Jerome Powell, the Chair of the Federal Reserve, shared his concerns regarding the fiscal direction of the United States during a “60 Minutes” interview with Scott Pelley.

Powell said, “The U.S. is on an unsustainable fiscal path,” emphasizing that the growth of the national debt is outstripping the growth of the economy.

Record-Breaking National Debt Levels

CNN reports that the national debt of the United States has reached an unprecedented level, surpassing $34 trillion for the first time in history.

This milestone was reported by the U.S. Treasury and reflects a concerning trend of rapid debt accumulation. According to Powell, “The debt is growing faster than the economy,” he said in the interview.

Congressional Delays on Fiscal Responsibility

The Hill reports that Congress has delayed addressing spending deadlines multiple times, showcasing a struggle to efficiently manage the nation’s fiscal affairs.

Since the end of September, there have been three instances of postponed decisions on government funding. These delays occur amidst debates on how to best manage the growing national debt, reflecting challenges in reaching consensus on fiscal policies.

Looming Deadlines for Federal Funding

The temporary measures passed by Congress to fund federal agencies are approaching expiration, with four agencies facing a deadline on March 1 and the remainder on March 8, The Hill explains.

This situation highlights the pressing need for decisive action to ensure continuous government operations and address the broader issues of fiscal sustainability and national debt management.

Political Standoff Over Borrowing Limit

A significant political standoff occurred last spring between President Biden and House Republicans regarding the borrowing limit, according to The Hill.

The disagreement nearly led to a fiscal crisis, with the U.S. dangerously close to defaulting on its debt.

U.S. Credit Rating Downgraded Amid Debt Concerns

In response to the growing national debt and repeated standoffs over the debt ceiling, Fitch Ratings downgraded the U.S. credit rating from “AAA” to “AA+.”

The downgrade reflects concerns about the fiscal health of the nation and the impact of political disputes on the United States’ ability to manage its debt effectively.

Economic Growth Amid Fiscal Warnings

Despite the concerns over national debt, Powell noted positive signs in the economy.

He said in the interview, “The economy’s in a good place.” The economy has shown resilience with a growth rate of 3.3 percent in the fourth quarter of 2023, according to the Bureau of Economic Analysis.

Inflation Trends and Interest Rate Adjustments

The Hill reports that inflation has decreased from its peak of 9% in the summer of 2022, with significant reductions achieved through the Federal Reserve’s monetary policy adjustments.

The Federal Reserve increased interest rates to address inflation, which has seen a reduction to 3.4 percent, via data from The White House.

Caution on Future Rate Cuts

The Federal Reserve, under Powell’s leadership, has indicated a cautious approach to future interest rate cuts.

According to The Hill, during his “60 Minutes” interview, Powell suggested that rate cuts in March might not be forthcoming, stressing the need for a confident assessment of economic conditions before making such decisions.

Economic Indicators Influencing Monetary Policy

Powell highlighted that the Federal Reserve’s decisions on interest rates would be influenced by key economic indicators, CBS News notes.

He said in the interview, “The kinds of things that would make us want to move sooner would be if we saw weakness in the labor market or if we saw inflation really persuasively coming down.”

Fed Chair Addresses Political Pressure

Amidst political criticism, Powell reaffirmed the Federal Reserve’s independence, stating during the interview, “We do not consider politics in our decisions. We never do. And we never will.. And I think the record – fortunately, the historical record really backs that up.”

This declaration emphasizes the Fed’s commitment to making decisions based on economic data and analysis, free from political influence.

Urgent Call for Fiscal Responsibility

Business Insider reports that Powell expressed a strong message regarding the need for fiscal responsibility, and the importance of not burdening future generations with current debt. He said, “It really should pay for those things and not hand the bills to our children and grandchildren.”

He also advocated for “an adult conversation among elected officials” to steer the federal government towards a sustainable fiscal path.

