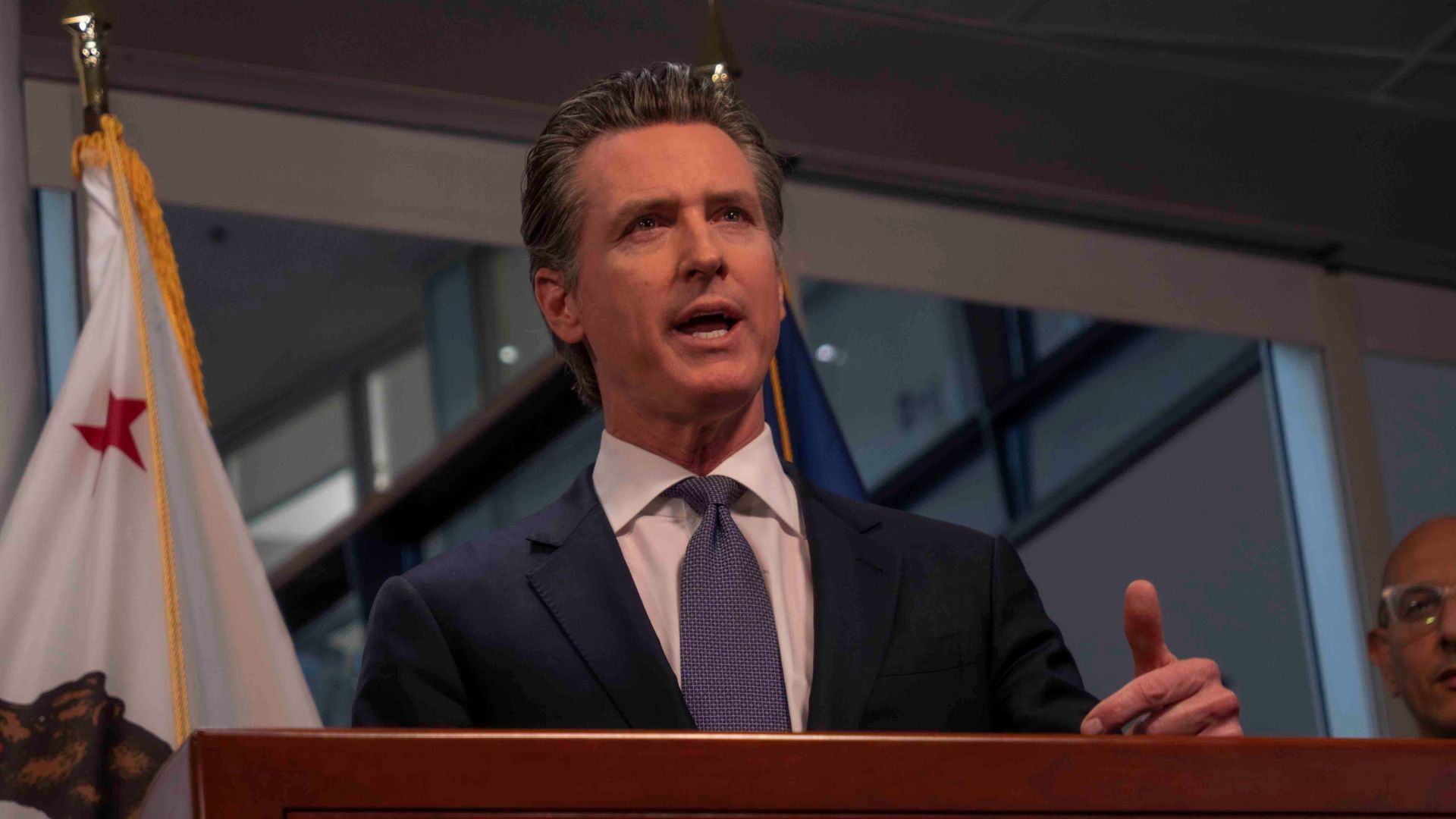

California Governor Gavin Newsom sent a letter declining to accept an approved pay raise for his government position in the context of budget issues plaguing the Golden State.

