Ask most Americans, and they will say that the current cost of living makes it almost impossible to save for the future. And now, an expert economist has validated their feelings with concrete statistics.

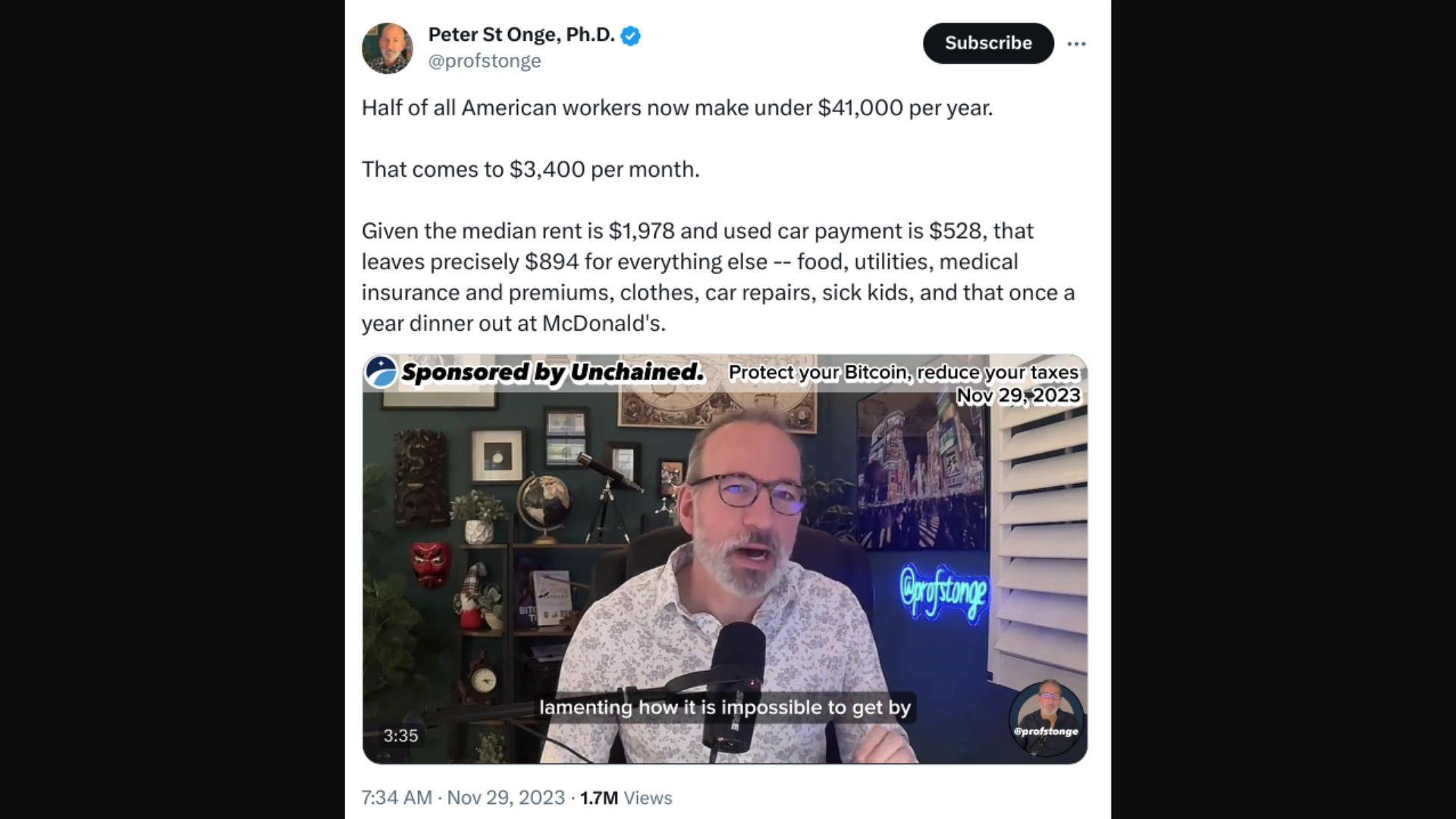

Peter St. Onge, economist and MBA professor, posted a video on X, formerly Twitter, explaining exactly why Americans are now struggling to make ends meet.

