Restaurant Brands International (RBI), the parent company of Burger King, has made a bold move by shelling out $1 billion to acquire Carrols Restaurant Group, its largest franchisee.

This strategic acquisition is a hefty investment aimed at expediting Burger King’s modernization plan, a critical step in keeping pace with its formidable rival, McDonald’s, which embarked on a $6 billion modernization spree for over 8,700 restaurants in 2018.

Why Does RBI Want to Buy Carrols Restaurant Group?

The motivation behind this significant gamble becomes clearer when examining Burger King U.S.’s historical standing in terms of guest experience and the modernity of its franchise locations.

Analysts, such as Siye Desta from CFRA, have pointed out that the fast-food giant has been trailing behind its competitors in these aspects. Executives at Burger King U.S. have openly acknowledged their struggle during the pandemic, leading to a decline in customer numbers. Additionally, a complicated ordering experience only added to their challenges.

Who is Restaurant Brands International?

Restaurant Brands International (RBI) is the owner of several high-profile fast food or quick service restaurants. They own Burger King, Tim Hortons, Popeyes, and Firehouse Subs.

They have a headquarters in Ontario, Canada and were founded in 2014. the company was created when Burger King merged with Tim Hortons in a $11 billion acquisition deal.

Burger King Does Not Have Enough New Customers

In the quarter wrapping up on June 30, Burger King witnessed a solid surge in sales at its U.S. restaurants that have been open for at least 13 months, marking an impressive 8.3% year-over-year increase. Globally the growth was even more robust, with sales at Burger King restaurants open for a year or more soaring by 10.2%.

However, it’s worth noting that a substantial portion of this sales uptick in the U.S. was driven by existing customers spending more during their Burger King transactions rather than an influx of new patrons. While this has been a positive trend, there’s a potential snag on the horizon—namely, if U.S. consumers decide to tighten their purse strings and cut back on spending, it could pose a challenge for sustaining this growth.

Delivery Service Apps Changed the Game

Delivery apps like DoorDash and Uber Eats saw a huge rise in the wake of the pandemic when many people were forced to sequester and could not go to their favorite dine-in restaurants for a while.

Customers are increasingly reliant on these services which puts restaurants on notice to either change with the times or lose out on potential business.

Burger King Delivery App

In 2022, Burger King came out with its own mobile delivery app to compete with the big players in the industry.

Now through the Burger King app, customers can place orders with the restaurant directly instead of going through DoorDash or UberEats. This gives Burger King greater control over what customers see and their menu pricing. The app includes an automatic surcharge for delivery that customers cannot avoid.

Rising Fast Food Prices in the United States

Fast food prices are currently experiencing a dramatic increase. In recent years the rising cost of domestic beef in addition to economic inflation have given many US customers sticker shock when looking at their dining bill.

CNET reported in January that fast-food menu prices jumped nearly 13% in 2022. Burger King managed to beat the average, only raising prices by 2% in that same period.

Why Are Prices Rising?

The United States economy is currently undergoing a period of high inflation. In recent months the rate of inflation has slowed down, but the damage has already been done to fast food menu prices.

A combination of wage and commodity costs has made the skyrocketing menu prices across the industry inevitable. Unfortunately, many people are starting to feel that the value of what they are getting at the drive-through is not matching up to the increase in price.

Fast Food is No Longer Affordable

One possible hope for RBI is that their investment in this franchisee can turn the tide of public perception against fast food.

Because of the increased cost of eating out, many Americans feel like it is no longer affordable. Fast Food was seen as a cheap and easy option in the past, but the affordability of these restaurants has taken a major hit in recent years.

Labor Costs Are Rising in Key Areas

2024 will be a challenge for many fast-food businesses because of proposals and laws coming into place that will increase their payroll costs.

For example, California passed a minimum wage law that will affect an estimated 500,000 fast-food workers. These workers will see their wages jump from a minimum of $16 an hour to $20 an hour on April 1.

Reclaim the Flame: Modernizing Burger King

In a bid to address these issues, Burger King initiated the “Reclaim the Flame” plan, a modernization effort that has shown early positive signs.

The acquisition of Carrols, its largest franchisee, appears to be a strategic move to accelerate this plan. Carrols has consistently outperformed its parent company in terms of foot traffic. Even during the most recent quarter, while RBI’s foot traffic remained flat, Carrols experienced an uptick.

