As your kids start to move out and away from home for the next phase of their lives, you must also prepare for the next phase of yours. While you will likely experience fewer expenses now that your kids are moving out, there will be additional challenges you might not think of.

Keep reading to find out which financial strategies you can take advantage of now that you are an empty nester.

Who Are Empty Nesters?

The term “empty nester” describes a parent or grandparent whose children have become adults and no longer live with them. Being an empty nester means you have successfully raised your children well enough for them to be self-sufficient and contribute to society.

Despite this success, many empty nesters feel a loss of purpose and find themselves with much more space and free time than they had before.

Empty Nest Syndrome

A common term used to describe the melancholy that parents feel when their children move out of the house is called “empty nest syndrome.” Upset parents who once had regular interactions with their children find those interactions increasingly infrequent.

This can lead to a form of depression that, if you aren’t careful, could contribute to financial expenses and other consequences you might not have considered.

Don’t Let Old Toys Pile Up

One of the consequences of empty nest syndrome is a tendency for empty nesters to horde or stockpile childhood toys that remind them of days gone by.

To combat this, when your kids move out, make it a point to get rid of or sell old toys that they played with. Try to only keep a few items for nostalgic reasons, and don’t let an accumulation of things take the place of the relationship of your children.

Remodel Your Home

When children move out, you will suddenly find yourself with plenty of extra space to use, like their former rooms. Some empty nesters turn these rooms into places where old stuff gets piled up. Remove the temptation to pile things in these rooms by investing in your house through a remodel.

A remodel can make it so the space can be more effectively used, and money invested in your house will improve its value, setting you up for success financially in the future.

Sell Old Books

Another common item that builds up over the time of raising a child is books. You will have likely bought books for your child over the years, from picture books to young adult novels to supplemental materials for school. Did you know that Amazon has a buying program for books?

Take advantage of modern convenience to turn these old books into cash to help better secure your financial future.