His letter was written just before the California Citizens Compensation Commission voted to increase the salaries of all elected officials in the state by 3.5% in June.

Newsom’s Letter

Newsom addressed the letter to Michael Sweet, the Chair of the California Citizens Compensation Commission.

“First, I want to express my utmost respect for the independence and the important work of this commission,” Newsom wrote. “Your dedication to ensuring fair and appropriate compensation for public officials is important to the functioning of our state government.”

Waiving the Salary Increase

The letter continues with Newsom ultimately declining the pay increase, citing the state’s financial challenges.

“While the Commission deliberates a proposed 3.5% salary increase, I feel it is important to acknowledge the fiscal challenges currently facing our state. In light of these circumstances, I have decided to personally waive any potential salary increase related to my state service for the time being,” wrote Newsom.

Governor’s Salary

According to state records as of December 2023, the governor makes the most of any elected official in the state at $234,101 per year.

If the salary increase was going to go through, this would have increased Newsom’s salary to around $242,294 by December of this year.

What the Salary Rejection Means

In the grand scheme of things, Newsom’s rejection of the salary increase will not make a huge difference to the state of California’s budget.

“Newsom saving the state $7,000 isn’t a lot,” said Lee Greenman, an accountant who helps cities and regional bodies with budget problems. “But this goes way beyond money matters. Him taking a pay raise when the state is tens of billions in the red? That doesn’t look great.”

State Budget Crisis

Previously, Newsom and state legislatures had to work out a deal regarding the state’s upcoming budget shortfall.

The final deal on the budget ended up having an estimated $46.8 billion deficit, a large increase over the 2023 budget which ended up being around $32 billion.

Why Is California in Financial Trouble?

California itself is one of the largest economies in the entire world, so it may surprise some that the state has had a string of budget shortfalls.

According to the California Budget and Policy Center, much of this shortfall is attributed to declining tax revenues that started in the 2022 tax year.

Previous Surplus

This shortfall is even more incredulous to some critics given that just a few years ago, Governor Newsom was bragging about an even bigger state surplus of $97.5 billion.

“No other state in American history has ever experienced a surplus as large as this,” Newsom said as he unveiled the spending plan for the 2022-2023 state budget.

Revenue Projections

The aggressive spending that Newsom and legislators authorized in that budget depended on a projection that tax revenues for the state would be increasing by $54.8 billion, something that ultimately did not go as expected.

According to CalMatters, income tax accounts for more than 75% of the state’s general fund revenue.

Effects of COVID

Newsom and others saw a recent spike in tax revenue and projected it to continue without thinking too deeply about why it happened.

In California, Newsom had shuttered the state’s economy to protect against the pandemic, resulting in around 2 million jobs instantly disappearing. It’s obvious that when restrictions were lifted some of the jobs would come back, but the government had counted on continued growth.

Other Salary Increases Have Been Delayed

Waiving the salary increase may have been the best choice for Newsom politically, given how many Californians have had to forego their raises.

Newsom’s new budget cut of $6.7 billion was reserved to increase the wages of healthcare providers. The state is now using that money to plug the state deficit. Healthcare providers agreed to be taxed in order to generate money that would be reinvested back into Medi-Cal, the state’s insurance program for lower-income households.

Broken Promises

Newsom’s budget has meant that previous agreements between the state government and Californian healthcare providers are no longer going ahead.

Health insurance plans serving Medi-Cal patients would be taxed so that the state would claim a dollar-for-dollar match in federal money. This would have generated upward of $35 billion that the state would have invested into healthcare workers’ reimbursement rates.

A Drop in Healthcare Quality

The diversion of dollars away from Medi-Cal means the quality of healthcare may “get worse and worse” in the coming years.