Breaking Down the Numbers

Professor St. Onge captioned the video, “Half of all American workers now make under $41,000 per year. That comes to $3,400 per month. Given the median rent is $1,978, and the used car payment is $528, that leaves precisely $894 for everything else.”

That less-than-$900 includes “food, utilities, medical insurance and premiums, clothes, car repairs, sick kids, and that once-a-year dinner out at McDonald’s.”

The Cost of Just Staying Alive

It’s important to understand that $894 doesn’t even begin to cover the necessary costs of literally staying alive such as heat, medical care, and food.

Although Professor St. Onge doesn’t mention it in his video, the newest studies show that the average American spends at least $300 a month on groceries, $420 a month on health care, and $429 for monthly utilities. That’s $1,149 without copays, gas, coffee, or absolutely anything else.

Even the Affordable Options Are Expensive

Professor St. Onge notes the average monthly car payment, even for a used car, is a whopping $528.

Essentially pointing out that even for Americans opting for the more affordable option for cars, rent, fast food, and non-brand-name products, prices are still through the roof.

‘It’s Impossible to Get By, Even Working Full Time’

In the nearly four-minute clip, St. Onge goes on to explain that this is why young people, i.e., Millennials and Gen Zers, have found it “impossible to get by, even working full time.”

They say that their parents owned multi-bedroom homes by the time they were 30, but these generations still have to live with roommates at 40. And, of course, St. Onge is not dismissing these complaints, he’s validating them.

Rethinking the American Dream

CNN tells the story of Rachael Gambino and Garrett Mazzeo, seemingly embodying the typical American Dream, however they are reevaluating their life choices. Having followed the conventional path of education, marriage, and homeownership, they now question its viability.

Rachael, expressing concern for their son, states, “I think a lot of Millennials were forced into saying, ‘you need a four-year degree in order to be successful,’”

Millennial Economic Burden

Millennials, despite being the most educated generation in U.S. history, face significant financial challenges. The cost of attending a public four-year college increased by more than 200% between 1987 and 2017, as per information from CNN.

Consequently, the average debt for borrowers aged 25 to 34 is around $32,000, according to Department of Education data. This economic strain is a result of escalating education costs and stagnating wages.

Generational Wealth Discrepancies

According to CNN, Millennials, now between 27 and 42 years old, confront a wealth gap when compared to previous generations. The economic prosperity of the 1990s they grew up in contrasted sharply with the Great Recession they faced as adults.

By 2016, families headed by Millennials born in the 1980s were about 34% below wealth expectations, as reported by the Federal Reserve Bank of St. Louis.

These Generations Can’t Even Think About Buying a Home

According to U.S. Census Bureau data, half of Americans have made less than $40,000 in the last few years (via Snopes). The idea that younger Americans could save up enough to buy a home is essentially impossible.

He said, “Don’t even think of buying a house. The cost of a mortgage on the median house at the moment is nearly $3,000, which would consume nearly 90% of the median income.”

The Housing Market Challenge

For many, like Rachael and Garrett, homeownership has become a difficult goal. The couple’s experience, aiming for a substantial down payment only to face rising home prices and mortgage rates, illustrates the broader housing market issues.

Speaking to CNN, Rachael questions, “This is the American Dream, But at what cost? What are we paying for the American Dream now?”

Shifting Attitudes Towards Homeownership

The traditional advice favoring buying over renting is now being questioned. In the current market, renting a three-bedroom home is more affordable than owning in almost 90% of U.S. local markets, according to data from Attom.

CNN reveals that this change in housing dynamics has led many, like Rachael and Garrett, to reconsider the value of homeownership, once considered an integral part of the American Dream.

The Housing Shortage

CNN also notes that the current housing crisis in America, characterized by a shortage of affordable homes and rental options, is a significant issue for Millennials.

This shortage is a result of various factors, including urbanization trends and limited housing development. Addressing this crisis requires comprehensive solutions, including expanding housing stock and support for first-time homebuyers, as per CNN.

