Prices are up in every industry these days, but residents in Montana are outraged as their property taxes are continuously going up and showing no sign of coming back down.

The property tax hikes have gone up so much that one resident has reported his taxes have gone up by 800% and that he is struggling to afford to live in the house he has lived in for years.

Montana Relies on Property Taxes

Unlike other states, much of Montana’s tax revenue comes from property taxes. This means that when the state needs to raise funds, it is more than likely that property tax will be the first to rise.

Property tax makes up 97% of Montana’s local tax revenue and 9.9% of the tax revenue of the Montana state government. This is in comparison to the other state governments, which are at 1.7%.

People Are Moving to Montana

One reason property taxes have risen is the sudden influx of people moving to Montana.

Regardless of the reason, this can mean a rise in taxes. When this has happened in the past, lawmakers have tried to lower the impact. However, lawmakers and state leaders never did this, which led to the increase.

800% Property Tax Increase

Some Montana residents have seen their property taxes increase by as much as 800% annually. One man’s property tax went from $895 to around $8,000 in a short time.

This means that residents who have seen their property tax increase by this much are paying around $700 per month to the state, a number that was significantly smaller in previous years.

Montana Pays Billions in Property Tax

Currently, Montana residents spend around $1.09 billion in residential taxes per year. Most of this will likely come from Madison County, home to 100 of the most expensive properties in the Treasure State.

Some have suggested a 20% decrease in property tax, costing $200 million annually. However, most of this tax relief would go towards the expensive properties, meaning most low-income earners would still be out of pocket.

How Property Taxes Are Calculated

Everyone’s property tax will vary and depend on several factors. It will depend on the value of the land owned and anything attached to it, such as houses, garages, concrete driveways, and sidewalks.

Taxes need to be paid in May and November every year. If these taxes haven’t been paid, you have three years to pay any past taxes owed, including any interest, penalties, or other costs incurred.

Montana Residents Have Taken to Social Media

Many Montana residents cannot pay their property tax, so they have taken to social media to plead with the state to lower their taxes.

One senior Montana homeowner took to TikTok to say he was struggling to pay his other bills with the rising property taxes, despite receiving social security and working full-time.

Montana’s Residents Want a Moratorium

The burden of paying such a sharp increase in property tax has become so bad for Montana’s residents that some are even asking for a moratorium.

This is a temporary suspension from paying their taxes until the issues that have led to the warrant of a moratorium have been resolved. These issues can include financial hardship and the need to get finances in order before starting to pay taxes again.

Montana Residents Can Take Action

More than a century ago, Montana’s residents enacted an initiative process that enabled voters to propose and enact laws if there was a need for them.

This process is still a part of the Constitution to give voters the protection they need. As there has been talk of a sales tax being enacted to lower property tax, this is one instance where an initiative process would occur.

California Also Has High Property Taxes

Another US state that has recently decided to raise its property taxes is California. This has been done in an attempt by the state to raise money for conservation efforts.

Property tax prices for median-value homes in the U.S. Golden State are set to double throughout the year, and residents are reminded that this is the price they have to pay for climate change.

Residents Are No Longer Paying Property Tax

As property taxes are rising everywhere, people in other states are taking action. Residents in New York have been refusing to pay property tax, to the point where the amount owed is now at $880 million.

It has gotten to the point where there are questions as to whether more action should be taken on those refusing to pay property tax.

Homeowners Are Selling Up

The situation in Montana has become so bad that its elderly residents who are past retirement age have had to go back to working full- or part-time jobs just to pay their property tax.

Others are finding things so bad that they have to sell the homes they have lived in for many years, and in some cases their entire lives, so they can go and live somewhere cheaper.

Why Property Tax Has Gone Up

There are many reasons why property taxes in various areas are going up. One of the main reasons is the rising prices of houses.

Between 1995 and 2023, Montana house prices have increased by around 272%. Every time the price of a property rises so does its property tax. So while you might be able to get more for it if you sell it, it comes at a price of having to pay more in taxes.

Reappraisal Notices Indicate Taxes Will Rise

Reappraisal notices were sent to homeowners over the summer last year, which indicated that property taxes were set to rise even further in the upcoming fiscal year.

At the time, it was expected that homeowners on the tax rolls in 2022 and 2023 would pay $213 million more in tax this year than they did in the previous year.

A Decline in Business Property Taxes

What doesn’t help the high property taxes for homeowners is that business and industrial properties in Montana pay much lower taxes.

This means that homeowners are paying more in tax to compensate for the amount that businesses aren’t paying.

