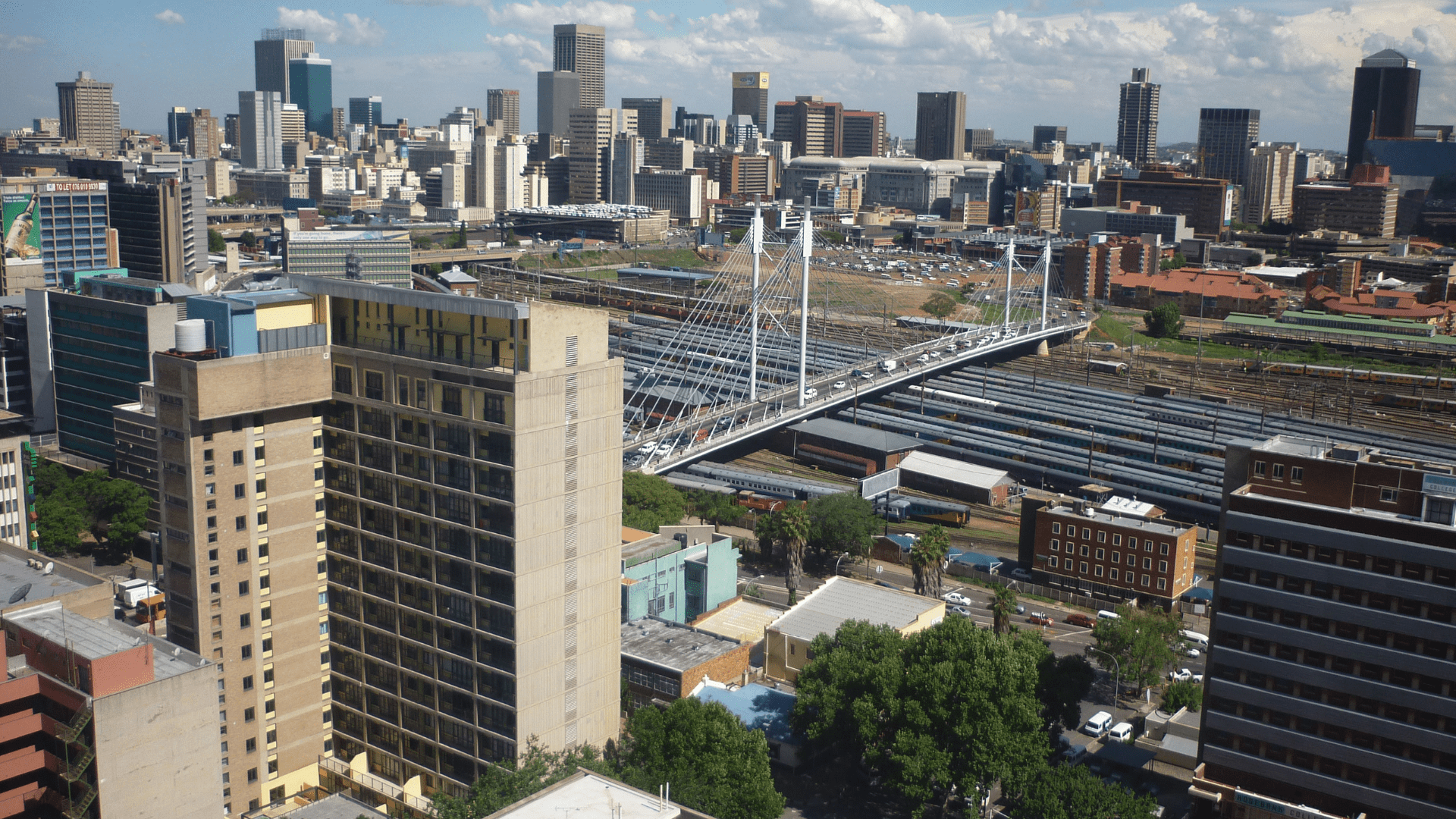

Small, South-African-based startup Renergen was going about business as usual in 2013. They executed a purchase on the rights to explore and produce on a plot of land near Virginia in South Africa’s Free State province.

