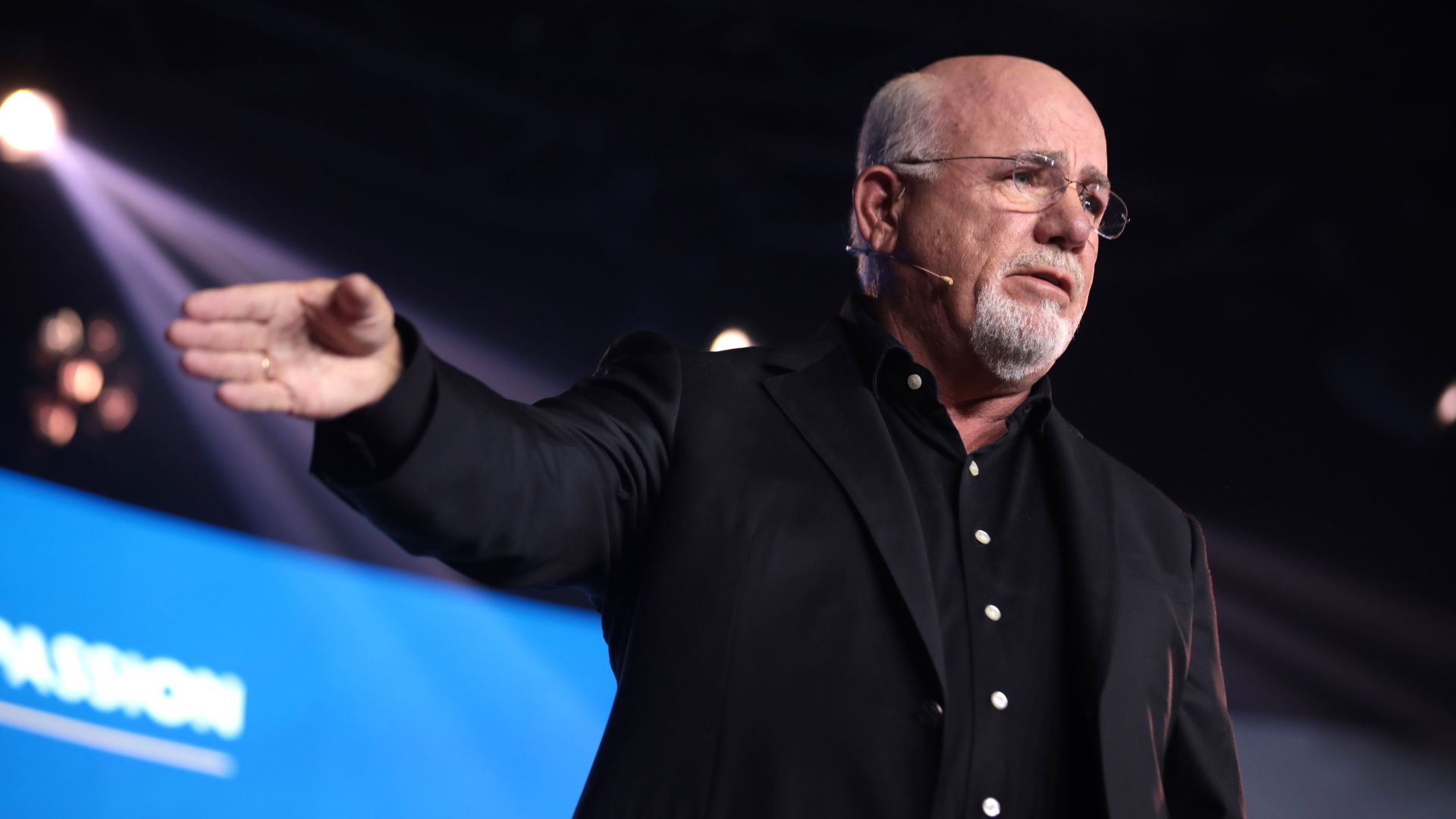

Financial author and advisor Dave Ramsey has opened up about Social Security and when, exactly, people should begin to take out their money.

According to Ramsey, people should begin to take Social Security when they are 62 years old — even though it is a “mathematical disaster.”

Dave Ramsey vs Social Security

Ramsey has never been one to keep his opinion to himself — especially when it comes to Social Security.

In the past, Ramsey has even said that Social Security is a “stupid thing”, as well as a “mathematical disaster.”

Collecting Social Security Benefits

However, Ramsey has also opened up about when he thinks Americans should collect their Social Security benefits.

This topic has long been controversial, as every financial advisor has a different opinion. Ramsey believes that people should begin to collect Social Security when they turn 62 years old.

What Other Financial Advisors Say

Often, financial experts recommend people don’t do what Ramsey says. Instead, these analysts state that Americans should wait until they are about 66 or 67 to collect Social Security.

Americans can receive full retirement benefits when they hit this age range. Often, if they wait until this time — or until they are older, such as 70 — seniors can receive more in monthly benefits.

Why Wait Until You’re 70?

Many people have questioned why they should wait until they are 70 to collect Social Security when they could follow Ramsey’s advice and collect it when they are 62.

Waiting until you’re 70 means that you are more likely to receive the highest payment as there aren’t any more financial advantages to waiting. You could even boost your finances by $182,000 just by waiting a few extra years.

Why People Shouldn’t Receive Social Security at 62

According to these other financial experts, seniors shouldn’t begin to collect Social Security at age 62, even if they can choose to do so.