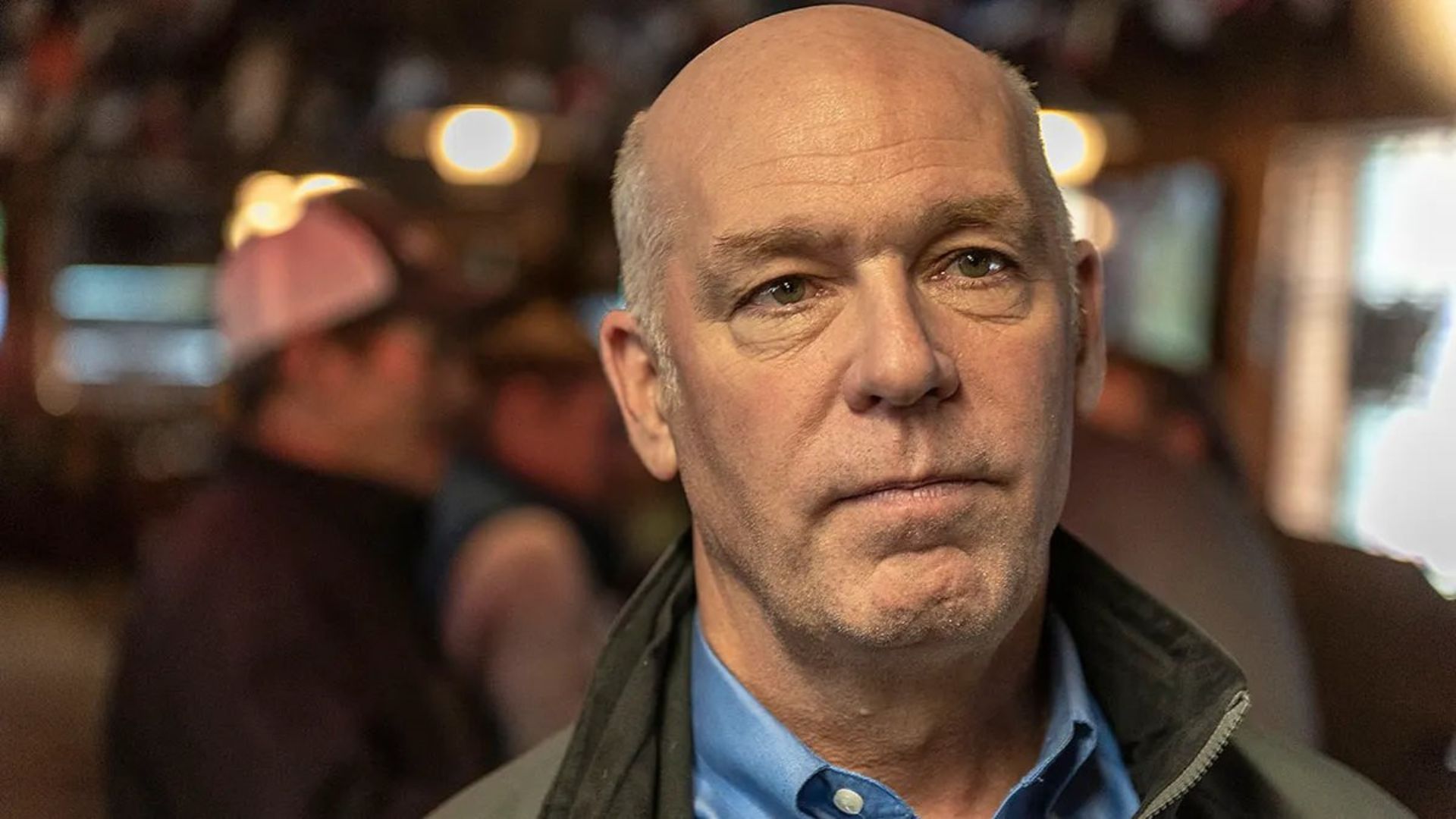

State Governor vs Local Government

What hasn’t helped the situation with property taxes is the arguments between the state governor Greg Gianforte and the local government.

The local government says taxpayers’ issues are due to the state-level tax code, which has been set by the governor and state legislature. However, Gianforte says rising taxes are a result of local government spending.

Gianforte’s Property Tax Has Gone Down

While Montana residents are seeing their property taxes go up, one resident whose taxes have actually gone down is state Governor Gianforte.

He lives in Helena; however, other residents in the same area surprisingly did not see their property taxes drop. This has led to much anger and uproar throughout the area.

