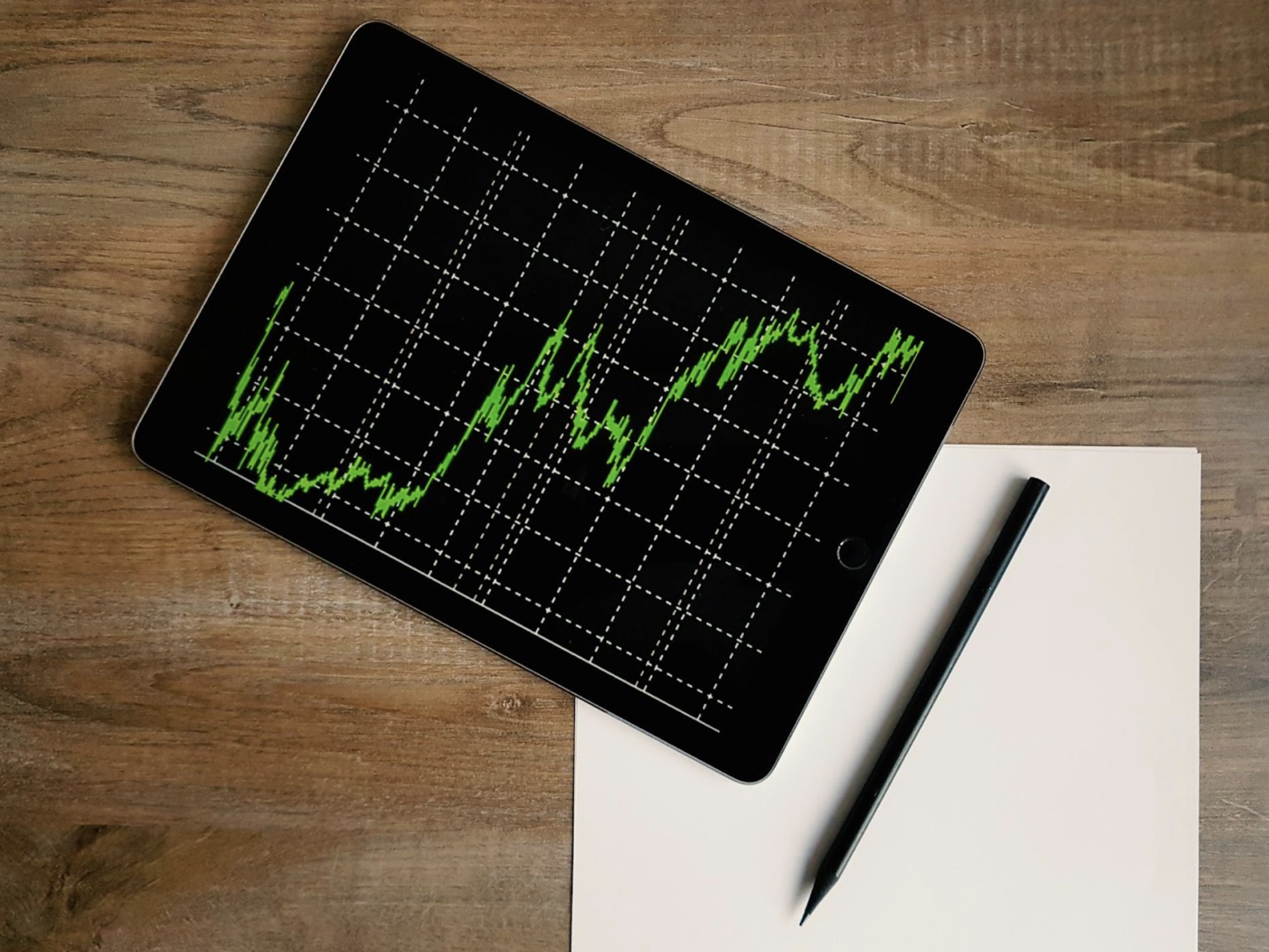

Donald Trump-owned media company, Trump Media & Technology Group, experienced a drop in its stock prices after only a week of trading publicly under the DJT ticker.

The stock dropped by 21%. The Monday closing price for Trump Media was $48.66. But although the drop is drastic, the company’s market cap is still $6.65 billion. And the former POTUS’ stake? Still worth $3.8 billion.

Public Dealing

The week before, Trump Media (DJT) soared 14% on the second day of trading on the Nasdaq. Trump Media & Technology Group is the parent company of Trump’s social media platform, Truth Social.

In its first day of trading, the company climbed 16%. It went public after a merger with special purpose acquisition vehicle, Digital World Acquisition Corp., (a shell company) after shareholders approved the deal.

Net Losses

The stock drop was most likely the result of an updated regulatory filing, the 8-K filing, that reported the company’s suffering from heavy losses and facing “greater risks” associated with Trump.

The filing stated, Trump Media reported sales of just over $4 million as net losses reached nearly $6 million for the full year ending December 31. The company expects losses to continue and there will be challenges to make profit.

Not Welcome News

According to the filing, Trump Media paid about $40 million in interest expenses and $16m in operating losses in 2023. This report certainly wasn’t welcome news to shareholders.

Compared to last week, the Monday closing price was $30 lower than the $79.38 high per share it hit when it became publicly traded. Trump’s share also took a hit of around $2.5 billion less than they were last week.

