Macy’s has been one of the world’s leading retailers for decades, but the company has recently experienced some financial trouble.

The retail giant has been considering selling and got an amazing $5.8 billion offer this week from a real estate tycoon. This offer is a big deal not only for Macy’s as a whole but also for its shareholders.

What Is Macy’s?

Most people have shopped at least one of Macy’s 783 stores around the world, but not everyone knows its rich history.

The very first Macy’s was opened in New York City in 1858, and over the past 165 years, it has grown into one of the biggest retailers on the planet.

Macy’s Owns an Incredible Amount of High-Value Real Estate

It’s almost important to note that while its billions of customers over the years have certainly contributed to the company’s financial success, it’s also done very well for itself in regard to real estate.

Of Macy’s 738 stores, many are in fantastic locations, including its flagship store in New York City, which is the largest retail store in the world.

Understanding Macy’s Ever-Changing Value

Now, before diving into the current offer on the table, it’s first important to understand the big changes in Macy’s stock market valuation.

Macy’s has historically done well financially, but in 2015, it hit its peak valuation at $70.99 per share. For comparison, famous retailer Walmart was worth about $75 per share in 2017.

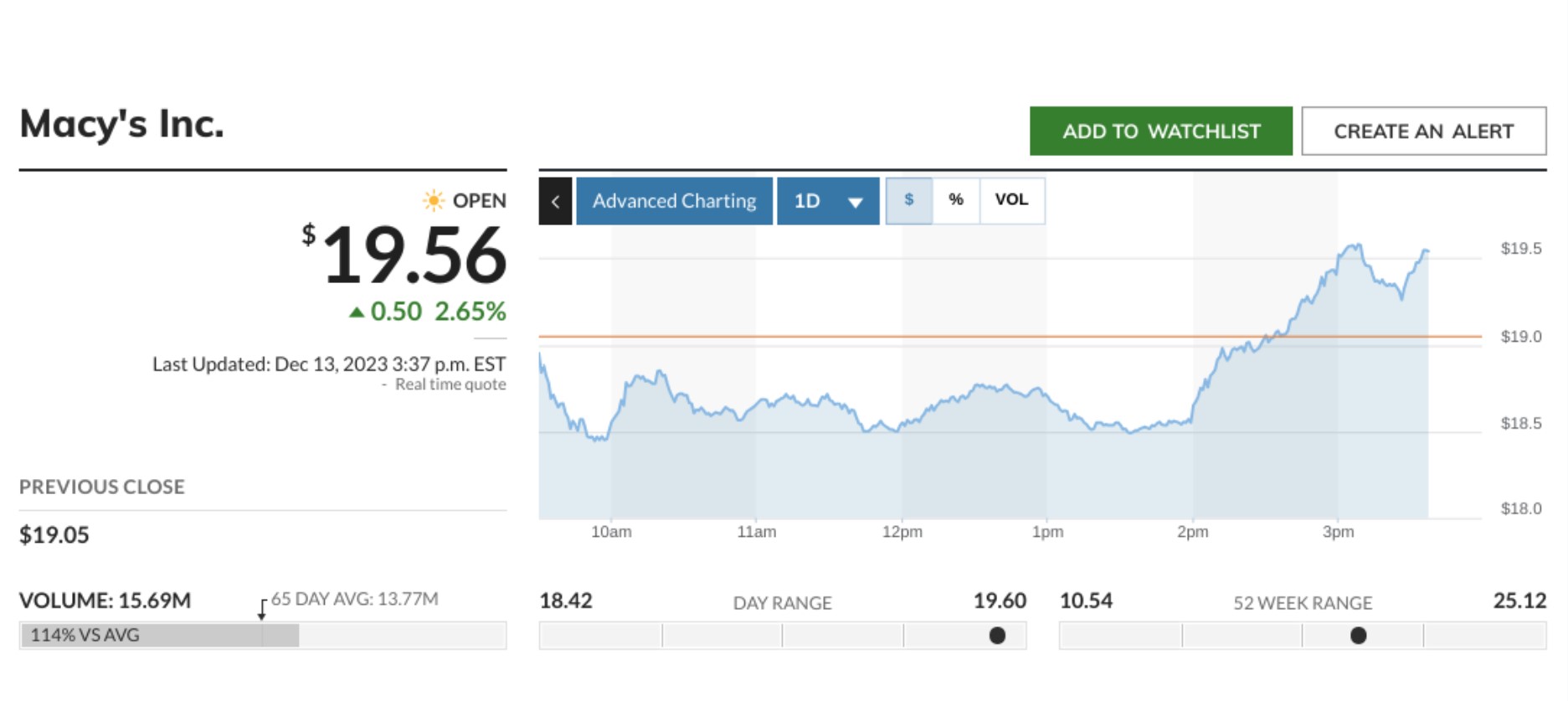

Macy’s Current Share Price

However, on Nov. 30, 2023, Macy’s shares were only worth $17.39, which is obviously a significant decrease for the shareholders.

Although the exact reason for the sharp decline is unknown, the general consensus is that Macy’s is making less than it has in recent years due to more retail options, lower prices elsewhere, and general shopping trends.

Macy’s Really Struggled During and After the Pandemic

It’s also noteworthy that Macy’s experienced significant profit loss during the COVID-19 pandemic.

Of course, the store closures were challenging, but it was also the change in consumer behavior after they were reopened that really affected the conglomerate. People simply stopped shopping at stores for their goods, especially those they could find at a discounted rate through online retailers like Amazon.

There’s Simply Too Much Competition

The truth is that these days, there is simply too much competition in the retail market.

Stores such as Walmart and Target are selling home goods for far less than Macy’s ever did, and retailers like TJ Maxx and Marshalls are essentially offering the same brands of apparel that Macy’s carries but at an extremely discounted price point.

Macy’s Is Looking to Sell

Due to complications from the pandemic and generally low sales, Macy’s has been looking for a buyout.

And on Dec. 1, 2023, many are saying Macy’s shareholders got an early Christmas present as an offer was sent by real estate company Arkhouse Management to the tune of $5.8 billion.

Is $5.8 Billion a Good Offer?

Macy’s is currently in a bit of a transition period. Longtime CEO Jeff Gennette is retiring, and executive Tony Spring is taking his place in just a few months. But with its falling stock prices and unimpressive revenue, it may be the right time for Macy’s to finally sell.

And the $5.8 billion offer is nothing to scoff about; this offer values Macy’s at $21 per share, which is 32.4% above what it came in at the day before.

Macy’s Stock is Rising and Falling Every Other Day

Just a few days after the offer was announced, Macy’s stock rose 19% and closed at $20.78, a significant increase from the $17.39 a few days before. However, according to MarketWatch, it plummeted again a few days later and continues to rise and fall.

Realistically, Macy’s value doesn’t just include its stock options; a big part of buying Macy’s means getting its real estate.

Macy’s Is a Big Name in Real Estate

In 2022, Cowen Investment Bank reported that Macy’s real estate holdings were valued anywhere from $6 to $8 billion.

Citi Bank analyst Paul Lejuez told clients, “Macy’s has some valuable real estate including its Herald Square location, which makes Macy’s more attractive as a target” (via Yahoo Finance).

What Will Happen to Macy’s If It Accepts the Buyout?

Because the company that offered Macy’s $5.8 billion is a real estate investor, one might wonder if they’re buying Macy’s for its retail value or its property.

Although it’s impossible to say just yet what will happen to Macy’s if they do sell, this just may be the last holiday season to shop at the famous and beloved retailer.