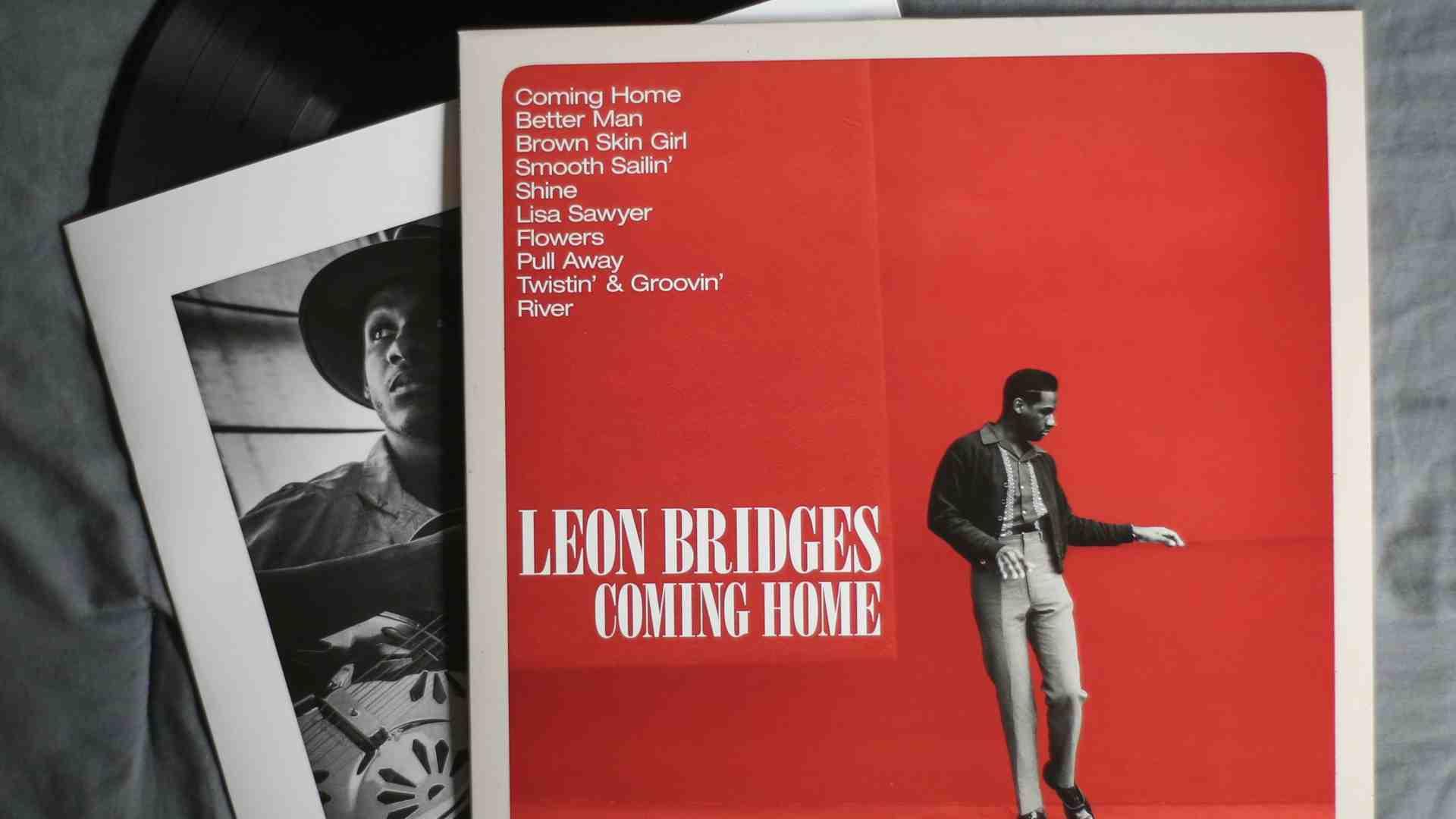

Look Through Your Albums

As the world becomes more digital with each passing decade, it is worth looking at your collection of old albums, cassettes, and CDs. With the advent of music streaming, you can easily get access to play any song you can imagine.

Getting rid of your analog music will free up clutter from your home and could make money at the same time. Do some research online to see what kind of items you have that a collector might pay for.

Make Money, Not Clutter, from Clothes

You are probably sitting on a collection of old clothes from when your child was younger that they can no longer use. When your children move out, you will want to quickly sort through this clothing, deciding which pieces are worth donating or selling.

By donating them to a charity, you could qualify for a tax write-off for that year, which will help you save money on your taxes. Once clothes start to pile up, the sorting process becomes more difficult, so don’t wait to take action.

Old Furniture

Try to get your child to take as much of their old furniture with them as possible when they move out. As you get older, moving things around the house is bound to become more difficult and time-consuming. Clear out any remaining furniture items like couches, mattresses, and dressers from your child’s room when you find the time.

If you live in a suburban neighborhood, you could sell items in a garage sale or advertise them online. That way, someone else will do the work of moving them for you.

Look Into Downsizing

The home you bought to raise a family might now be too big for your needs and the needs of your significant other. As you walk by empty rooms that once had smiling kids you used to play with, you might start to feel the pains of empty nest syndrome. One way to combat this is to look into moving into a smaller home.

Your goal should be a home that is more affordable and will set you up for a comfortable life in your later years.

Cut Out Unnecessary Expenses

Now that your kids aren’t living with you, there are probably many expenses you can cut out of your budget. Some expenses you might consider come from subscription services, like Netflix or Hulu, that you might not have actually been using much yourself.

Take a detailed look into your finances and figure out which expenses you can eliminate now that your kids have moved out.

Turn a Hobby Into a Business

Keeping busy is an essential part of holding back empty nesting syndrome. Now that you likely have more time than before, you should look into turning one of your former hobbies into a business to earn money.

Not only will this help you financially, but you will have something to keep you busy in the future. This is also an opportunity to meet new people and find a replacement for the daily interactions you used to have with your children.