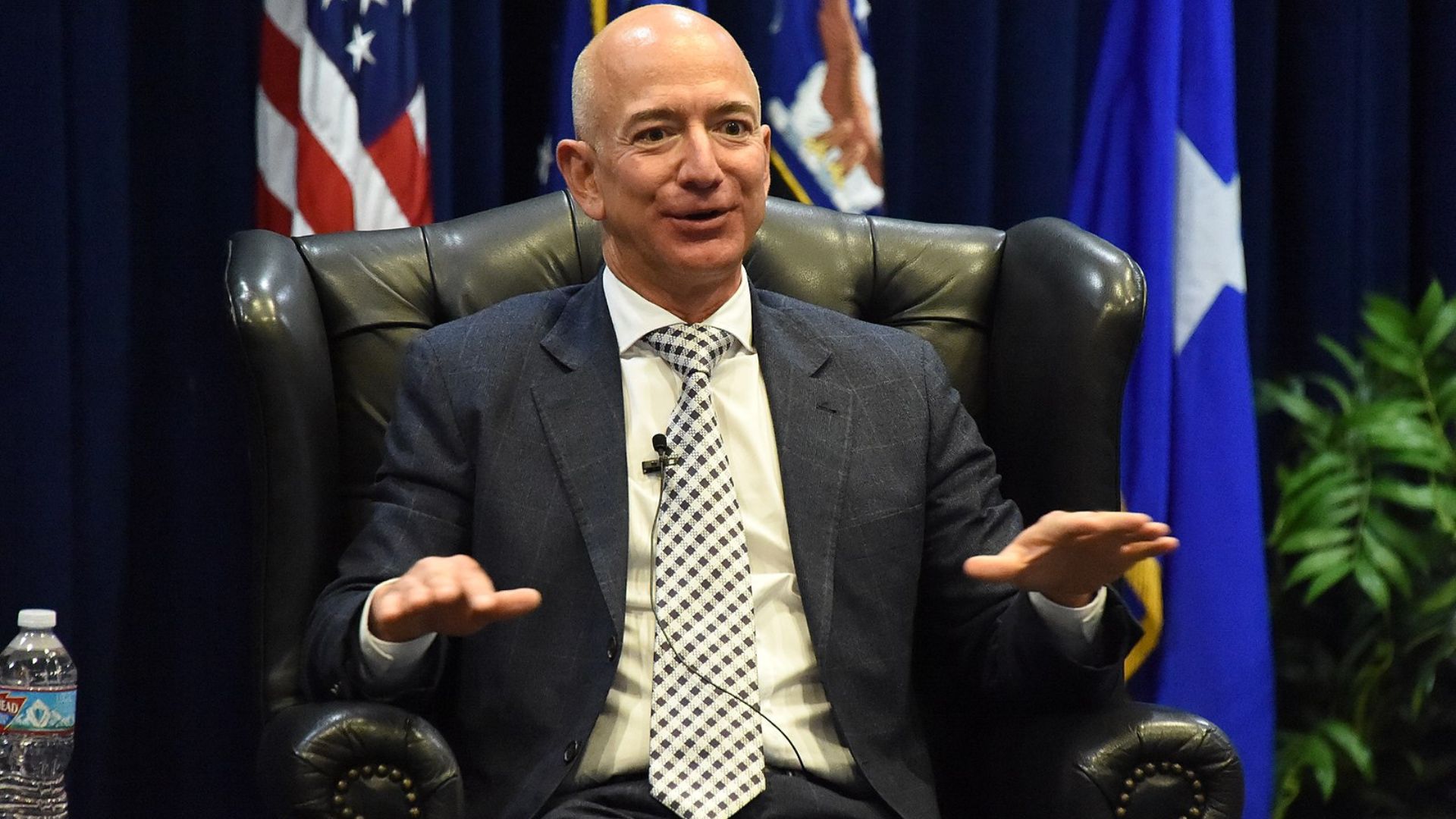

In a notable financial move, Jeff Bezos, the world’s third-richest individual, has sold an impressive $8.5 billion in Amazon stock this month.

