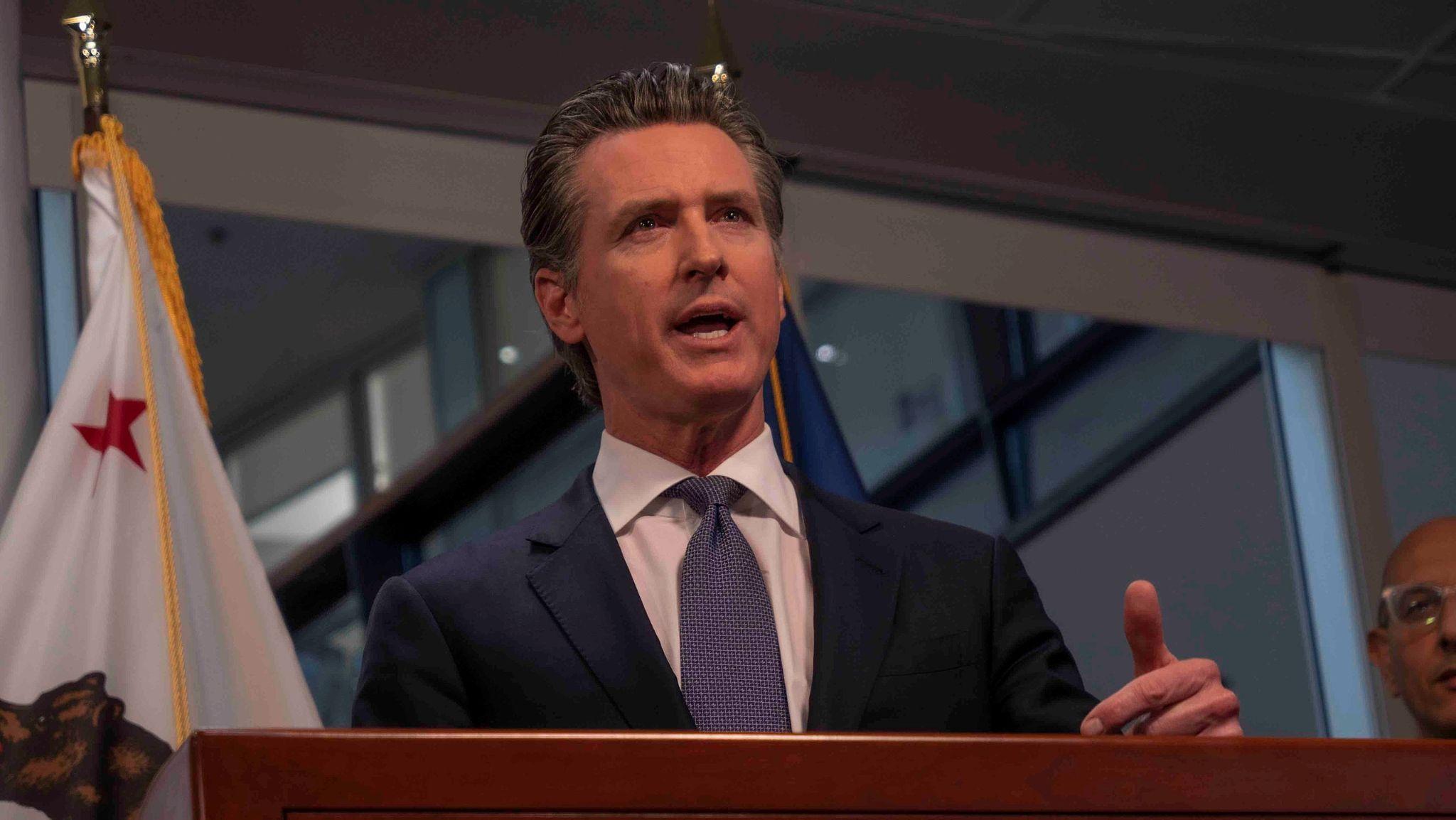

The financial issues in the Golden State are escalating. Instead of getting a shortfall, as anticipated by Governor Gavin Newsom, California is looking at a billions dollar deficit.

While cuts to the budget are planned, the solution is not so simple. Many experts say the problem is big — perhaps too big for California.

A New Deficit

An updated data indicates a deficit that could reach $73 billion for the state. The Legislative Analyst’s Office cautioned a $68 billion shortage, but the actual numbers exceeded their estimates.

Initially, Gov. Newsom anticipated a $37.9 shortfall. But instead, California received $24 billion less money than anticipated.

Budget Cuts Proposed

The first solution Gov. Newsom and the lawmakers proposed is to cut the budget by $12 to $18 billion.

Another proposed move is to raise taxes or borrow money. But these moves still prove to be problematic.

Major Proposals

California’s major proposals include delaying $1 billion for transit infrastructure and another $550 million for preschool and kindergarten facilities.

The state also wanted to shift $1.8 billion of cap-and-trade revenue intended to reduce greenhouse emissions to backfill other programs.

Tax Worries

Raising taxes would require a two-thirds vote in Sacramento. This would be very challenging.

Furthermore, the lawmakers are also concerned about making taxpayers pay more tax during a time of economic uncertainties and political limitations.

Rainy Day Fund

Back in January, it was announced that Newsom planned to dip into the state’s reserves (often called the rainy day fund). It was a plan that would’ve saved investments in education and public safety.

However, this plan might not be viable. Republican Assemblyman James Gallagher once called the governor’s budget plans “pure fantasyland.” He accused the governor of not minding his “overspending.”

Curb the Spending

Gallagher said, “His proposal is to empty out the savings account and nothing to really fundamentally fix our spending problem.”

But Assembly Speaker Robert Rivas warned of tough times ahead if the state considered steep program cuts.

State Income Reduced

States like California and New York are facing huge losses, with state income decreased by 4%. This is because they no longer receive federal pandemic aid.

As a result, many states are striving to balance their budgets with different strategies involved. Some states like Arizona, Colorado, and Utah are cutting taxes. But California and New York might need to raise them instead.

Temporary Solutions for Fundamental Issues

California lawmakers’ solutions are considered temporary: putting a stop to spending and using money from savings. However, the fundamental issues in the state are much more vital.

For example, a big portion of the budget goes to public worker salaries and benefits, costing the state $40 billion. The proposal mentioned earlier also planned to reduce funding for state departments by more than $760 million, based on vacant positions, and deferring another $1.6 billion in employee pay. But reducing these costs might not be enough.

Unstable Tax System

Charging more tax is an even riskier move if you consider an L.A. Times column that blames California’s tax system as unstable because it relies “too heavily on the rich. And politicians are too cowardly to fix it.”

The news agency described it as an “irresponsible policy” that creates chaos in budget planning and drives some well-heeled taxpayers out of the state.

Worthy Public Services Axed

And now the state is reaping what it’s sown: worthy public services programs are in danger of getting axed. These programs include homelessness prevention and low-income housing funding.

Before the new budget is passed on the June 15th deadline, there may be more cuts targeted on schools, parks, and health care.

Long-Term Fix Needed

With the economy facing tough times and signs of a recession looming, the state and federal government must take action now.

In California particularly, politicians from warring parties need to find a compromise for the budget to work. Only with compromise and cooperation can the state fix its deficit without surrendering essential service.