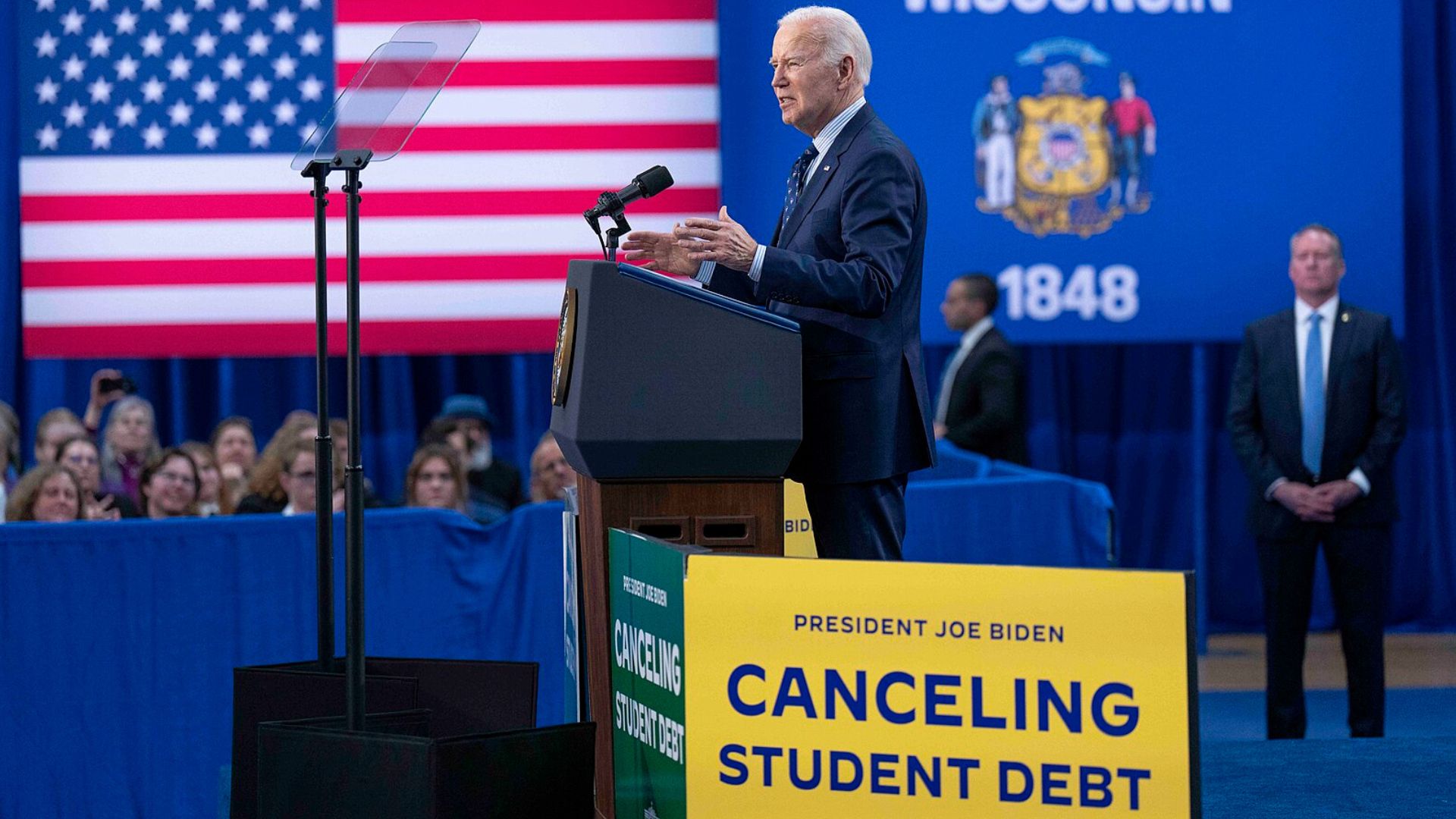

A federal appeals court has issued a ruling that effectively halts the Biden administration’s student loan debt relief plan.

This plan, which was designed to reduce monthly payments for borrowers, has been stopped following an appeal from seven Republican states. This decision impacts several components of the Education Department’s strategy that a lower court had not previously blocked.

Comprehensive Block on Student Debt Relief

The U.S. Eighth Circuit Court of Appeals granted the request by these states to block the Education Department’s efforts under the student loan plan.

This ruling extends the prohibition beyond the initial measures halted by a lower court, essentially freezing the administration’s attempt to implement its proposed financial aids for student borrowers.

Initial and Extended Legal Challenges

Previously, a U.S. District Court in St. Louis had only partially blocked the administration’s plan.

The most recent ruling by the appeals court expands this block, putting a stop to all remaining elements of the Biden administration’s Saving on a Valuable Education (SAVE) plan that were still in motion until the appeal.

Details of the SAVE Plan

The SAVE plan, which has now been halted, aimed to offer more generous repayment conditions for borrowers.

It included provisions for reducing monthly payments based on income levels and proposed forgiving the remaining debt for borrowers whose original principal balances were $12,000 or less after ten years.

Missouri Leads the Opposition

The effort to halt the SAVE plan was led by Missouri’s Attorney General Andrew Bailey.

The challenge escalated to the federal appeals court after initial blocks by a district court. Last week, these states asked the 8th Circuit to extend the block to the entirety of the SAVE plan.

Court’s Swift Response

The federal appeals court responded to this request with a concise one-page ruling that issued an administrative stay on the entire SAVE plan.

This decision effectively puts all of the plan’s provisions on hold pending further court deliberations.