The company, who produces and sells compressed natural gas and produces helium and liquified natural gas, expected to find small reserves of natural gas on the land. The goal was to extract, refine, and sell it to nearby mining operations. Little did they know what they’d discover beneath the soil.

Renergen Begins Testing the Gas

The company began a sustained process of testing the composition of gasses on the land, which they purchased at the ridiculous sum of $1.

The testing was done using some existing old drill pipes that had been left behind by a previous company’s mineral exploration efforts years before.

Renergen Discovers Helium

As they began testing the gas flowing from these pipes, they discovered unexpectedly high levels of helium in it.

Of course, more sustained testing was necessary to see if the readings were accurate and to uncover just how much helium was available.

The Value of Helium

Everyone is familiar with helium from birthday parties. They make balloons float, and kids have fun inhaling them to speak in high-pitched voices.

However, helium has incredibly valuable commercial applications. When condensed into liquid, helium is vital to the manufacture of microchips and is also used to operate MRI scan devices.

What Renergen Discovered After Thorough Testing

Helium’s global prices are volatile and ever-shifting, being produced in less than 10 countries worldwide. Still, the prospect of massive helium reserves in this South African plot promised incredible revenue for Renergen.

What they discovered and proved over time was a helium reserve of approximately 7 billion cubic feet. This massive deposit has an estimated worth of at least $4 billion, and could potentially draw upward of $12 billion when other possible nearby reserves are factored in.

From Humble Beginnings to Global Opportunity

What began as a humble project to uncover enough gas to power local mining operations has quickly escalated into a global opportunity far beyond the company’s original aspirations.

Nick Mitchell, Renergen’s COO, has relayed that the company “had no idea of the extent and scale and the sheer world-class nature of this helium deposit.”