Jarrod DePriest, president of Maxim Healthcare Services, said between 2018 and 2024, the number of nurses employed under his company dropped by half. He said this is because the reimbursement rates have not kept up with salaries and inflation. Now, his company receives almost 10,000 fewer patients.

Patients Losing Out

If the lack of money in the healthcare sector is driving workers away, many low-income Californians will no longer be able to access healthcare.

Dustin Corcoran, president of the California Medical Association, said providers will only accept more Medi-Cal patients if they feel the state can fund the program permanently. Corcoran said providers need to avoid “choosing between bankruptcy and patient abandonment. That shouldn’t be a choice a provider ever has to make.”

Critical Cuts to Public Services

The budget deficit has led to spending cuts in essential public services.

Democratic leaders in Sacramento are pushing for drastic cuts in prison spending. This has been a long-term goal of the California state government. With the enormous budget deficit, Democratic leaders may be able to put more pressure on Newsom to make the cuts.

Empty Beds

The push to slash prison spending is at odds with Democratic leaders who are looking to raise the penalties for crimes like selling fentanyl and serial retail theft.

Democratic lawmakers argue that the $14.5 billion budget of the California Department of Corrections and Rehabilitation is overinflated. The government agency estimates there will be nearly 15,000 empty beds in the next fiscal year.

Criticism Online

Despite the effort of apparent goodwill from the governor of rejecting an approved salary increase, some commenters online are still critical of Newsom.

“He kept his salary the same while other state employees took 8-10% cuts to help others keep their jobs during COVID. Gimme a break,” said an X user.

Pay of Government Officials

Some commenters were curious why some government officials make so much money, especially given the wealth that many already possess.

“Why should a millionaire be taking a salary at all to do public service?” wrote X user Zachary Murray.

Recent Musk Drama

One commenter brought up Newsom’s recent spat with tech billionaire Elon Musk, who promised to move SpaceX from California to Texas following the governor’s signing of a law Musk didn’t like.

“If he really wants to help, he should go talk to Elon and try to keep all those Space X Jobs in California he lost,” said X user Carlos Magana.

Newsom’s Political Future

Newsom’s decision to waive the salary increase may be informed by optics should he run for office again.

“It does look like a strong stance from a financial perspective. But on the other hand, he knows how much a raise would hurt him politically. But he does also have a step up against lawmakers and others who have said nothing of the raise yet,” said Greenman.

Coping With Inconsistent Revenues

The swing from a huge budget surplus to a staggering deficit means the state needs to find a way to fund itself despite volatile tax revenues.

Newsom used budget reserves during the pandemic, which are intended to cushion the blow of lulls in income tax. Now, critics are warning against misusing the reserves this year to plug the deficit. This is because draining the reserves now could leave Californians stranded in the event of a recession.

A Rainy Day Fund

In California, debates around the solution to revenue volatility have happened since Arnold Schwarzenegger was state governor.

Over the years, the state government has created budget reserves to protect the budget from downfalls in revenue. Earlier this month, there was a debate at an Assembly Budget Committee hearing over whether the state should expand its rainy day funds.

Criticism Over Savings

Due to his misguided projection of revenues, Newsom now wants to avoid acting on spending estimates of windfall revenues until the money is actually in the state’s pocket.

Others have criticized this idea as they believe the state needs to increase spending to support low-income Californians. Scott Graves of the California Budget and Policy Center said raising the cap for reserves could “leave less revenue to meet the immediate needs of Californians.”

Future Budget Planning

At best, Newsom’s rejection of his salary increase is an admirable statement, showing that the state is in trouble and he will not accept more spending than is necessary.

However, what needs work is California’s progressive tax structure. What is clear is the boom-and-bust cycle that California goes through due to the volatility of tax revenues. While California is better equipped to handle this deficit than during the Great Recession (when it had no reserves) the state’s financial well-being currently fluctuates with the stock market.