RBI Wants a Modern Burger King

As part of the “Reclaim the Flame” plan, RBI CEO Joshua Kobza is trying to make Burger King as competitive as possible.

The Associated Press reported Kobza said in a conference call that “We need pretty much every Burger King all across the country to be modern, convenient, and competitive with all of the other concepts out there that have new and modern buildings.”

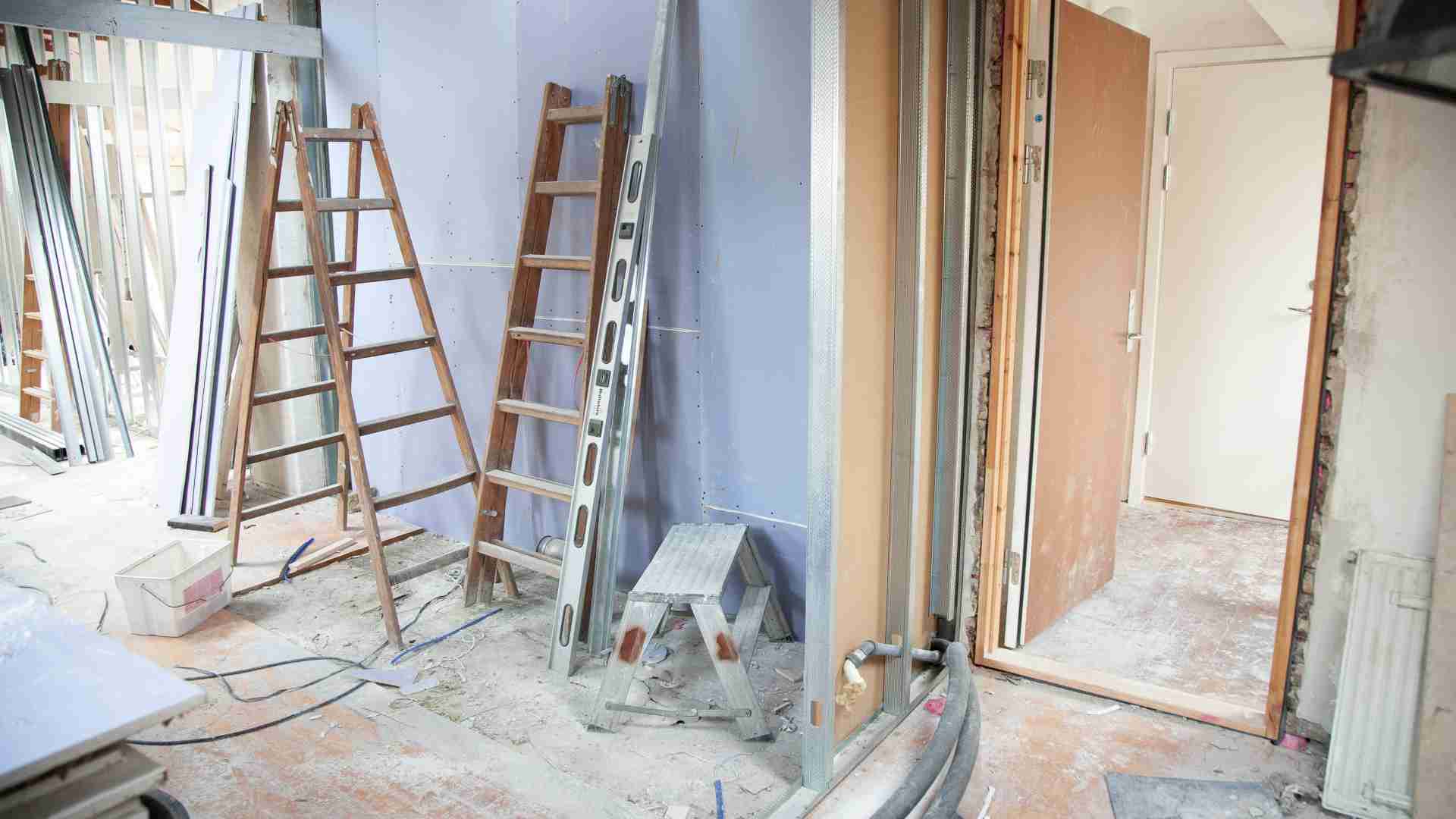

Remodeling 600 Burger Kings

Carrols’ superior operational performance and historically higher sales make it a valuable asset in Burger King’s quest for modernization.

