Some of the largest banks on the planet are reporting plummeting numbers, and a few have even closed their doors for good in the past few months.

And it seems that the common denominator throughout these struggling banks from New York to Tokyo is significant losses within the commercial real estate industry.

NYCB Lost $353 Million Last Quarter

The New York Community Bancorp (NYBC) reported a $252 million loss last quarter and, consequently, experienced a 38% drop in stock prices.

Within its report, the giant bank noted that it reserved $553 million to cover loan losses, most of which was spent on office buildings. CEO Thomas Cangemi blamed the company’s downturn on “general office weaknesses throughout the country” on an investors’ call last week.

Japan’s Aozora Bank Also Blames US Offices

Aozora Bank from Japan simultaneously reported a significant loss of $1.9 million in 2023, which it also blames, at least in part, on US offices.

The Japanese bank said that it hopes American commercial real estate will “stabilize” over the next year or two as people return to in-person offices. But for now, Aozora is experiencing a 21% decrease in its stock.

Julius Bar in Switzerland Is Experiencing Residual Effects

Julius Bar is one of the most well-known private banks in Switzerland, but even this wildly successful company is reporting shockingly low numbers.

The company’s adjusted profit plummeted by 55% in 2023, thanks to a $680 million loss on loans. The situation is so bad at Julius Bar that its CEO, Philipp Rickenbacher, consequently retired.

Deutsche Bank Lost $133 Million from Commercial Real Estate Loans in the USA

Additionally, the largest bank in Germany, Deutsche, recently announced that it used an almost unbelievable $133 million last quarter for potential defaults for loans on US commercial real estate.

That’s more than four times what the bank allocated for the same quarter the year before. Because Deutsche Bank is such a behemoth operation, the German bank will survive the significant loss, but other banks weren’t so lucky.

Some Major Banks Have Even Been Forced to Close Down for Good

Disappointing numbers are frustrating, but they’re nothing compared to having to completely close down. That’s what happened to several banks, such as First Republic, which shut down in May of 2023.

First Republic’s closing was considered the second-largest bank failure of all time, behind Washington Mutual, which fell during the financial crisis of 2008.

Hurried Takeovers Are Creating a Larger Problem

When banks fail, other financial institutions acquire their customers and, as a result, their loans. For many companies, annexing banks that couldn’t make it work is a solid business decision.

However, it is quite costly, so when they’re already struggling, it can become a burden. For example, NYCB acquired $13 billion worth of loans from Signature Bank, which failed last year. And with skyrocketing interest rates over the last year, they have yet to make that money back.

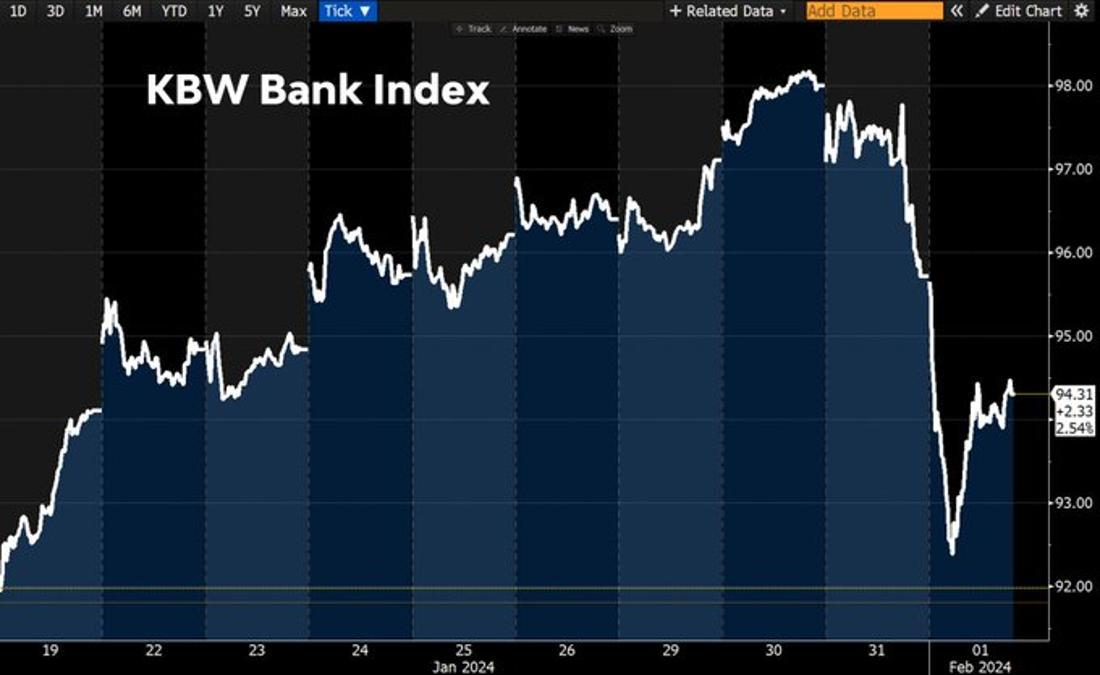

Banking Loses Around the World Are Directly Affecting the KBW Index

From closings to losses worth hundreds of millions of dollars, banks around the world are struggling more than they have in years. As a result, the KBW Bank Index, a benchmark for the entire banking industry, is absolutely plummeting.

With almost every major bank experiencing crashing stock prices, the KBW is falling every day and is currently as low as it has been in four years.

Why Are These Banks Crashing?

There is typically a wide variety of factors that play into a stock market crash. But in this case, the majority of the struggling or even failed banks have reported that the main factor is the ever-decreasing value of commercial real estate in the USA and around the world.

Part of this problem is that, since the pandemic, thousands of companies have abandoned their office buildings in favor of the work-from-home model. Not only were their employees happy to stay home instead of commuting, but these businesses also saved a fortune on renting commercial spaces.

High Interest Rates Are Also Playing a Part

Hundreds, if not thousands, of empty office buildings, are certainly a problem, but that’s not the only issue the commercial real estate industry is facing.

With today’s extremely high interest rates, real estate developers who would typically use substantial loans to fund their projects aren’t able to repay as they used to.

Banks Are Hoping the Federal Reserve Will Cut Interest Rates

In the wake of this dramatic turn of events in which banks’ stock prices are falling by more than 50%, and some are closing their doors. Therefore, the banking industry has been begging the Federal Reserve to cut interest rates as soon as possible.

However, according to the New York Times, while Federal Reserve officials have “hinted that their next move will be a cut in interest rates,” it will still be at least several months until that happens.

Will Corporations Returning to Work Make a Difference for Banks Around the World?

There are some financial and banking experts who argue that as soon as the world and, specifically, America, returns full-time to in-person office spaces, the commercial real estate industry will level out, and the banks will bounce back.

However, the Federal Reserve will need to cut interest rates in order for the banking industry to truly and wholly recuperate.