The High Cost of Parenthood

The economic impact of parenting is particularly pronounced for Millennials. Rachael and Garrett have had to reassess their family planning due to the high cost of childcare, according to CNN.

This challenge is representative of many in their generation, who find the financial burdens of parenting a significant factor in their life decisions.

Child Care Costs as an Economic Barrier

Child care expenses pose a significant challenge to American families. The U.S. government’s limited investment in child care, averaging $500 per child annually, contrasts starkly with the OECD average of $14,436.

The high cost of child care in the U.S. is a major factor affecting the economic stability and family planning decisions of many young families, CNN reveals.

The Disparity Between Economy and Perception

Despite economic indicators suggesting a thriving post-Covid America, public sentiment tells a different story.

A CNN poll reveals a staggering 71% of Americans consider the economic conditions “poor,” a contrast to the avoidance of an actual recession.

Childhood Poverty in the United States: A Growing Crisis

Fox News reports that childhood poverty in the U.S. has hit alarming levels, with the U.S. Census Bureau reporting a record-high increase in 2022. The number of children living in poverty doubled, bringing the total to approximately 9 million.

This significant rise in childhood poverty in the wealthiest nation highlights a critical social issue that needs immediate attention and action.

Sharp Increase in Poverty Among Older Americans

The poverty rate among older Americans has also seen a sharp increase, according to the U.S. Census Bureau. Using the supplemental poverty measure, which provides a more accurate reflection of income and spending, the rate of poverty among those over age 65 rose from 9.5 percent in 2020 to 14.1 percent in 2022.

This represents over eight million older Americans living in poverty, according to the New York Times. Ramsey Alwin, president and CEO of the National Council on Aging, called this situation “quite alarming” and “really unacceptable,” emphasizing the need for urgent intervention.

Nationwide Issue

The New York Times reveals that in southwestern Virginia, the situation mirrors the national trend, with 20 percent of older residents living in poverty. The District Three Governmental Cooperative, which provides senior services, has assisted more than 3,000 low-income residents in applying for benefits in the 2023 fiscal year.

The high poverty rate among both children and older adults in this region, as well as the decline in median household income, illustrates the widespread and deepening economic challenges faced by vulnerable populations across the United States.

How Did We Get Here?

While it’s certainly nice for Millennials and Gen Zers to feel supported in their frustrations, the bigger question on most people’s minds is, “How did we get here?”

And Professor St. Onge has quite a lot to say on the matter. In fact, he believes he knows exactly what has led America to this horrific economic situation.

Something in the American Economy Is Broken

St. Onge first explained that what “makes us richer is productivity, and ever since 2000, American productivity has been in free fall.”

He says that this lack of productivity is a sign that “something broke” within the economy, and according to St. Onge’s research and understanding, manipulated interest rates and increased government spending are what broke it.

Manipulated Interest Rates

“Between 1954 and 1999 real interest rates (that’s after inflation) were roughly 2%. Since 2000, they’ve been negative 1%” explained Professor St. Onge.

He then clarified, stating, “Those low rates meant easy money flow to garbage businesses that feasted on the cheap money but didn’t make the economy grow.” Essentially there were several “booms” in the economy, but they were each “knocked out” by the next recession.

‘Soaring’ Government Spending

Next, he sheds light on what he calls “soaring government spending,” claiming that “the productive economy [has been] stolen by bureaucrats and used to chain the rest of us with regulatory mandates.”

Onge continued this strong opinion and said, “Since 2000, government funding has grown by nearly half as a share of the economy … We get to survive on the leftovers.”

Loan Issues Aren’t Far Behind

In another one of Professor St. Onge’s videos on X, he notes a secondary issue that Americans are facing due to their current economic struggles.

He noted, “‘Buy-now pay later’ soars 14% as poorer Americans borrow furiously to make up for lost real wages,” and that these loans are “setting up a default catastrophe.”

‘Outright Decline’ Will Be Here Soon

Professor St. Onge has several more clips on his profile explaining the county’s current economic issues and how they affect average Americans. But concluded the viral clip about monthly spending with words of extreme warning that anyone who views it won’t soon forget.

He said plainly, “If we do not change course, which doesn’t look like we are, it will not be stagnation anymore — it will be an outright decline.”