This event is part of a larger trend where several American billionaires, including Mark Zuckerberg, Jamie Dimon, Leon Black, and the Walton family, have collectively sold approximately $11 billion in stock. The timing and scale of these sales have sparked widespread discussion and speculation regarding their underlying motivations and potential foreknowledge of economic conditions.

Jeff Bezos’s Major Move

Bezos’s sale of $8.5 billion in Amazon stock is a significant transaction that stands out due to its sheer magnitude.

Observers are keen to understand the context and reasoning behind such a substantial financial decision, especially considering the broader economic indicators and market performance.

Zuckerberg’s Considerable Stock Sale

Similarly, Zuckerberg, recognized as the world’s fourth-richest person, has not stayed on the sidelines. He sold roughly 1.4 million Meta shares worth roughly $638 million, marking a significant divestment in the technology sector.

This move by the Meta CEO adds to the pattern of major stock sales by leading billionaires, raising questions about their collective market outlook and individual financial strategies.

Jamie Dimon’s Financial Strategy

Dimon, the chairman and CEO of JPMorgan Chase, also made headlines with his recent stock sale.

He sold $150 million, marking a notable change in his financial strategy, as this was his first cash-out since assuming leadership at the bank nearly two decades ago.

Leon Black’s First-ever Sale

Leon Black of Apollo Global Management made a significant move by enacting his first-ever sale, selling $172.8 million in his equity firm.

Having held onto his shares for 34 years, this decision marks a notable shift in his investment approach and contributes to the broader pattern of stock sales among prominent billionaires.

The Waltons’ Stock Strategy

The Walton family, known for their association with Walmart, also participated in this trend, selling $1.5 billion of Walmart stock in a week, with their total reaching $2.3 billion since December 2023.

These transactions add another layer to the unfolding narrative of significant stock sales by some of the country’s wealthiest families, prompting observers to consider the potential implications for the retail sector and the broader market.

Collective Timing and Market Speculation

The concurrent nature of these sales, which all occurred within weeks of each other has not gone unnoticed.

Market analysts and the general public alike are keenly observing these billionaires’ actions for clues about their collective market perspective and the possible economic indicators they are responding to. The alignment in the timing of these sales adds an element of intrigue and speculation about the broader economic implications.