The plan is to revamp more than half of Carrols’ locations, providing a modern image to Burger King restaurants. After the acquisition is completed, RBI plans to remodel 600 of Carrols’ 1,022 Burger King locations across 23 states.

How Much Does Remodeling Help?

What is old can become new again. Remodeling restaurants is one of the top ways to change the perception of a business with customers. People will want to check out the look and upgrades to the restaurant.

It will also improve the perception of the brand in customer’s minds. These improvements improve the efficiency of the space and will drive sales, making them a helpful investment.

Refranchising Burger King

Tom Curtis, the president of Burger King U.S. and Canada, sees the acquisition as an “exciting accelerator” for the modernization plan.

However, there’s an interesting twist—RBI plans to hold onto the acquired locations for a limited time. After remodeling Carrols’ restaurants over the next five years, the plan is to refranchise them, putting them back into the hands of motivated local franchisees.

What is a Franchisee?

A franchisee is different from a franchisor. The franchisee is the person who pays the franchisor for the right to operate a business under their name. The details of the payment vary on the agreement struck between the parties.

Typically a franchisee will have to pay upfront costs to start the business and some form of royalty when the business is in operation.

Funding the Remodel

To fund this ambitious remodeling effort, RBI intends to utilize approximately $500 million of Carrols’ operating cash flow.

The company will retain a portfolio of a couple of hundred restaurants for strategic innovation, training, and operator development purposes.

Have it Your Way Mentality

Burger King’s popular slogan that it advertises for customers is “Have it Your Way.”

This slogan romanticizes the ability for customers to order off the Burger King menu in whatever way they see fit. In the same way that customers are having it their way, the parent company of Burger King RBI is hoping to take more direct control over its market share.

Improving Sales and Growth

The “Reclaim the Flame” modernization plan, initiated in September 2022, initially pledged $400 million for enhanced advertising, restaurant remodels, and the implementation of new technologies to boost online sales.

Analysts believe that the acquisition of Carrols could be a positive long-term driver for Burger King’s earnings, potentially paying dividends for the brand. UBS analysts, in particular, see the acquisition as a means for Burger King to further improve sales growth and store profitability, especially as the modernized stores transition to well-motivated franchisees.

Carrols’ and RBI’s Shares Surge

Carrols’ shares experienced a notable surge, rising as much as 14% in pre-market trading following the announcement, while Restaurant Brands’ shares remained flat.

Despite the flat pre-market performance, Restaurant Brands’ shares had already seen a robust 21% increase in 2023, outpacing the New York Stock Exchange’s Composite Index, which saw an 11% increase during the same period.

Acquisition Price for Carrols’ Shares

The agreed-upon acquisition price is set at $9.55 per share for all Carrols shares not already held by Restaurant Brands International or its affiliates.

This price represents a substantial 23% premium to Carrols’ 30-day volume-weighted average price as of the preceding Friday, underscoring the value attributed to the acquisition.

Restaurant Brand’s Stock Price in Recent Years

Restaurant Brands has seen its stock price fluctuate in the past five years. It reached a high point in August 2019 at $78.45 a share but has not quite recovered to that level after it dropped.

Its lowest valley was in March 2020 when RBI stock was selling for $40.03 a share. Today the stock price has almost reclaimed its pre-pandemic peak, reaching $75.88 on January 1 2024.

The Outlook is Optimistic

As Burger King U.S. positions itself for a turnaround in its second year, analysts suggest that RBI’s acquisition reaffirms a commitment to the brand’s turnaround and will likely accelerate remodeling plans, fostering better growth opportunities.

The outlook is optimistic, with analysts assigning a buy rating and a $90 price target to Restaurant Brands International, indicating a potential 18% return over the next 12 months.

Breathing New Life Into Burger King

In essence, this acquisition signals a strategic and financial commitment by Restaurant Brands International to breathe new life into the Burger King brand.

The infusion of capital and the extensive remodeling plan underscore the company’s dedication to transforming the customer experience, with a long-term vision aimed at reshaping the trajectory of one of the world’s most iconic fast-food chains.