Between sky-high mortgage rates and ever-increasing price tags, buying a home these days costs more than it ever has before, especially if one wants to live in a great neighborhood.

So Sean O’Dowd decided to use his fund, Scholastic Capital, to purchase hundreds of homes in the Midwest in districts with fantastic schools and rent them to families who prioritize their kids’ education but can’t afford a million-dollar mortgage.

Who Is Sean O’Dowd?

Sean O’Dowd has been frequently making headlines recently as his investment scheme has proven to be wildly successful, both for O’Dowd and those who are participating.

O’Dowd is a real estate investor who decided to use his fund, Scholastic Capital, to purchase family homes around the Midwest, specifically those in high-performing school districts. Then, he rents the homes to families who want their children to attend a good school.

The Scholastic Capital Investment Plan

Sean O’Dowd has purchased four homes so far, but he plans to increase his investment to an almost unbelievable 250 homes as soon as possible.

So far, he’s focusing on neighborhoods in the Midwest, but eventually, O’Dowd wants to own homes in California, Florida, Texas, and the suburbs of New York City.

The Kinds of Homes O’Dowd Buys

O’Dowd explained that he looks for houses in great school districts, as well as those near playgrounds and parks.

Of course, houses in those areas typically have extremely high price tags; in fact, many are even over $1 million. But while many middle and even upper-class families can’t afford to buy there, they can afford to rent.

Safety Is Key to O’Dowd’s Investments

Sean O’Dowd also ensures that the neighborhood speed limit is under 25 miles per hour and that the existing residents feel safe there and truly love where they live.

Once he’s found the right neighborhood, he purchases a three-bedroom home with one and a half baths that would be perfect for a family with children.

Why Is Sean O’Dowd’s Plan Working?

There are really several factors to explain why O’Dowd’s investment plan is already working. First, many families simply cannot afford these homes, but they desperately want to live in school districts that offer their children the best possible education.

Next, with mortgage rates through the roof, many Americans not only can’t afford an expensive home, they can’t afford any home and have decided renting is the best course of action until something changes.

The Plan Is Really a Win-Win

And finally, many of these families plan to move into more affordable neighborhoods after their kids graduate, so they don’t want a long-term commitment.

At the end of the day, it’s a win-win for both O’Dowd and the families who rent from him. In fact, he said, “One of the tenants literally broke down in tears. It was one of the only rental homes she’d seen in the last 18 months because they’re never available in that community and she really wanted to send her kids to that school.”

Let’s Talk About America’s Mortgage Crisis

When it comes to buying a house, mortgage rates are one of the most important factors to consider. It’s not just about the house price; it’s also about how much interest buyers will have to pay over the years.

