With increasing house prices, it’s becoming more and more difficult for people to get their first step onto the property ladder.

California has a solution to this with its Dream for All program, which helps homebuyers buy their homes. However, there is a catch: Once their home is sold, they will have to give back a share of the profits.

Houses in California Are Unaffordable

One issue many have is that California housing prices are unaffordable to many despite the housing market plunging to an all-time low.

This is due to many factors, such as not having enough affordable housing, higher interest rates and property tax rates, and California being one of the most expensive places to live in the U.S.

The California Dream for All Program

The California Dream for All program has been developed to help Californians hoping to get on the property ladder. It acts as a second loan when buying a house.

Those buying the home will be offered 20% of the price, up to $150,000, and are expected to pay this and a percentage of the home’s appreciation value back.

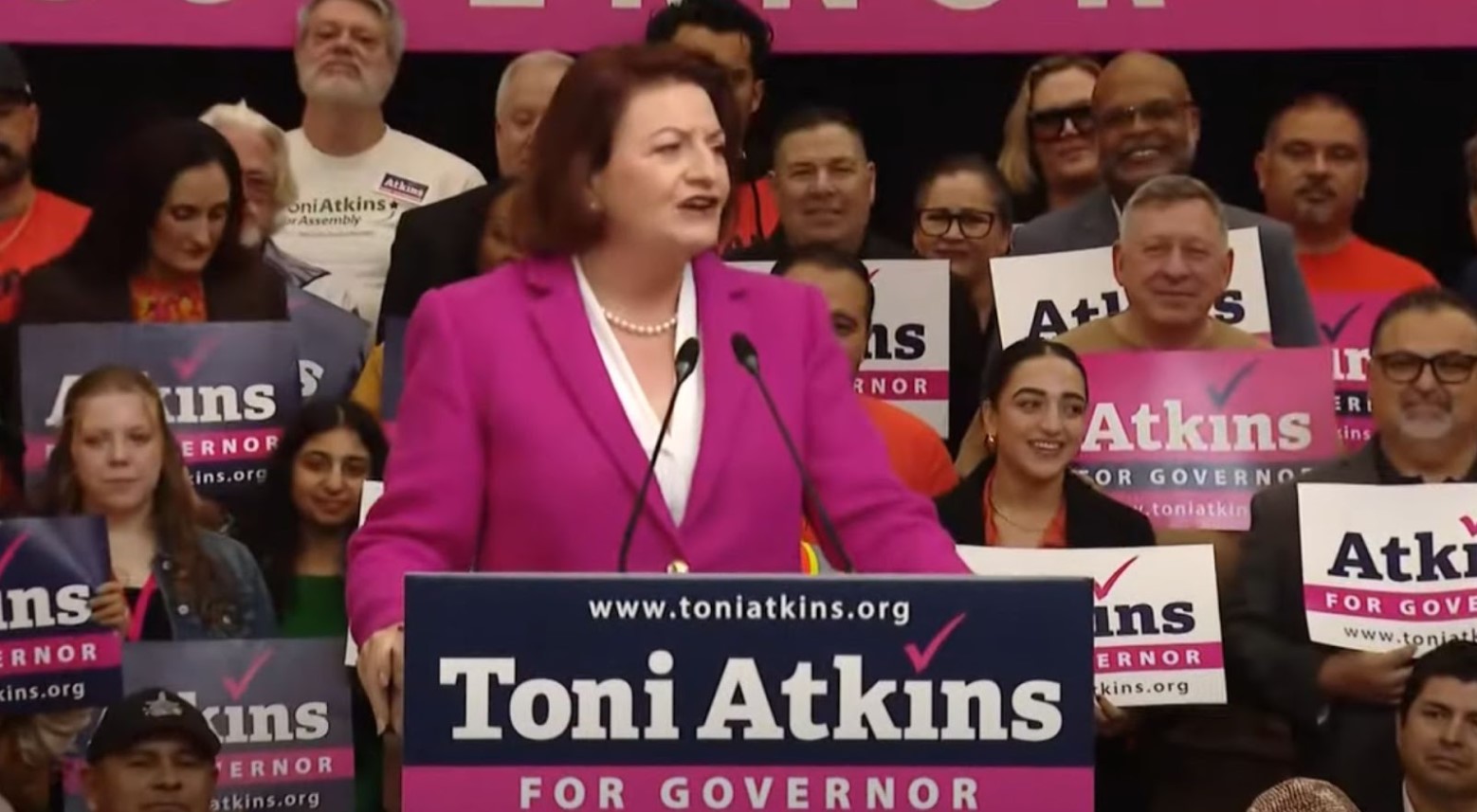

Dream for All Was Introduced in 2022

California’s Dream for All initiative isn’t entirely new, as it was first introduced to Californians in 2022.

It is a homebuyer assistance program first introduced to Californians by Senator Toni G. Atkins. The money will be paid to those who qualify for the program.

Buyers Must Be Able to Afford the Mortgage

One of the conditions for people wanting to receive assistance with the initiative is that they must be able to afford the mortgage payments.

The initiative is simply to help buyers with the capital for a down payment and the closing costs.

Repayments Are Based on Income

One of the catches with the Dream for All initiative is that when homeowners decide to sell their homes, they will have to pay back the 20% loan they initially received.

They will then have to pay back some of the appreciation value. Low-income earners will have to pay back 15%, and moderate-income earners will have to pay back 20%.

Homebuyers’ Credit Ratings Are Considered

Alongside their income, the Dream for All initiative plans to take the credit ratings of those wanting to use the program.

