More California drivers are opting for electric vehicles (EVs) over traditional gas-powered cars. While good for the environment, it’s bad for the state’s budget. More EVs mean less revenue from the state’s gas tax.

To offset this, California is testing a new initiative that would completely change the way drivers contribute to road maintenance in the state.

The Financial Impact of More EVs

Traditionally, maintenance of California’s highways and road infrastructure has been funded by its gas tax. Drivers would pay a tax based on fuel consumed. As EVs consume less fuel, the state is getting less revenue.

According to the California Department of Transportation (Caltrans), this reduced gas tax income will result in a $4.4 billion shortfall in the state’s budget over the next decade.

Funding Road Infrastructure

The average state gas tax paid by California drivers is $300 per year, according to a spokesperson for Caltrans. EVs have only a $100 annual registration cost, meaning the shift from gas-powered cars to EVs results in a $200 million per year loss.

There simply isn’t going to be enough income from the gas tax to fund infrastructure as EV adoption grows. Moreover, one group of road users is paying disproportionately more than another group — a growing group. California is looking to find a more equitable system for funding road repair and maintenance.

The New Tax Proposal

To address these financial discrepancies and mitigate the lost revenue from the gas tax, California is launching a pilot program to instead tax drivers based on the distance they travel.

This per-mile tax is set at approximately 3 cents per mile. Proponents of the new tax program see it as a fairer and more sustainable way to fund road infrastructure than the old approach of state gas taxes.

The Program Is Incentivized

The state is looking for 800 volunteers to take part in the pilot program. Volunteers who agree to have their mileage tracked in the tax trial are entitled to up to $400 in incentives.

This includes initial and concluding bonuses, each $100, and a further $200 awarded to participants who fulfill their mileage tax commitments throughout the trial period.