Delays and Beginning Production

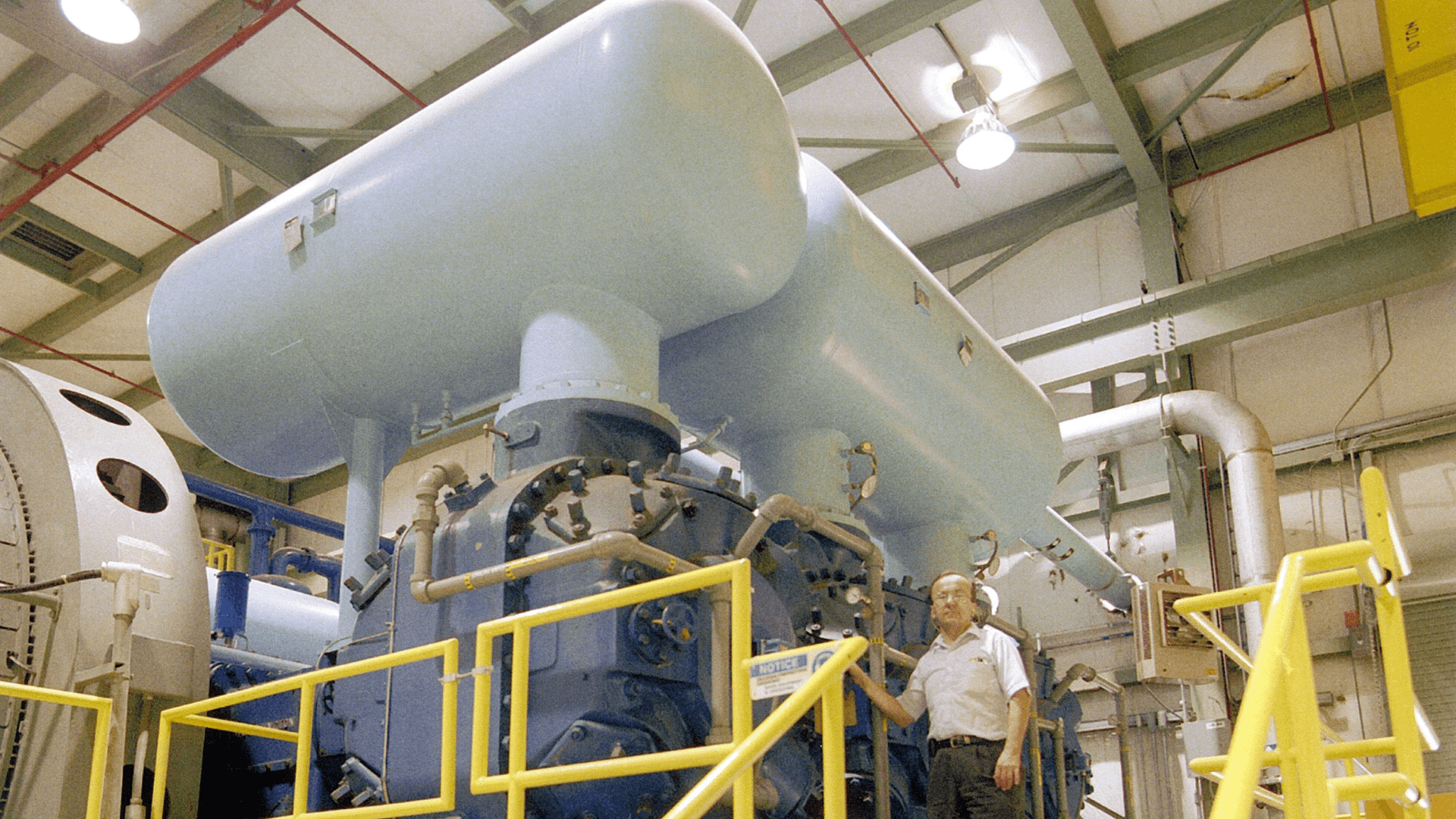

Renergen was able to successfully produce liquid helium from the plant they built on the land in the very beginning of 2023. However, there have been some delays that halted production throughout the year.

The helium cold box, a piece of equipment used to condense gaseous helium into liquid form, was faltering throughout 2023 due to a vacuum seal leak. They’ve been able to solve the issue and now hope to begin full-scale production in February 2024.

Renergen’s Unique Positioning in Africa

Renergen’s strike of helium in South Africa is uniquely positioned. Since helium supply is erratic worldwide, their operation is welcomed as a much-needed additional global player.

There is, in fact, no other commercial producer of helium on the continent, setting their plant up for enormous success.

Phase One and Phase Two Projects

The company plans to roll out and increase their production efforts across a multi-year period using two projects.

The first project aims to extract and produce enough helium to satisfy all of South Africa’s needs. The second project will significantly increase production to the point that Renergen will supply 6-8% of the world’s helium.

