Bipartisanship in the US is surprising, particularly during a presidential election. So Democratic and Republican leaders both seem to need to lay out a sovereign wealth fund to assist the US with financing projects.

Plans have been quietly in development for a sovereign wealth fund over the past few months.

Top Aides

Top aides to President Joe Biden, including National Security Advisor Jake Sullivan and his deputy, Daleep Singh, have been working on plans for the fund.

The specifics, including the structure, financing, and investment strategy, have not been disclosed yet. However, planning documents are making the rounds in the White House and Biden desires to get it off the ground before he leaves office.

“Great National Endeavors”

News of Biden’s intentions came not long after former president Donald Trump asked for a comparable state-owned investment fund to back “great national endeavors” during a campaign stop at New York’s Economic Club.

Countries like Saudi Arabia and Norway which generate vast wealth from their natural resources are some of the countries that have sovereign wealth funds and are an old concept to finance large projects.

Large Profits

Nations move their cash reserves to the state-owned fund so it can develop.

The largest sovereign wealth fund in the world, Norway’s $1.6 trillion Government Pension Fund Global revealed that it netted $213 billion in profits last year thanks to returns on investments in tech stocks showing the potential for the idea.

Fund Resources

The Norges Bank Investment Management, the part of Norway’s central bank that controls the fund, said the fund is upheld by investment returns on equities, fixed income, real estate, sustainable energy infrastructure, and income from oil and gas production.

