Medicare Part D will undergo some changes in 2025, according to a glimpse provided by the Centers for Medicare & Medicaid Services. In addition, the Inflation Reduction Act of 2022’s Medicare rules will begin to take effect in 2025, transforming how you pay for medications.

The Social Security Administration determines how much the Medicare program will cost each year.

Social Security Act

Utilizing the guidelines outlined in the Social Security Act, the Social Security Administration then either raises or lowers deductibles and premiums. In the coming weeks and months, the CMS is expected to fill in the changes to Medicare 2025.

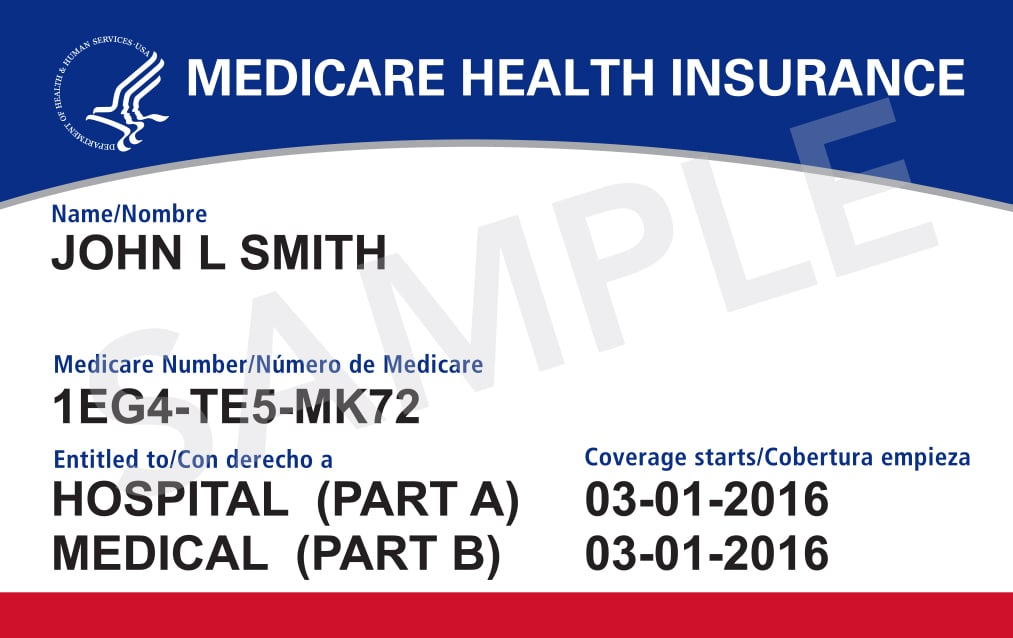

Inpatient care in hospitals, critical access hospitals, and skilled nursing facilities is covered by Part A of Medicare.

Part A Changes

Nearly 99% of Medicare recipients get Part A free of charge since they paid Government health care charges while working, as per the Centers for Medicare & Medicaid Services.

On October 12, 2023, the CMS announced the Part A changes for 2024 so a similar date should be expected for this next year’s announcement.

Part B Changes

Medical services like doctors’ services and outpatient care are covered under Part B. This part is discretionary, and for 2024, Part B’s premium is $174.70 each month.

The CMS reports yearly adjustments to Part B in the fall, so we’ll need to stand by until then before we can get the all relevant information for 2025.

Part C Updates

Some updates will also be made to Medicare Advantage, also known as Medicare Part C. Part C plans come from privately owned businesses and can offer additional coverage, for example, vision, hearing, dental, and well-being and health programs.

The plan you select determines how much this alternative costs. Beginning in 2025, participants in Medicare Advantage will receive a mid-year notification informing them of any unused benefits that they may utilize.

Re-enrollment to Medicare Advantage

The mid-year reminder will remind you to make use of your benefits and prompt you to reevaluate whether you require the particular plan you signed up for.

You will be able to make a more educated decision about whether you should stick with your current plan or switch to a new one when the time comes for re-enrollment.

Part D Increases

Part D can assist with taking care of the expenses of prescription drugs. This year, a slew of changes to Part D plans will be made possible by the Inflation Reduction Act.

As per the CMS, the Part D base recipient premium will increase by $2.08, or 6%, from $34.70 to $36.78.

Significant Change

The IRA includes a 6% cap to the base Part D plans, yet actual premiums might shift. CMS said it will deliver preliminary Part D premium averages later this year.

The annual out-of-pocket maximum of $2,000 for medications will be a significant change for Plan D enrollees in 2025.

Millions Will Benefit

The cap on out-of-pocket expenses will help millions of people.

