This last year has been tough on people’s bank accounts. Luckily, there might be a break coming to married couples. Married couples filing a tax return jointly might get a tax cut bill thanks to a group of four New York House Republicans.

The discussion around the bill is set to be discussed in the chamber in the coming days. This is everything we know about the bill.

A Call to Reform the SALT Deduction Bill

According to Newsweek, the New York House Republicans held a procedural vote on unrelated bills on Tuesday after the GOP failed to include a reform on SALT. The tactic was used to get attention and pressure the other Republicans to include the reform.

SALT stands for state and local taxes, and lets people deduct some of those taxes from their federal taxes, lowering their federal tax bill.

The SALT Cap Is Too Low

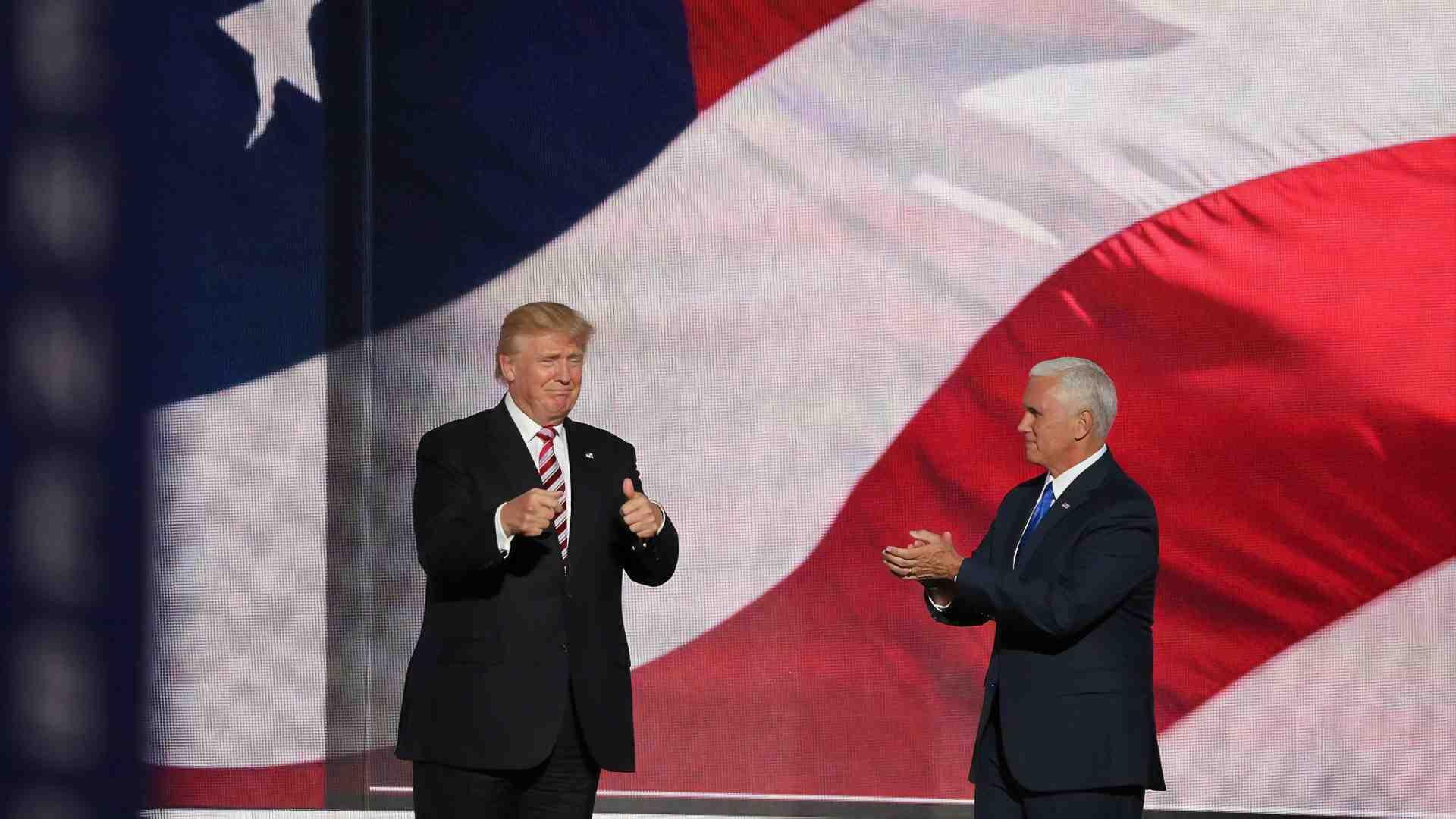

The New York House Republicans want to push back against the $10,000 SALT cap that Donald Trump imposed during his 2017 tax overhaul. The tax disproportionately hurts taxpayers in blue states, according to the House Republicans.