Analyzing President Biden’s 2024 Fiscal Year Budget Proposal

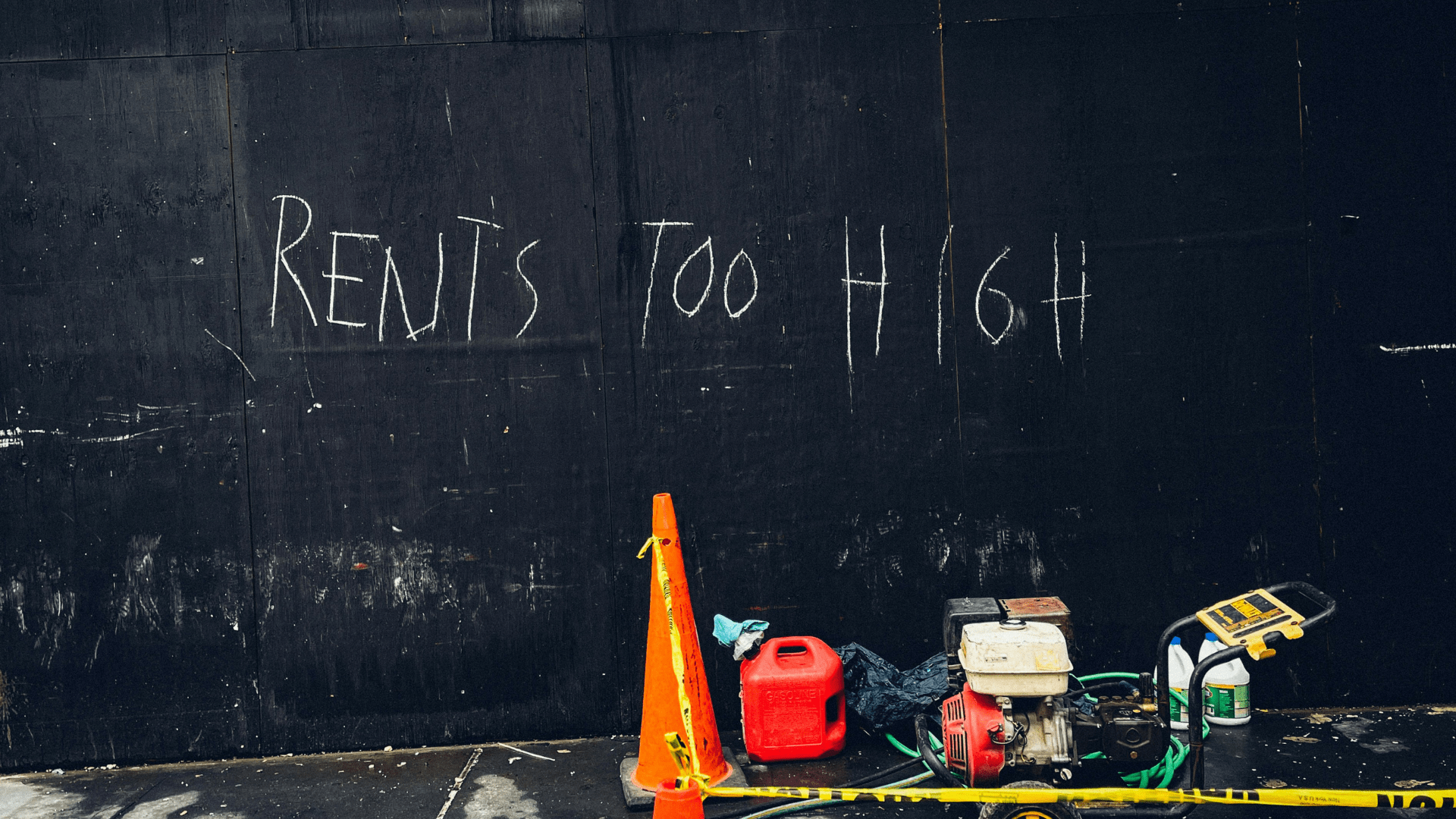

President Biden’s budget proposal for the upcoming fiscal year marks a watershed moment in the commitment to affordable housing, addressing critical issues such as homelessness, public housing, and disaster recovery.

The proposed budget, with its focus on mandatory spending, underscores the administration’s dedication to creating transformative change in the housing landscape. Let’s look at key components of the budget and examine the impact on various housing programs and their potential to reshape the lives of millions.