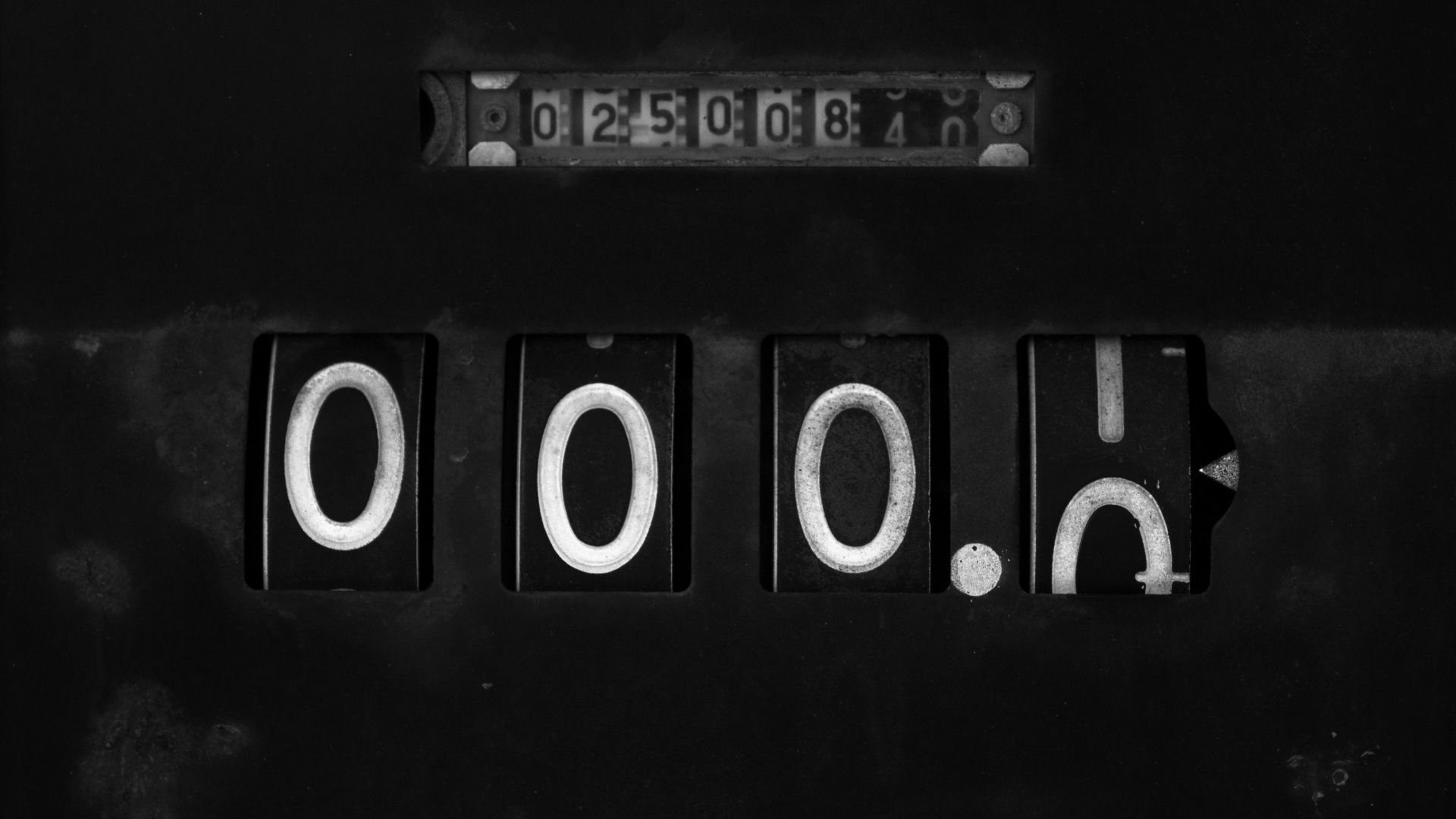

Tracking Mileage

There are a few different ways trial participants can report their mileage as part of the six-month trial.

Trial volunteers can have a tracking device installed in their vehicle or make use of any built-in mileage tracking features their vehicle might have. They can also manually submit odometer readings if they wish.

There Has Been Some Pushback

Though this is a simple opt-in pilot scheme for a new taxation approach, it has been met with some opposition.

El Cajon Mayor Bill Wells took to X to say it’s important to “push back” against mileage tax proposals made by the state, saying “San Diegans have made it clear, they do not want to be tracked and taxed.” He’s critical of the approach, suggesting there are other ways to pay for transportation infrastructure without a mileage tax that “invades your privacy.”

California Leading a Trend?

California’s per-mile tax program could set a precedent for other states looking at how best to tax vehicles. Many are already considering similar measures.

Oregon and Utah have already put voluntary mileage tax programs in place. Charges are lower, ranging from 1 to 2 cents per mile. States like Massachusetts and Washington are exploring mile-based tax legislation.

Other States Have Different Approaches

With the growing number of EVs on the road, many states are looking at reassessing how they tax vehicles. Not all have landed on a per-mile tax approach, however.

Texas has opted to impose a $200 per-year registration fee on owners of EVs in an attempt to offset losses of gas tax revenue. Other states are exploring the viability of taxing the electricity used by EV owners at public charging stations to recoup gas tax losses.

Will the California Model Catch On?

The makeup of cars on America’s highways is changing. While potentially a benefit for the environment, more EVs aren’t so great for state budgets. As shown, many states are looking to implement solutions to offset gas tax losses.

It remains to be seen whether the per-mile model will catch on across the nation, but California is at least being proactive in trying something. This may well have a domino effect of inspiring other states to try something, and if this pilot is successful, they may well just adopt the California model.

California Wants to Encourage Even More EV Adoption

Steps have to be put in place as a loss of gas tax revenue is only going to increase. Particularly as EV adoption will likely skyrocket in the coming years.

California is committed to reducing its impact on global climate change and forging a sustainable future. To this end, they’ve declared that the sale of gas-powered vehicles will be banned by 2035.

California’s Green Future

The makeup of Californian highways is changing. In 2023, Californians purchased over 400,00 new EVs. The state continues to lead the way in terms of EV adoption. As America’s roads evolve and become greener, innovative solutions for road funding need to keep pace.

There’s debate over the best way to go about this, but California’s per-mile tax pilot will provide valuable insight into how states can maintain crucial public infrastructure in an increasingly electric future that renders the income models of the past obsolete.