By April 1 this year, more than 1.7 million people, about 3.5% of people covered in drug plans, had already reached $2,000 in out-of-pocket costs on their prescriptions.

Exclusions to the Maximum

For enrollees who are required to take expensive medications on a monthly basis, this maximum out-of-pocket change may have significant advantages.

Note that because they are typically administered by a doctor or practitioner at a facility, Medicare Part B-covered medications will not count toward this maximum which is due to be implemented in 2025.

A First-Time Change

“It’s the first time in the history of the Medicare program that people have a cap on how much they could have to pay out of pocket,” said Meena Seshamani, director of the Federal Center for Medicare.

“And such a significant change means that in open enrollment, it is so important to shop. Because with such big changes, there very well could be a plan that better suits your health and financial needs,” said Seshamani.

Eliminating the Donut Hole

There were four stages of coverage in 2024, Deductible, Initial, Coverage Gap (also known as the donut hole), and Catastrophic.

The Coverage Gap is a temporary limit on what the drug plan will cover for medication expenses. The donut hole coverage gap will be eliminated by Medicare in 2025, further simplifying coverages.

Closer to the Next Level of Coverage

Participants in Plan D will now have to pay their deductible (up to $590) and copayments until they reach the new out-of-pocket maximum of $2,000, moving them closer to the next level of coverage than in previous years.

People will be able to pay for their medications over the course of the year using a new payment plan option rather than paying for them all at once.

Payment Plan

The new plan lets people choose to participate in this payment plan and spread out their payments over the rest of the year, up to a certain limit.

The payment plan is only opt-in.

These significant changes to Medicare will come alongside any further updates to be announced later this year.

Helping Patients Budget

This change will make out-of-pocket expenses more manageable, especially when paired with a cap on how much a patient will owe.

Seshamani said: “This will enable people to spread out the out-of-pocket drug costs over the course of the year so that you don’t experience that sticker shock and those cash flow issues at the pharmacy.”

Higher Premiums Not Affected

While this change will help a lot of people, there was also some anxiety.

“There was some concern that changes in the Medicare Part D benefit design that lower costs for beneficiaries, like the $2,000 cap, would lead to higher premiums for 2025,” said Tricia Neuman, executive director for KFF’s program for Medicare policy. The cap does not include premiums.

New Drugs Will Be Covered

Medicare cannot cover drugs specifically for weight loss. However, Part D plans can cover weight loss drugs like Ozempic and Mounjaro for type 2 diabetes.

In March, the FDA approved Wegovy for people with cardiovascular disease who are overweight.

Even More Drugs in 2025

More weight loss drugs may be covered in Part D plans by 2025.

“We estimate that roughly one in four Medicare beneficiaries with obesity or who are overweight could be eligible for Wegovy to reduce the risk of series heart disease,” said Diane Omdahl, president of 65 Incorporated, which helps people make Medicare decisions.

More Opportunities for Family Caregivers

A program for dementia patients and their caregivers that launched this year will quadruple in 2025.

The program is called Guiding an Improved Dementia Experience. It provides a 24/7 support line, a care navigator to find medical services and community-based assistance.

Serving More People

The program provides caregiver training and up to $2,500 a year for at-home, overnight, or adult daycare respite services.

CMS selected 96 organizations to participate from July 1 this year. These groups included academic medical centers, hospitals, practices, and community-based organizations that already provided programs for dementia patients. CMS chose 294 organizations to participate in the program next July.

Important Criteria for the Expansion

Participants must be enrolled in original Medicare and have a dementia diagnosis to benefit from this program. They also cannot be in a hospice or a nursing home.

“We’re very excited about this,” said Janet LeClair, CEO of Memory & Movement Charlotte. “The caregiver is really the pivotal person ensuring the quality of life of the patients.”

Pushing for More Mental Health Services

The number of adults aged 65 and older reporting they used mental health services increased by only one point to 20% between 2019 and 2022.

Access to care may have been a barrier, but now, licensed marriage and family therapists, mental health counselors, and addiction counselors cannot enroll as Medicare providers. Now, they can.

Some Providers Have Enrolled

Mental health service providers do not automatically become Medicare providers. They have to go through a paperwork process.

Seshamani said: “We’ve had such tremendous excitement and interest with tens of thousands of clinicians enrolling in the Medicare program, which will make a big difference for access to care.”

Big Changes on the Horizon

These changes are pushing to make Medicare more affordable by next year.

Not only that, but these improvements will also reach a wider range of patients who need care. Those who may not have been able to afford large lump sums can now opt for stable installments. However, we will not know the true impact of these changes until they are employed in 2025.