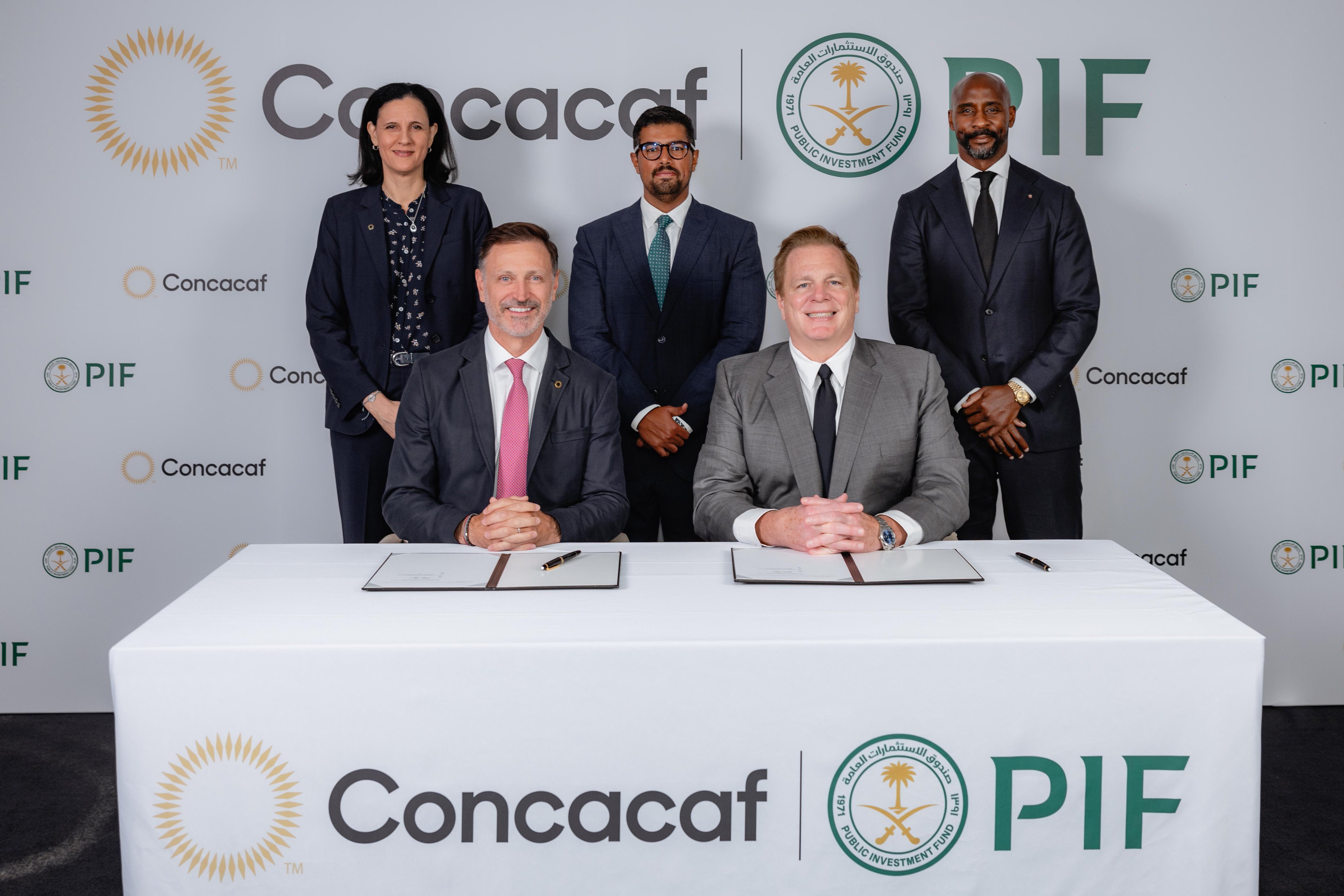

Saudi Arabia’s Public Investment Fund, which oversees about $925 billion in resources, detailed a $36.8 billion profit for 2023.

Allocation of Investment

According to the PIF, capital injections from the government, government assets transferred to PIF, loans and debt instruments, and retained investment earnings are the four sources of funding.

That cash is being utilized to put resources into everything from Uber and Blackstone to Heathrow and LIV Golf. It’s likewise utilizing it to fund Vision 2030, an enormous drive to change the nation’s economy and diminish its dependence on oil.

Potential Initiatives

It is unclear how an American fund would be financed or how it would work.

People familiar with the plans of the Biden administration have stated that if the United States established a fund, it would be able to invest in areas of national security such as supply chain initiatives, energy, and technology.

“Invest in the Growth of Our Economy”

Washington has considered the establishment of a sovereign wealth fund before. Sen. Angus Ruler and Sen. Bill Cassidy led a bipartisan group of lawmakers last March to discuss a sovereign wealth fund to pay for Social Security.

The fund would enable the United States to “be able to borrow at low interest rates and invest in the growth of our economy, and perhaps economies of other nations as well,” according to Sen. Mitt Romney, who attended the talks at the time.

Many Potential Uses

Lawmakers are excited by the prospect of the almost infinite number of potential uses for the fund if it can ever be funded.

Its desire to compete with China, which has multiple state-owned funds itself, appears to be one of the motives for the White House to move on a sovereign wealth fund.

“Bridge Financing”

White House staffers suggested that an American fund could support national interests by providing “bridge financing” for companies that are competing with China.

Quantum cryptography and other technologies with high entry barriers, such as geothermal and nuclear fusion, have been proposed for the fund’s support. Or it could buy futures contracts to make synthetic reserves of crucial minerals.

“Larger Than Any of the Existing Funds”

The sovereign wealth fund could also be used to lower the national debt.

In an interview with Bloomberg Television last week, billionaire John Paulson stated, “It would be great to see America join this party and instead of having debt, have savings. It would be, over time, larger than any of the existing funds.”

“Hard to Believe”

Although it may sound appealing, its success is contingent on sound investments and funding from the government.

In an interview with Bloomberg TV last week, Former Treasury Secretary Larry Summers said that it was “hard to believe that setting aside lots of funds for unspecified investments made in unspecified ways, where you don’t even know what it’s going to be called, is a particularly responsible, kind of proposal.”

While the idea seems to have bipartisan support, the clock is ticking on whether Biden can pull off the ambitious project before leaving office.