The credit rating needs to be over 660, and income cannot be any more than 120% of the average earnings of those living in the same areas, which excludes many.

$300 Million Was Available to Homebuyers

When this initiative began, $300 million was set aside to help those wanting to climb the property ladder.

The initiative proved very popular as Californians had used up the total amount in under two weeks.

Homeowners Could Suffer Under Dream for All

While Dream for All helps Californians get on the property ladder, they are expected to suffer when selling their home.

As they will have to pay back more than they were given, and many rely on the profits from the sale of their home to buy their next one, the program is expected to leave many struggling and with very little money left.

Funding Will Target Low-Income Earners

The next round of the program is expected to target those at the lower end of the earning scale.

It is also expected to target first-time buyers who have yet to buy a home, especially those who are the first in their immediate family to buy a house.

People Are Unlikely to Sell Their Homes

Due to the strict conditions of the initiative, many people will likely put off selling their homes for far longer than necessary to avoid paying the loan back.

There are not enough houses in California currently, which means that while the initiative will help some people buy their first home, it will leave others without a home and potentially homeless.

Dream for All … A Blessing or a Curse?

The main benefit of Dream for All is that it enables those who previously never thought they would own their own home to buy a house.

However, a caveat is that people using this initiative expect to pay back much more than they initially borrowed, which will put people off selling their homes. So, while it gets some people into a house, it keeps many others out.

Community Economic Growth

Increased homeownership through the Dream for All program can significantly boost local economies. New homeowners often invest in their properties, purchasing goods and services from local businesses, which stimulates economic growth. This can lead to the revitalization of neighborhoods and an increase in property values.

Over time, these changes can contribute to more stable and prosperous communities, fostering a sense of pride and ownership among residents. The economic ripple effects can enhance overall community well-being and development.

Changes in Demographics

As more diverse groups gain access to homeownership, neighborhoods may become more culturally rich and varied. This diversity can foster greater social cohesion and cultural exchange, enriching the community fabric.

Of course, with any demographic shift, there may also be challenges such as potential gentrification and displacement.

Comparative Analysis

California’s Dream for All program shares similarities with New York’s HomeFirst Down Payment Assistance Program, yet there are distinct differences. Both programs aim to assist first-time homebuyers, but they vary in funding limits and repayment terms.

New York’s program offers up to $100,000 with no appreciation value repayment, unlike California’s 20% repayment of home appreciation.

Lessons from Other States

Successful elements from other states’ housing programs can enhance California’s Dream for All initiative. For instance, Massachusetts’ ONE Mortgage Program offers low-interest loans and has a proven track record of sustainable homeownership. Incorporating features like financial education and long-term support could improve California’s program.

By learning from other states, California can refine its strategies to better address affordability and ensure long-term success for its residents.

Sustainable Building Practices

The Dream for All program has the potential to promote sustainable building practices. Encouraging energy-efficient homes and environmentally friendly materials can reduce long-term costs for homeowners. Sustainable housing not only benefits the environment but also lowers utility bills, making homeownership more affordable.

By integrating green building standards, California can lead in creating a housing market that prioritizes sustainability and resilience, contributing to its broader environmental goals.

Impact on Urban Sprawl

As more people move to suburban areas to take advantage of affordable housing, cities might experience shifts in population density. This could lead to greater demand for public transportation and infrastructure improvements.

Balancing development with sustainable practices will be crucial to managing urban sprawl and ensuring that growth is both equitable and environmentally sound.

Importance of Financial Education

Financial literacy is crucial for beneficiaries of the Dream for All program. Understanding mortgage terms, repayment conditions, and budgeting can help new homeowners manage their finances effectively. Programs offering workshops, counseling, and online resources can provide essential support.

Enhancing financial education ensures that participants are well-prepared for homeownership, reducing the risk of default and promoting long-term financial stability and success.

Support Networks and Resources

In the same vein as financial literacy, support networks play a vital role in the success of the Dream for All program.

Counseling services, financial planning workshops, and online resources can help new homeowners navigate the complexities of buying and maintaining a home.

Current Housing Market Trends

Trends in the housing market can also influence the success of sustainability initiatives. For example, low-interest rates and high demand for single-family homes have contributed to a surge in new construction, increasing urban sprawl and potentially impacting environmental goals.

It will be important for policymakers and developers to consider these trends when implementing sustainable housing initiatives, ensuring that they align with broader environmental objectives.

Future Market Predictions

The long-term effects of the Dream for All program on the housing market could be substantial. By increasing homeownership rates, the program might help stabilize housing prices and increase inventory.

However, external factors such as economic conditions and policy changes will also play a significant role. Predicting these outcomes involves considering potential shifts in buyer behavior and market responses, which could lead to more balanced and accessible housing markets.

Advancements in Construction Technology

Recent advancements in construction technology can complement the Dream for All program by making affordable housing more accessible. Innovations such as modular homes, 3D printing, and sustainable materials reduce construction costs and time.

Integrating these technologies into the program can provide cost-effective and efficient solutions, helping to meet the high demand for affordable housing while also promoting sustainability.

Smart Home Technology

Smart home technology offers numerous benefits for low-income families participating in the Dream for All program. Energy-efficient devices can significantly reduce utility bills, enhancing affordability.

Security systems and smart appliances also improve convenience and safety. Partnering with tech companies to provide affordable smart home solutions can enhance the program’s value, making homeownership more attractive and sustainable for participants.