This is because their benefits and monthly payments will be much less than if they just wait a few more years.

Reduced Benefits

Collecting social security as soon as you turn 62 could mean that your benefit is reduced by up to 30% for the rest of your life.

Given how much everything costs, it is better to wait this long so you can collect everything you are entitled to. Even though it’s completely your choice, waiting just a little longer will serve you better in the long run.

You Might Be Entitled To Higher Benefits

Aside from knowing you will definitely be entitled to more money if you leave it until you’re 70, you will also get more money if any social security raises happen once you have claimed it.

These benefits are based on the higher benefit you earned due to delaying the collection of Social Security. In the long run, this will continue to pay off year after year.

Social Security’s Predicted Increase

The good news is that experts have predicted social security will increase over the next few months; however, nothing is certain.

Experts have predicted that social security will increase by 2.6%, although the exact amount will not be known until October, as this increase will rely on data from the third quarter. This means those who waited until they were 70 to collect it will be better off than those who collected it at 62.

A Breakdown of Social Security

There is a big difference between the payments of those who collected social security at 62 over any other age. A 30% reduction means those at 62 will only receive $700.

As each year goes by, the reduction decreases. For example, claiming at 66 means you will only receive a 6.7% reduction at $933. In comparison, those who claim at 70 will receive $1,240 and will get an increase of 8% each year after full retirement age.

Ramsey’s Advice

However, Ramsey doesn’t follow this normal advice and instead has told people to begin to collect Social Security when they are 62.

Ramsey has stated that this is an okay method to take — as long as you make another move alongside the collection. He said, “It almost always makes sense to take it early if you’re gonna invest every bit of it.”

Receiving More Money

Ramsey has further added that if you begin to invest this money early, you’ll receive more money than if you wait until you’re 66 or 67.

“That one account will make you more than enough to cover up the difference between your [age] 66 account and your [age] 62 account,” he explained.

Finding Good Mutual Funds

To truly ensure you’re investing accurately, you must find good mutual funds. These funds can then allow you to bring in more money by collecting Social Security when you’re 62.

However, finding these good mutual funds can be an incredibly difficult task — especially if you’re not comfortable with investing or do not have a professional doing it for you.

Over $300,000 in Investments

In some circumstances, if you invest the $700 you receive every month from the age of 62 to 77, you could potentially end up with around $318,000, which is much more than you would have received at 70.

However, the average life expectancy for Americans is 77, which means that by the time you receive that money, you could have passed away. This is why most other financial advisors suggest waiting longer to collect social security.

Ramsey’s Advice May Be Risky

Some critics have pointed out that Ramsey’s advice may be risky to many people.

After all, if you don’t know how to accurately invest in good mutual funds, then you could end up putting yourself in a worse financial situation than if you had just waited to collect Social Security when you were older.

Seniors May Need Money Now

Furthermore, other critics have explained that seniors looking to retire and collect Social Security may not have the chance or opportunity to invest their money.

Instead, they may need that money to pay their bills or to use it in their daily lives. Therefore, this advice wouldn’t work for them.

Waiting Around for Investments

Meanwhile, other older Americans may not be in a financial situation where they can wait around for these investments to pay out well in the near future.

As everybody is in a different situation, this advice may only benefit the select few who have the opportunity to invest their Social Security.

Investing Can Be a Good Thing

Even though investing can be beneficial, it comes with plenty of risks. Not everyone following Ramsey’s advice will earn more money from these investments than what they put in.

Especially if you know you will be in a position where you solely rely on this money to live out the rest of your years, it is better to not take the risk and know you’ll be guaranteed more money.

Looking at Individual Circumstances

The most important thing you can do is look at your own circumstances. These will likely vary from that of a friend, neighbor, or anyone else you know, so you should do what is right for you.

Following what one of your friends does is risky. Taking the money out at 62 and investing it may work really well for them, but you could do that and end up losing money.

Do You Need Social Security for Living Expenses?

If you’re unsure whether you should take Social Security out at 62, consider whether you will need it to cover your living expenses or whether you have other money that can cover it.

If you need social security to cover your living expenses, you should stay at work for a few more years and only collect the money as late as possible. However, if you do not need the money for living expenses, then you have a bit more room to invest it and not worry about how you will afford to live day-to-day.

Working and Collecting Social Security

You can work while collecting social security; however, this has some downsides. In 2024, you have an annual earning limit of $22,320, and social security money is deducted if you go over that amount.

This amount is if you are under retirement age, and $1 will be taken off benefit payments for every $2 that you earn over the threshold. However, if you are of retirement age, the limit on earnings is $59,520. In this case, $1 will be deducted from your benefits for every $3 you earn over this amount.

Some People Can’t Work Until They’re 70

Some people cannot work until they’re 70, no matter how much they want to. This can be because of illness, or they might work in a heavy-lifting job, such as construction, that becomes difficult for them to do the older they become.

This means that these people may have no other option than to retire before they turn 70 and collect their social security money early.

Taking Financial Advice

If you are unsure of whether you should collect social security before retirement age or wait a few years, the best thing you can do is talk to a financial advisor about what the best thing is for you to do.

They will be able to take a look at your personal financial situation, as well as the benefits you will be entitled to. This should help you make the best decision on how to move forward.

Social Security Practices Vary

Clearly, Ramsey’s advice could be incredibly helpful to some — and not helpful at all to others.

Advice on how and when to collect Social Security — and then how to use these benefits — varies from advisor to advisor. Expert advice will likely only continue to differ in the years to come.