The U.S. government’s deficit isn’t just a number—it’s becoming a serious income issue for Americans.

Last week, the Congressional Budget Office (CBO) adjusted its deficit projection up by 27%, which translates to an additional $408 billion for a staggering total of $1.9 trillion this year.

Debt and Your Wallet: A Direct Connection

It turns out, servicing this massive debt means less cash for other critical economic activities.

When the government borrows more, it pulls funds away from private investment, potentially stifling wage increases across the board, according to economists.

Predicting Pay Cuts: The 10% Warning

Kent Smetters, a Wharton School professor, said: “The exploding debt could cause as much as a 10% reduction in wage income within 30 years.”

For the average household earning $75,000, that’s a potential $7,500 gone from your annual income.

What’s Fueling the Debt Surge?

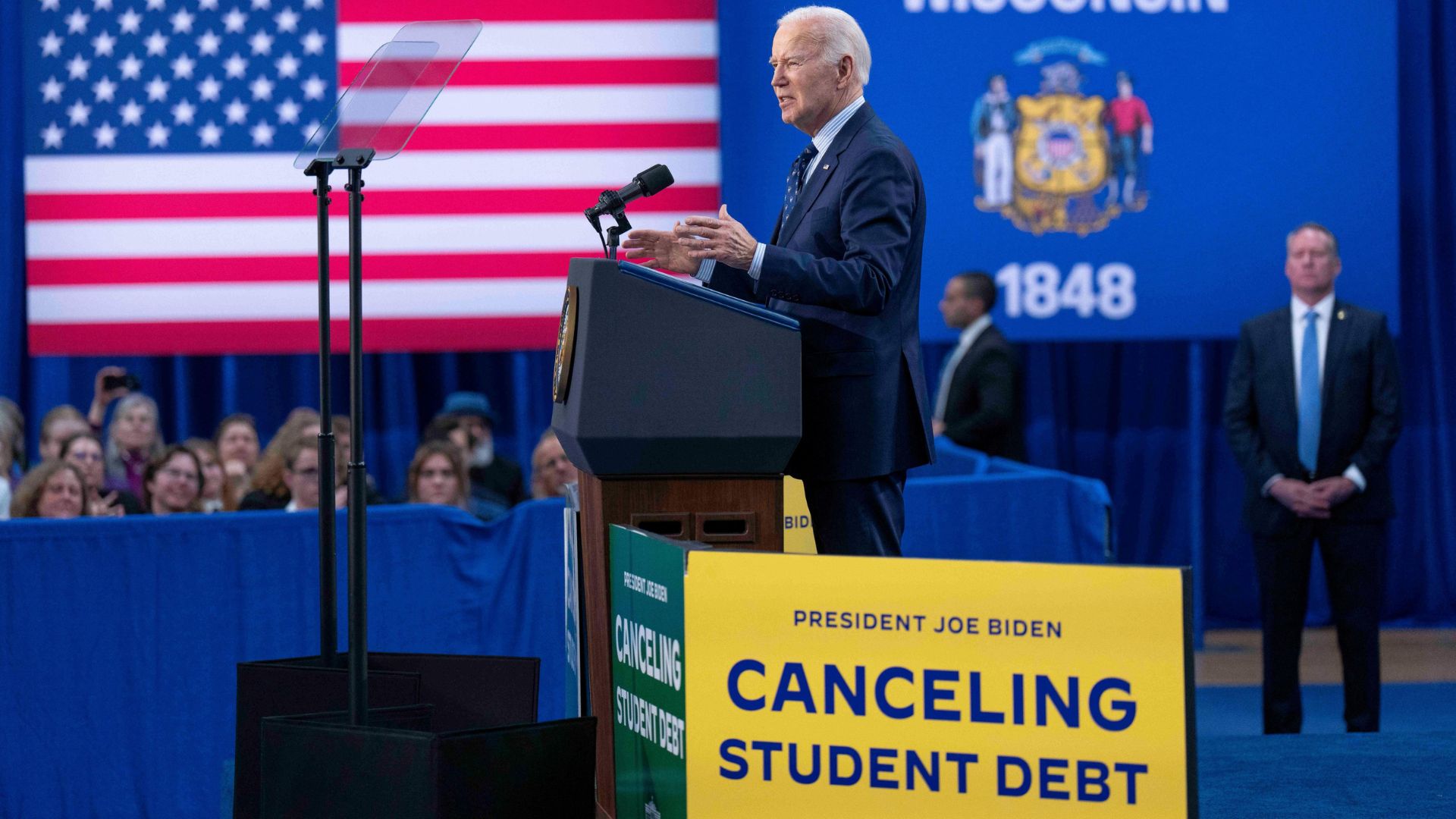

A closer look reveals the culprits behind the soaring national debt: student-loan relief, higher Medicare costs, and aid to Ukraine are major factors.

The CBO also foresees the decade’s deficit hitting a frightening $22.1 trillion.

The Crowding Out Effect Explained

The government’s issuance of debt draws investment away from the private sector, known as the “crowding out effect.”

This shift reduces funding available for private enterprises, potentially stifling economic growth and job creation by diverting resources to less productive government bonds.

Every Dollar’s Heavy Cost

According to CBO estimates, every dollar added to the deficit siphons off 33 cents from private investment.

This loss is more than just money; it’s a reduction in economic vitality and future wage growth.

Historic Debt Levels on the Horizon

Fast forward to 2034, and federal debt could reach 122% of GDP, smashing past post-WWII records.

These aren’t just numbers; they’re predictors of potential economic strain and diminished living standards.

The Misconception About Falling Paychecks

Will you see less money in your paycheck directly?

Not necessarily. It’s more about what you won’t see: the earnings that could have been, which means a gradual, not immediate, impact on your financial well-being.

The Intergenerational Impact

Future generations could face a lower standard of living, compounded by potential hikes in taxes and interest rates.

It’s a quieter form of economic hardship that slowly shifts the landscape.

Rising Interest Rates: A Hidden Consequence

To attract bond buyers, the federal government might raise interest rates.

A CBO study highlights a stark reality: a 10% rise in the debt-to-GDP ratio could mean a 0.2 to 0.3% increase in interest rates. This affects everything from mortgages to loans.

Searching for Solutions Amidst Division

The solution seems straightforward—reduce spending, increase tax revenue. However, achieving this in a polarized Congress is another story.

The political challenges are significant, with blame shared across both sides of the aisle.

A Bipartisan Call to Action

In a rare moment of unity, lawmakers from both parties acknowledge the gravity of the situation.

“The national debt has now exceeded $100,000 for every person in the United States… continuing to turn a blind eye will only put the American Dream further out of reach for our children and grandchildren,” they warn in a joint statement.