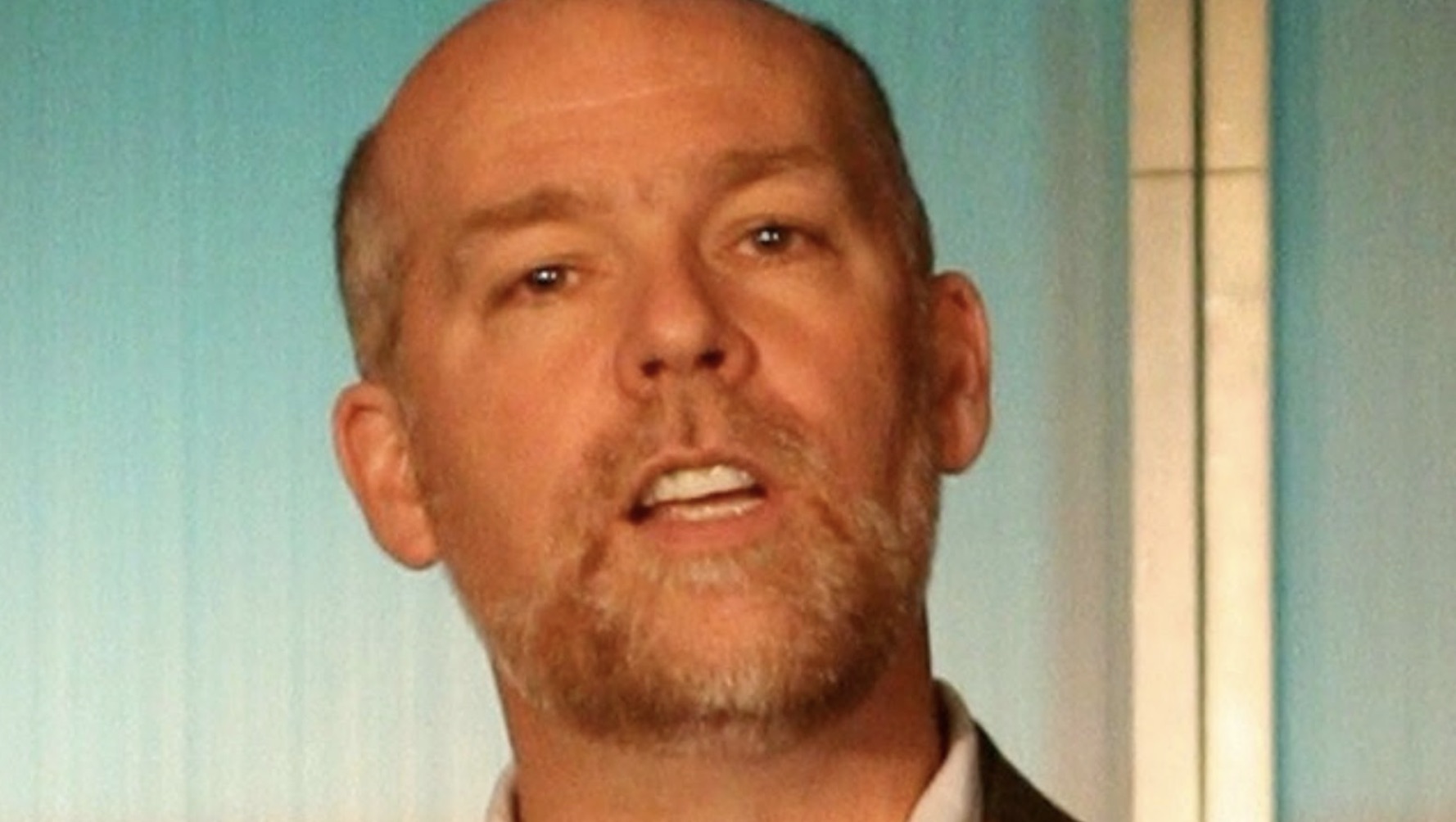

Democrats Want to Cut Property Tax

Montana is currently being run by a Republican government, so naturally, the Democratic candidate, Ryan Busse, has made cutting property tax one of his main policies during his bid for governor.

He made it clear that property taxes don’t discriminate. Whether Republican or Democrat, people won’t be getting a higher property tax bill due to the color of their mailbox.

Legislators Should Adjust the Property Tax Rate

The Department of Revenue has long told state legislators to adjust the property tax rate to help those whose property tax has increased significantly.

This also needs to be done to help those struggling to pay their taxes. However, the legislature has yet to act on this.

Did Republicans Make a Mistake?

One question that has been going around is whether the Republicans have made a mistake. This comes after previous calls for them to reduce the state property tax rate to help ease the burden on homeowners.

This comes after calls from Democrats to do this, and yet Republicans never answered these calls. Regardless of the political party, a continuing number of Montana residents want the tax rate to be reduced, one way or another.

Higher Property Taxes Are a Short-Term Solution

Gianforte has tried to assure Montana taxpayers that the high property tax rates are just a short-term solution to the cash flow problem.

He claims that he and the state government are investigating more efficient and long-term solutions to the issue. However, it’s currently unknown what this solution will be and how long the high property taxes will last.

Moving to States With Lower Property Taxes

Many people believe that they shouldn’t have to stay in a state with high property taxes when they can move to a state with lower property taxes.

One example of this is Texas. Property tax rates here are at 1.68%, which seems like a much more attractive number than the amount people are paying in Montana.

Not Paying Taxes Leads to Serious Consequences

While some might think that their taxes being too high means they should stop paying them, they should avoid doing this at all costs, as not paying your taxes can lead to serious consequences.

At best, you can receive a penalty or fine, where the IRS will add interest to your current tax rates. At worst, the IRS can seize your property to pay off any debts owed from not paying your taxes.

Montana Has Property Tax Assistance Programs

For residents who are struggling with figuring out how to pay property taxes or who believe they are entitled to some sort of help, Montana has some property tax assistance programs.

These include assistance for low-income earners, disabled veterans and their surviving spouses, and property owners with land worth more than the value of their homes.