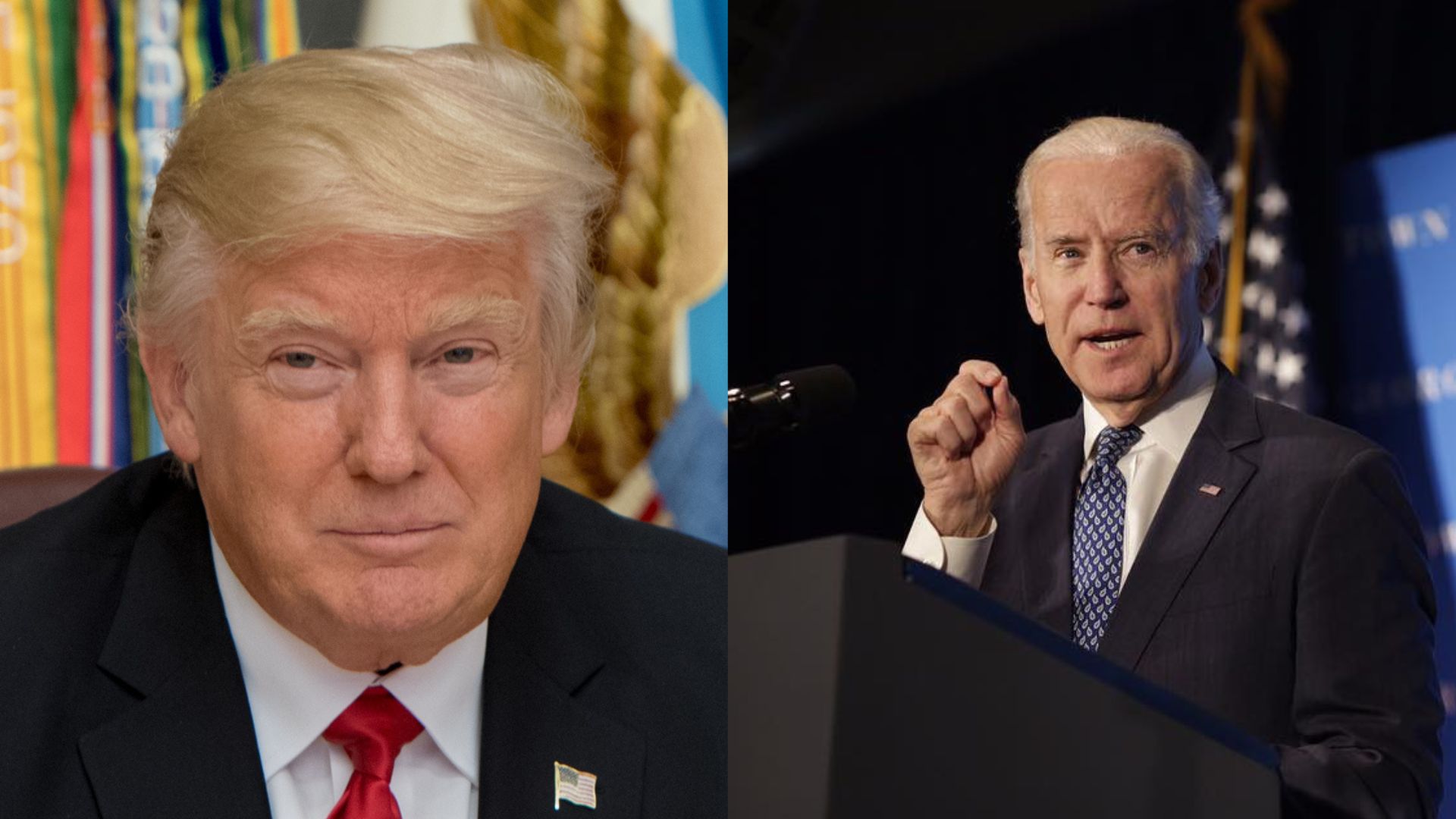

Economic Forecasts and Election Concerns

Some experts believe these stock sales may be influenced by the upcoming election and the current state of the market.

As one finance firm consultant, Alan Johnson, suggested, “If you’re reading the tea leaves and looking at what may happen with our politics in the next year or so, things are pretty good right now – the markets are up.” This perspective indicates a strategic response to potential political and economic shifts on the horizon.

Market Performance and Strategic Decisions

The S&P 500 index’s performance, being “at an all-time high,” coincides with these high-profile stock sales, suggesting a connection between market conditions and the billionaires’ actions.

Observers are considering whether these sales are a response to market highs and what this might indicate about the billionaires’ expectations for future market performance.

Diversification and Financial Planning

Johnson highlighted the rationale for diversifying holdings, especially when market conditions are favorable, as they currently are.

This approach to financial planning might explain some of the billionaires’ motivations, offering a glimpse into their strategies for preserving and growing their wealth amid uncertain economic times.

Anticipating Tax Policy Changes

The sales could also be a preemptive response to potential changes in tax policy. Wealthy individuals might be adjusting their investment strategies to capitalize on current tax advantages that could be altered with a shift in political leadership.

As Johnson noted, taking advantage of current tax breaks is a strategic move given the potential policy changes that a new administration might bring.

Broader Economic Implications and Analyst Insights

The recent actions of these billionaires have broader implications, sparking debates and analyses regarding the economic forecast and the potential warning signs these sales could signify.

Analysts and economic experts are closely monitoring these developments, trying to decipher whether these moves are isolated financial strategies or indicative of a larger trend with significant economic implications for the market and the average American.