Property and state income taxes are higher in these states, and the SALT bill helps to ease the pressure of those taxes.

Discussions Around the Bill Are Starting

Reps. Nick LaLota, Anthony D’Esposito, Andrew Garbarino, and Mike Lawler threatened to block legislative action over an enhancement of SALT, which reportedly would create a larger discussion around the bill in the coming days.

The New York House Republicans are looking to move the SALT cap up from $10,000 to $20,000.

How Does the SALT Deduction Help Married Couples?

The SALT deduction helps married couples in two ways. When married couples filed jointly, they could combine their individual SALT deductions. This could exceed the individual limit and help the couple save more on their annual taxes.

Married couples filing together had a higher standard deduction, meaning they had a higher threshold before needing to itemize deductions.

The Cap Introduced the “Marriage Penalty”

A cap on the deduction now cripples these once-beneficial features. Since 2018, regardless of how you file, you can only deduct a maximum of $10,000, drastically limiting the potential gains. This means that potential benefits have a ceiling on them.

Some believe that this cap disproportionately affects married couples in high-tax states that can fully utilize their combined potential deduction. For some couples, choosing to file jointly can backfire due to the “marriage penalty,” which raises their tax obligations.

The House Republicans Want the Bill to Move Fast

Lawler, one of the four House Republicans, wrote on X: “I look forward to the SALT Marriage Penalty Elimination Act coming to the floor and passing the House. Upon its passage, Senator Schumer must move it through the Senate ASAP.”

Lawler punctuated his statement, writing: “The hard-working taxpayers of #NY17 deserves nothing less.”

The Fight for SALT Relief

LaLota wrote on his social media that he “promised Long Islanders I would fight tooth and nail for SALT relief and vote against this year’s tax bill if it didn’t have a reasonable amount of SALT in it. Tonight I fulfilled that promise by voting against the Wyden-Smith tax bill.”

The Wyden-Smith tax bill, officially known as the Tax Relief for American Families and Workers Act of 2024, proposes to expand child tax credit, reinstate business tax breaks, boost affordable housing, and accelerate the deadline for filing backdated claims.

Cutting Taxes for Families

“Thankfully, the fight for SALT isn’t over,” LaLota wrote. “Tonight I helped introduce the SALT Marriage Penalty Elimination Act, which would raise the joint filing deduction to 20K and ensure that we keep our promise to push pro-family and tax-cutting bills.

LaLota continued: “Speaker Johnson has pledged to allow this bill to come to the floor next week. Stay tuned!”

The Bill Could Help Those Who Make Less Than This

According to the redacted text posted by journalist Laura Weiss on X, the deduction cap for married couples could be increased by $10,000.

This rule applies specifically to tax returns filed jointly for the tax year 2023 (between January 1st, 2023, and December 31st, 2023). It only applies to couples with a combined adjusted gross income of less than $500,000 for that year.

The Reform Might Not Last Forever

While this could help some couples, Weiss wrote that it “is a very limited, temporary deduction increase for married couples.” According to anonymous sources quoted by The Hill (via Newsweek), Congress will meet in the coming days to discuss a SALT-related bill.

According to sources, the bill is unlikely to bypass usual procedures for a vote. Instead, it will go through a more traditional and potentially longer process involving specific rules and procedures before reaching a vote in the chamber.

Other Tax News

While it is not official that married couples will be saving money this year on their taxes, we might have a clear picture in the upcoming days.

After concessions to the four New York House Republicans, the House passed the $78 billion bipartisan tax bill: the Tax Relief for American Families and Workers Act. It is unclear if the bill will pass through the Senate.