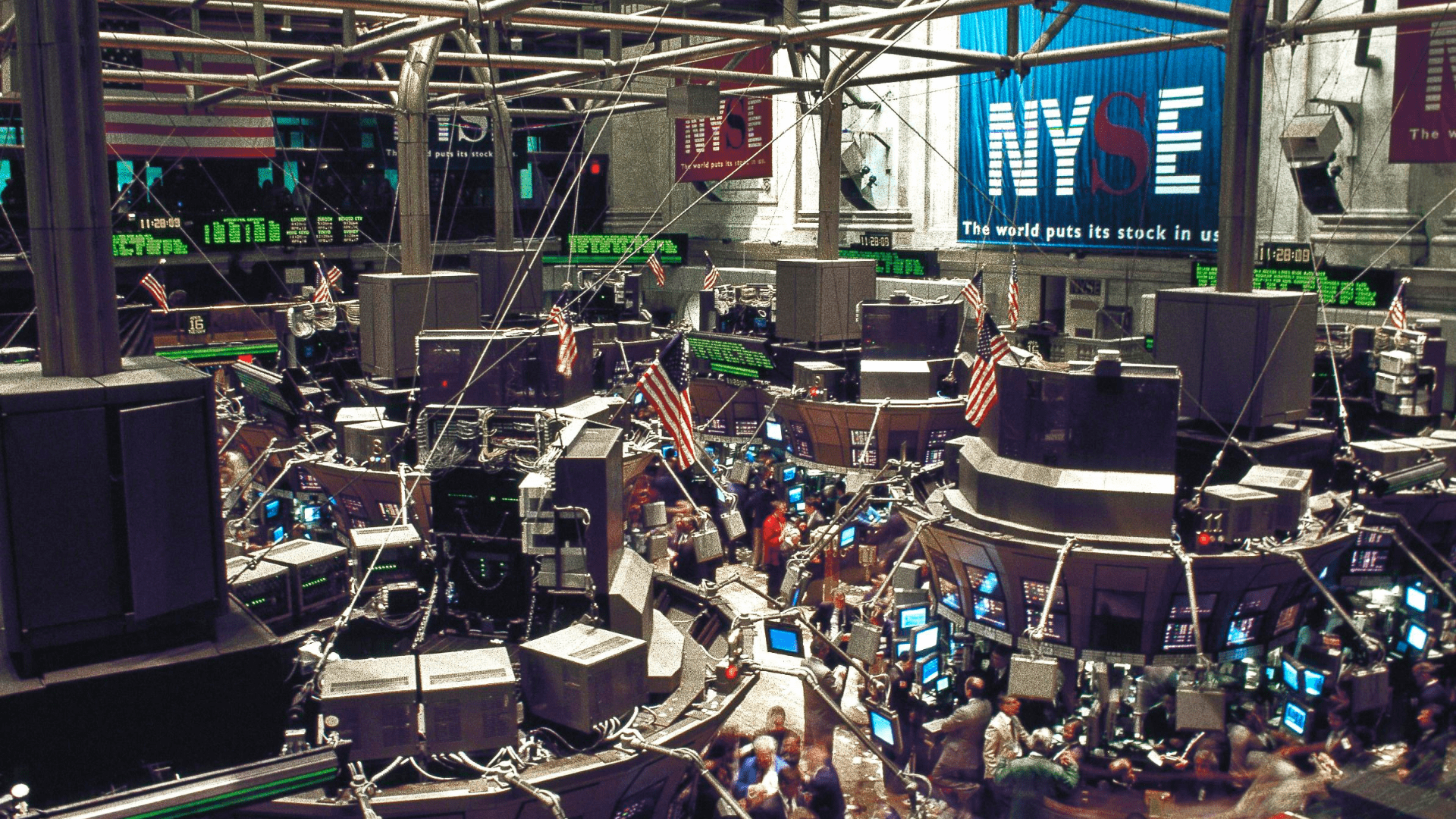

Share Price Fall in Q4 of 2023

Renergen has set its sights on a huge picture. They’re aspirations are global, and they’re carefully working their way toward realizing their goals.

Unfortunately, even though they’ve received funding pledges for their projects from the U.S. government and South Africa’s Standard Bank, the company faced financial blows in the final quarter of 2023. Their share price significantly fell across Q4.

Transparency Criticisms

With so much going for the company, why would share prices be falling just as they begin to ramp up their production efforts and secure funding?

Experts at CNN have claimed that the share price fall is likely linked to criticisms over transparency that Renergen has faced. Stefan Marani, the company’s CEO has faith that they can overcome investor doubt and move forward with their phased projects.

The Future of Renergen

In December 2023, raised additional equity for its projects by selling 5.5% of its equity to two Johannesburg-based investment management groups. A new plan to raise more involves obtaining listing on the US Nasdaq stock market via an initial public offering.

Further, the company plans to consistently battle doubts that investors may have about their operation. Marani has no illusions about the uphill fight before them: “Building up confidence is going to take a very long time.” The fixed vacuum leak and the beginning of successful production in February are the first step in overcoming investor hesitation.