California Governor Gavin Newsom, addressing the state’s $73 billion deficit earlier this month, firmly stated to reporters, “the answer is no,” when questioned about raising taxes to solve the fiscal crisis.

Despite these assurances, his recent budget proposal includes $18 billion in tax hikes specifically targeting businesses, revealing a significant shift in strategy.

Previous Commitments Versus Current Actions

Governor Newsom had previously pledged not to increase taxes, particularly in the context of a budget crisis that has emerged just two years after the state enjoyed a nearly $100 billion surplus.

Despite this, his current budget proposal laid out plans for considerable tax increases on businesses.

Newsom’s Budget Proposal Details

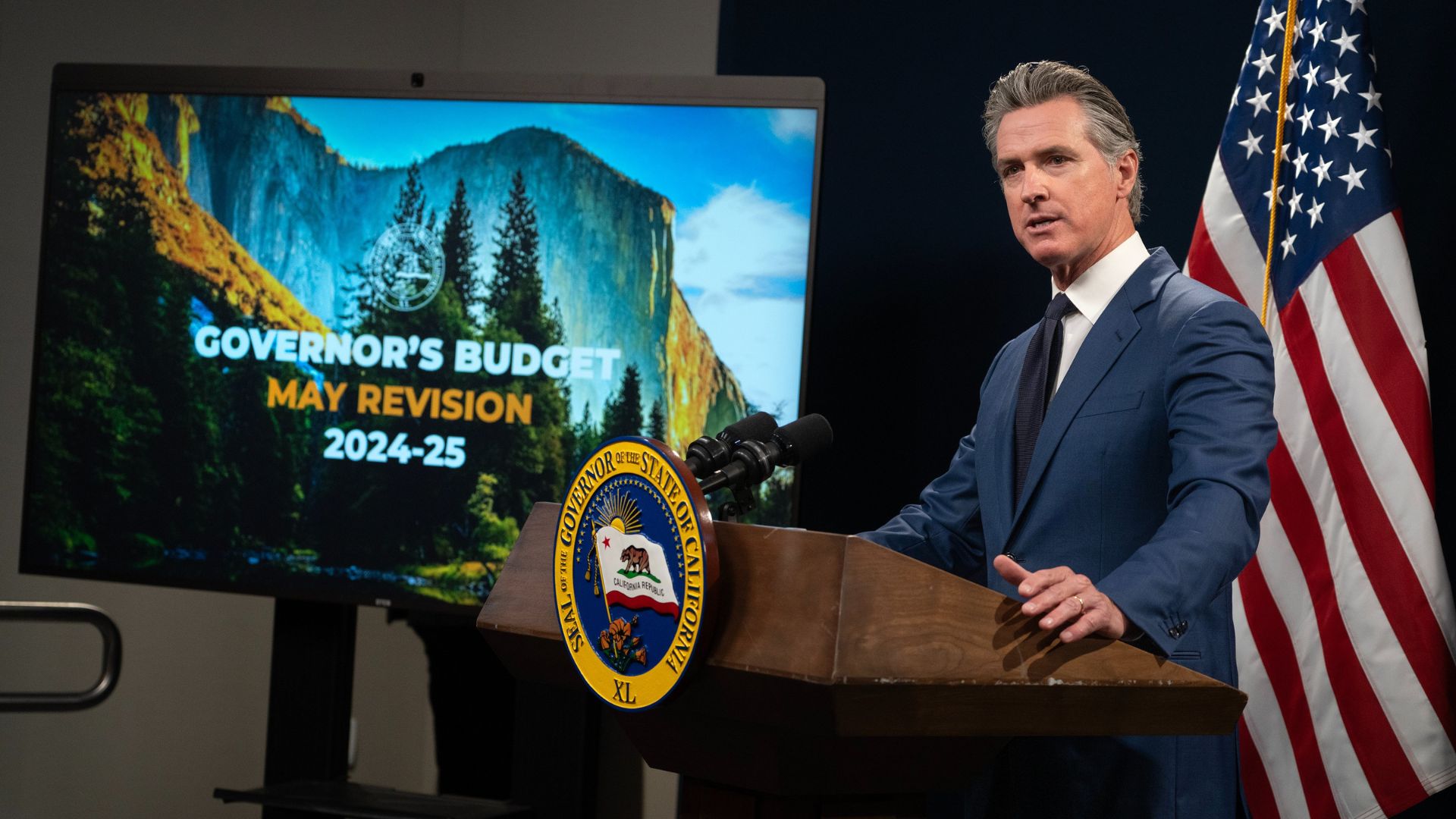

On May 10, Governor Newsom unveiled a budget proposal which was detailed further the following week.

The proposal seeks to restrict businesses with earnings of $1 million or more from deducting operating losses from their taxes and limit their business tax credits. These measures are intended to generate approximately $18 billion through 2027.

Focus on Protecting Small Businesses

The tax adjustments introduced in the budget are described by state finance department spokesman H.D. Palmer as “designed to protect small businesses.”

He emphasized that the changes would affect only a small percentage of corporations, primarily impacting how they claim credits for research and development.

Timing of Tax Increases Criticized

The proposed tax hikes have been met with criticism.

David Kline, vice president of communications and research for the California Taxpayers Association, highlighted the poor timing, saying, “this would be the worst possible time to impose $18 billion in additional business taxes that would trigger job losses and higher costs for consumers.”

Economic Uncertainty Caused by Tax Proposals

Jon Coupal, president of the California tax watchdog group Howard Jarvis Taxpayers Association, criticized the proposed taxes for creating “a climate of economic uncertainty” and described it as “playing a risky game with people’s jobs.”

His comments reflect concerns over nearly half a million residents losing their jobs in the state earlier this year.

Concerns Over Business Stability

The tax changes could undermine business confidence, as Jon Coupal pointed out.

He stated, “The suspension of established tax credits and net operating loss deductions sends a message to businesses that California may yank the rug out from under them any time the budget is under stress, even when that stress is caused by reckless government overspending.”

Budget Growth Despite Population Decline

Governor Newsom’s proposed $288 billion budget is a significant increase from the budgets during his tenure beginning in 2019.

It is also much higher than his predecessor’s $201 billion in 2018-19, even though California now has at least 300,000 fewer residents.

Economic Stagnation and Fiscal Measures

California’s economic stagnation and a decrease in tax revenues, exacerbated by an exodus of both high-earning residents and businesses, have driven the need for these tax increases.

The state’s economic challenges are deepening, necessitating decisive fiscal measures.

The Ongoing Debate Over Tax Hikes

The implications of these proposed tax hikes are a subject of intense debate.

Citizens are weighing whether these measures will stabilize California’s fiscal situation or further challenge the economic environment, particularly impacting businesses.

Diverse Impact on State’s Economy

The administration claims the tax proposals are aimed at protecting small businesses while ensuring that larger corporations contribute more during the economic downturn.

This approach, however, has stirred a debate on its fairness and effectiveness in addressing the state’s financial issues.

The Future of California’s Economy

The outcome of these proposed tax changes will be crucial in determining the future economic direction of California.

As the state contends with these fiscal proposals, the responses from businesses and residents will shape the political and economic landscape in the coming years.