgently when he released a statement last year about the cost reduction strategy. The statement only said, “We are conducting a comprehensive review of our business model to identify actions that we believe will meaningfully reduce pre-tax costs and enable a more efficient and effective organization.”

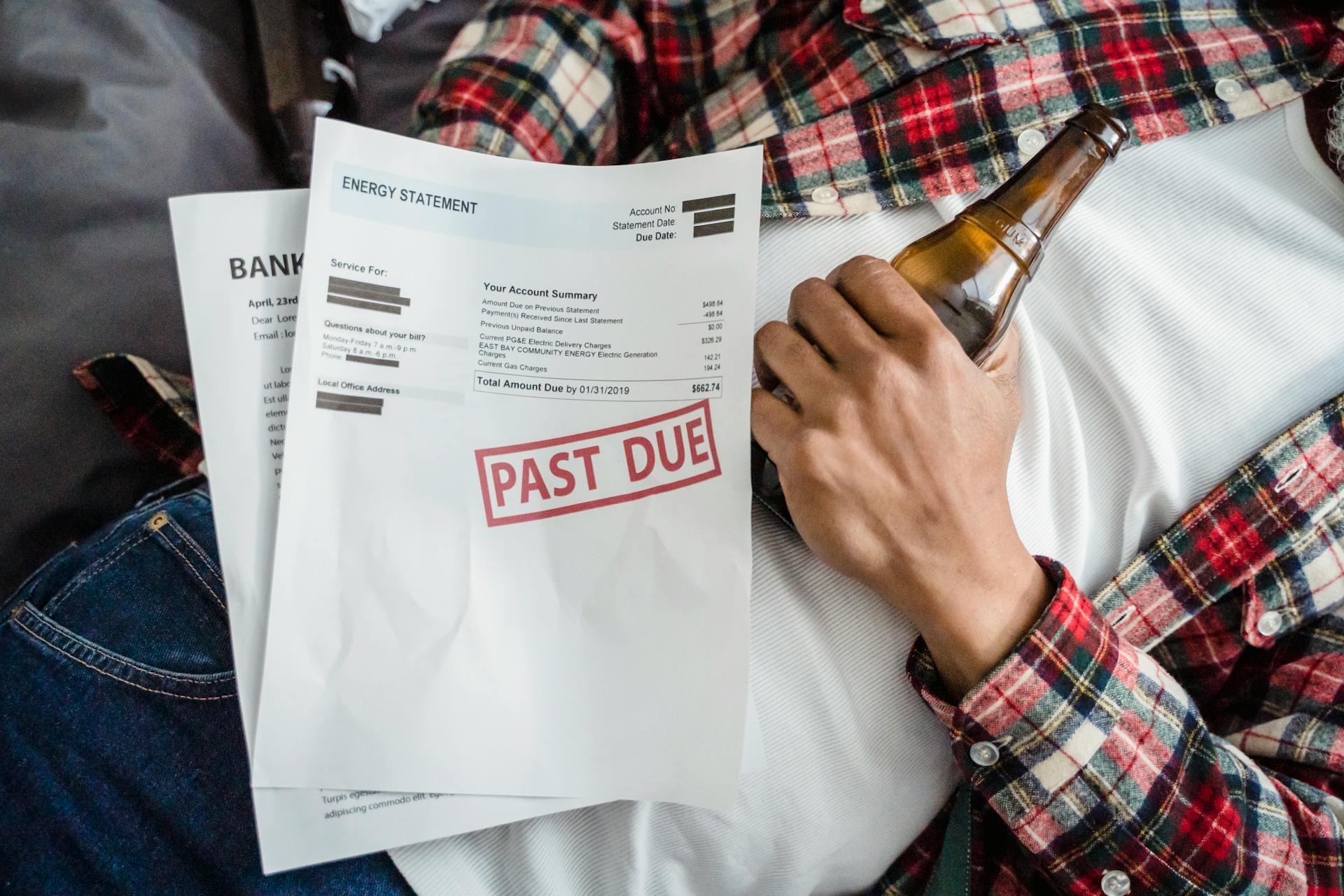

Debts Piling Up

Sure enough, Creditsafe data at the end of 2023 showed that 35% of the company’s debts were past due, amounting to over $3 million. It was a deceptively small figure, but it indicated a troubled cash reserve in the company.

Debbage explained again, “While this might not seem like a big chunk of money compared to Express’ annual revenue, the fact that the retailer’s DBT (Days Beyond Terms) has increased consistently for the last six months indicates that its cash reserves are likely low, which will only drop even lower if sales continue to decline, operating costs keep rising and its debt load grows.”

The Next Steps

Even back at the end of last year, Debbage already prepared some advice for Express should they go for a Chapter 11 bankruptcy filing.

Debbage detailed, “The retailer’s finance leadership should also be prioritizing data, analytics and technology to make sure it has the right financial data so it can get a clear picture of its financial affairs, especially if it tries to secure financing to stave off bankruptcy.” Time will eventually tell if Express followed this advice.