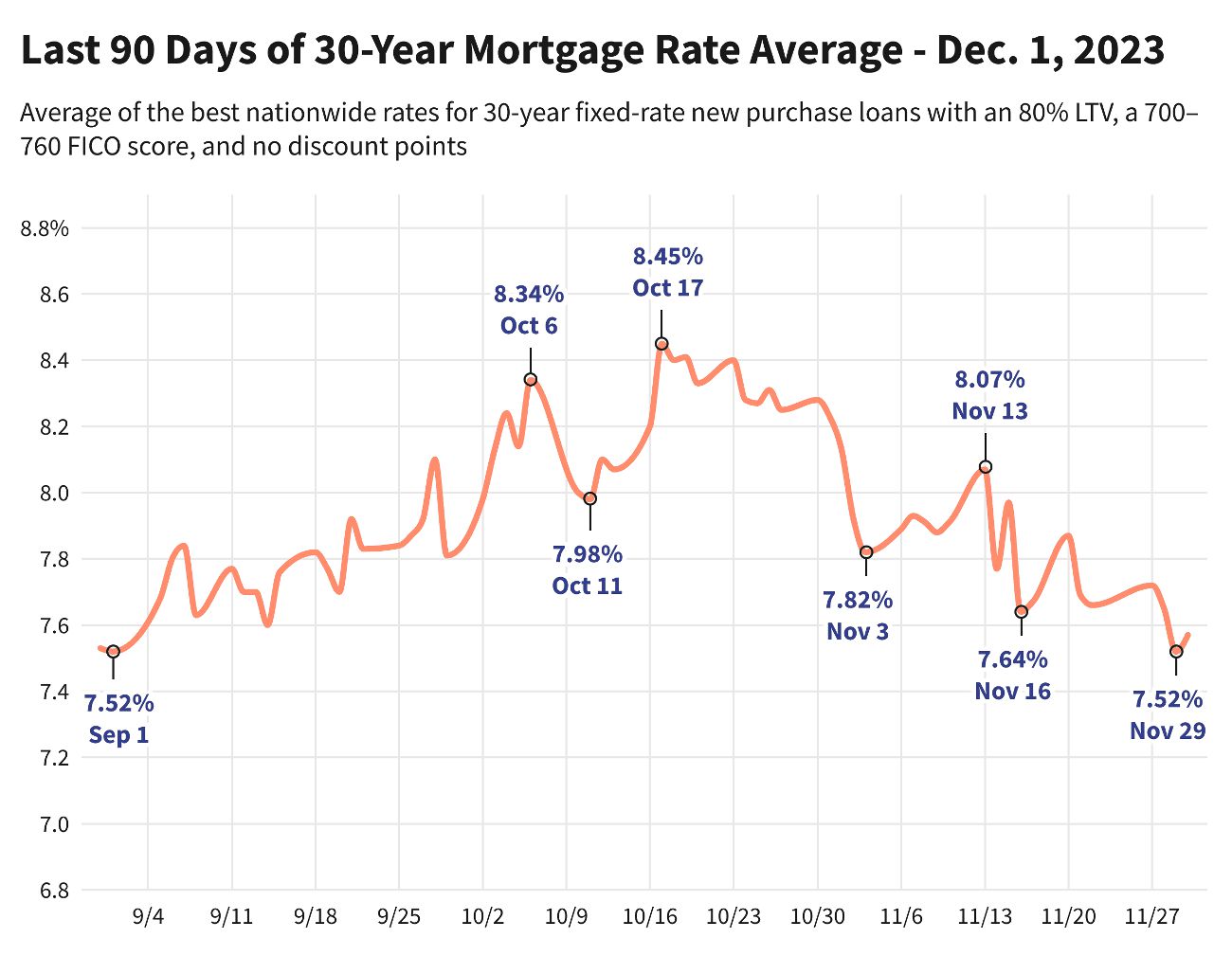

The current average mortgage rate in America is around 6.81%, though they passed 8% several times in 2023. For comparison, the average mortgage rate in 2019 was only 3.94%, and it dropped as low as 2.96% in 2021.

Houses Are Also Extremely Expensive

Not to mention the fact that the asking price of an average family home has absolutely skyrocketed over the past few years.

Although it varies from state to state, the national average is currently $431,000. This is especially concerning as the average price tag was only $329,000 and, shockingly, $165,300 in 2000.

Americans Are Frustrated

The truth is that Americans are extremely frustrated with the current cost of housing and mortgage rates, but until something changes, this is the reality many young families are facing.

They simply cannot afford to buy a house, especially in a great, safe, and education-focused district. So, instead, they’re renting.

Renting Can Be Just as Debilitating as Buying

Rent around the country is on the rise as well, but for many, it’s the only option. As O’Dowd explained it, putting down $250,000 on a million-dollar house may be impossible, but paying $3,000 in monthly rent is feasible for many households.

O’Dowd also noted that not every family is looking for a long-term investment. He said, “People are running the buy-versus-rent math, and they’re looking at it as, ‘I’m going to be in this area for four years, then my kid is out of the house. That’s all I need it for.’ ”

Will Other Real Estate Investors Follow in O’Dowd’s Footsteps?

With Sean O’Dowd’s initial success now public knowledge, we may see other real estate investors follow suit and attempt a similar or even identical investment scheme.

Which would not only affect the way American families live, rent, and buy property but also the housing market as a whole.