Reaction from Missouri’s Attorney General

“The Court granted our emergency motion to BLOCK Joe Biden’s entire illegal student loan plan, which would have saddled working Americans with half-a-trillion dollars in Ivy League debt,” Andrew Bailey stated on X, formerly known as Twitter.

His statement reflects the substantial financial implications he attributes to the blocked plan.

Education Department’s Assessment

Following the ruling, an Education Department spokesperson stated, “We are assessing the impacts of this ruling and will be in touch directly with borrowers with any impacts that affect them.”

This comment indicates the administration’s ongoing commitment to navigating the court’s decision.

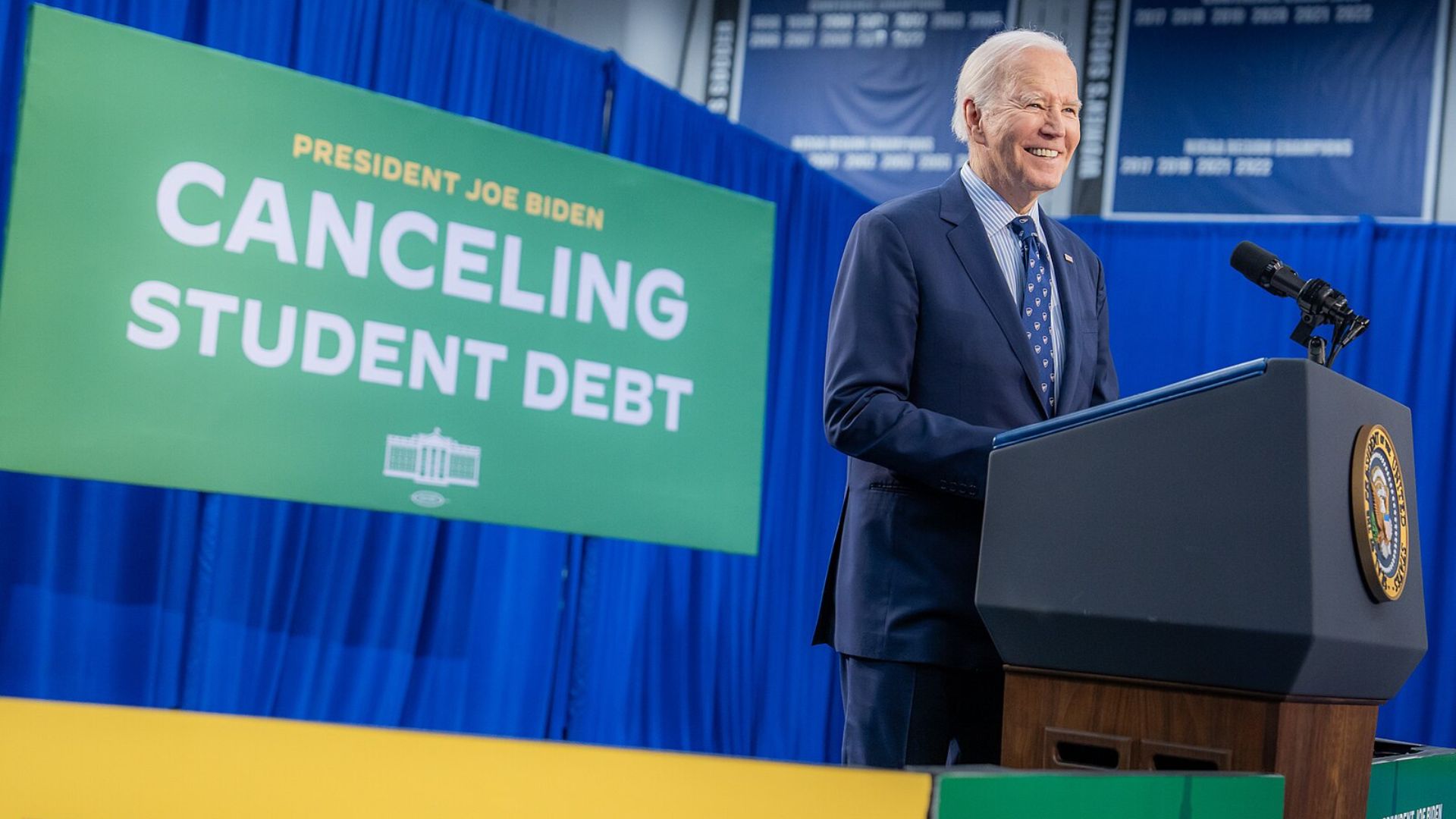

Administration’s Determination to Defend the Plan

Despite the legal setbacks, the administration remains determined to defend the SAVE Plan.

“Our Administration will continue to aggressively defend the SAVE Plan – which has been helping over 8 million borrowers access lower monthly payments, including 4.5 million borrowers who have had a zero dollar payment each month,” the administration said.

Potential Consequences Highlighted by Secretary Cardona

Education Secretary Miguel Cardona commented on the potential fallout from the ruling.

He said it could have “devastating consequences for millions of student loan borrowers crushed by unaffordable payments if it remains in effect.”

Temporary Measures for Affected Borrowers

In light of the court’s decision, Secretary Cardona announced that borrowers currently enrolled in the SAVE plan will be “placed in an interest-free forbearance while our Administration continues to vigorously defend the SAVE Plan in court.”

This measure is intended to provide temporary relief during the ongoing legal proceedings.

The Future of Student Loan Relief Remains Uncertain

With the appeals court’s ruling, the future of the Biden administration’s student loan relief efforts is uncertain.

The administration, along with affected borrowers, awaits further legal processes to determine the ultimate fate of the SAVE plan and the broader implications for student debt relief in the United States.