Emergency Rental Assistance Program: A Pillar of Success

The budget proposal builds on the monumental success of the Emergency Rental Assistance program, a lifeline for millions of renters during the pandemic.

With an infusion of $3 billion, the proposal aims to strengthen upstream prevention and eviction diversion. These funds will not only provide emergency rental assistance but also enhance renters’ access to critical resources, such as legal counsel, housing counselors, and court navigators.

Expanding Rental Assistance: Empowering Vulnerable Populations

Recognizing the unique challenges faced by youth aging out of foster care and extremely low-income veterans, the budget allocates $9 billion and $13 billion, respectively, to expand rental assistance.

This includes the establishment of a housing voucher program catering to the annual 20,000 youths aging out of foster care and the expansion of rental assistance for extremely low-income veteran families.

Addressing Capital Needs: Bolstering Public Housing

A critical aspect of the budget is the mandatory funding of $7.5 billion dedicated to addressing the capital needs of the most distressed public housing properties nationwide.

The infusion of funds aims to revitalize public housing infrastructure, with a particular focus on climate-related improvements. This move is crucial, considering the estimated capital needs backlog of over $70 billion in the public housing sector.

Revamping Tax Credits and Rental Assistance Contracts

President Biden’s proposal seeks to inject new life into affordable housing development by allocating $51 billion in additional Low-Income Housing Tax Credits (LIHTC).

Additionally, a new Neighborhood Homes Tax Credit and mandatory funding for project-based rental assistance contracts aim to spur the development of affordable homes, with a focus on extremely low-income families. The White House’s commitment extends further to closing the qualified contract loophole that investors have exploited to evade federal affordability requirements in the LIHTC program.

Tenant-Based Rental Assistance: A Comprehensive Approach

The budget earmarks $32.7 billion to tenant-based rental assistance, a significant increase designed not only to renew all contracts but also to extend assistance to an additional 50,000 households in need.

By leveraging program reserves, the proposal aims to expand assistance to an extra 130,000 households. The budget acknowledges the importance of prioritizing additional rental assistance for those facing homelessness or at risk, as well as survivors of domestic violence, dating violence, sexual assault, stalking, or human trafficking.

Public Housing: Meeting Capital Needs

A substantial increase in the budget, amounting to $3.71 billion for the Public Housing Capital Fund, reflects the administration’s commitment to addressing the capital needs of public housing.

This includes a $300 million set-aside for climate-related improvements, aligning with broader efforts to promote sustainable and resilient housing infrastructure. The recognition of the $70 billion capital needs backlog emphasizes the urgency of sustained investments to maintain services and improve living conditions for public housing residents.

Combatting Homelessness: Strategic Funding

The budget allocates $3.7 billion for Homeless Assistance Grants, marking a $116 million increase over the FY23-enacted level. This funding is strategically designed to renew existing Homeless Assistance Grants contracts and expand assistance to an additional 25,000 households.

Priority is given to individuals experiencing various forms of violence and youth grappling with homelessness. The targeted resources align with the administration’s recently released Federal Strategic Plan to Prevent and End Homelessness, demonstrating a coherent and integrated approach to combating homelessness.

Support for Specialized Housing Programs

The proposed budget allocates $1.023 billion for the Section 202 Housing for the Elderly program and $356 million for the Section 811 Housing for People with Disabilities program.

While the former sees a slight decrease of $52 million compared to FY23, the latter is $4 million less. However, both programs receive set-asides to support the construction of an additional 2,200 units of affordable, accessible housing for people in the Section 202 or Section 811 programs.

Empowering Communities through CDBG Program

The budget proposes $3.415 billion for the Community Development Block Grant (CDBG) program, with $3.3 billion earmarked for formula funding.

This represents an increase of approximately $100 million from FY23-enacted levels, excluding earmarked funding. Of the total amount, $85 million is set aside for a competitive program rewarding jurisdictions removing barriers to affordable housing developments, such as restrictive zoning. Additionally, $10 billion is dedicated as mandatory funding to incentivize jurisdictions to undertake zoning and land use reforms.