Initial High Valuation

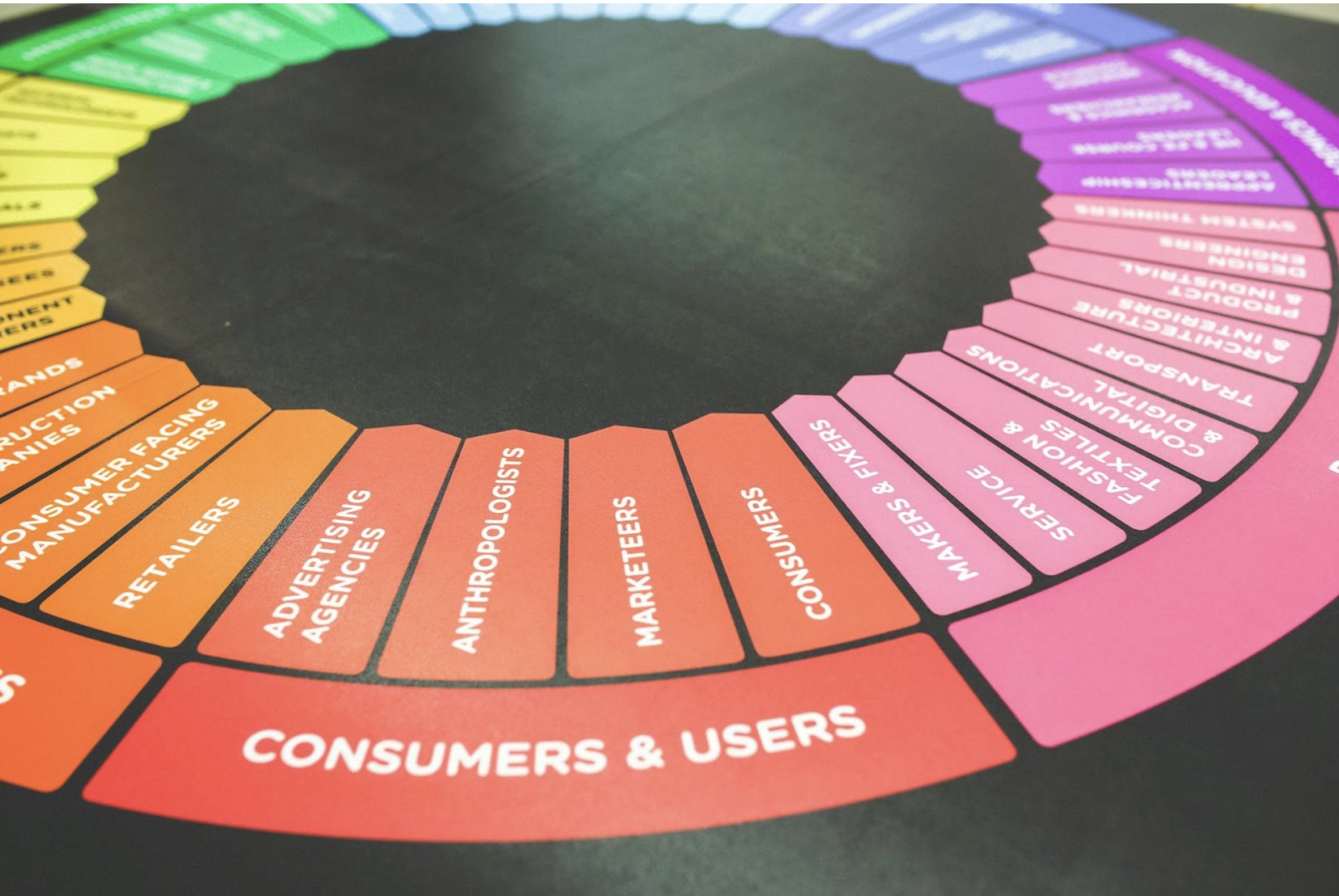

Why was the initial price so high? According to analysts, the initial valuation of DJT was high because Trump’s political supporters purchased the stock. However, their enthusiasm in owning part of Trump’s company might have created unique risks.

The 8-K filing said Trump Media “may be subject to greater risks than typical social media platforms because of the focus of its offerings and the involvement of President Trump.”

Legal Troubles

The company’s more comprehensive annual report filing listed those risks in more detail. It cited Trump’s legal troubles as one of the possible causes of a negative impact on TMTG’s stock price.

The 10-K filing stated: “TMTG’s success depends in part on the popularity of its brand and the reputation and popularity of President Trump. Adverse reactions to publicity relating to President Trump, or the loss of his services, could adversely affect TMTG’s revenues and results of operations.”

CEO’s Statement

An explanation from Trump Media was not entirely transparent. Trump Media CEO Devid Nunes released a statement to CNBC announcing, “We are excited to be operating as a public company and to have secured access to capital markets.”

The statement continued, “Closing out the 2023 financials related to the merger, Truth Social today has no debt and over $200 million in the bank, opening numerous possibilities for expanding and enhancing our platform. We intend to take full advantage of these opportunities to make Truth Social the quintessential free-speech platform for the American people.”

Truth Social

This particular social media platform was launched in 2022 after Trump himself was banned from Twitter (now X) and Facebook due to his involvement in the 2021 US Capitol attack.

The platform used X’s rival Mastodon as its backend, which provided an alternative to the platform he was previously most vocal on. Even after his membership was reinstated in X and Facebook, he still uses Truth Social as his main social media platform.

Not-So-Great Social

Truth Social claimed to have more than 8 million people signing up for its service. But it has refused to share the performance metrics that would give shareholders a better overview of how it operates.

Analytics firm Similarweb offered a figure of below half a million active users in February this year. But this is not impressive, considering other platforms like the Meta-operated Facebook had 3 billion users logging in every month.

Zero Actual Value

Talking Points Memo founder Josh Marshall reacted to the news by posting a series of threads on X. He wrote, “Truth Social has trivial levels of and like 15x the expenses. So business bleeding money like crazy.”

He followed it up with: “This company has zero actual value. The best case for its value is that they haven’t actually tried to build the user base. So it’s as tho it was still a prospectus with an amazing strategy. But in fact it’s been around for two years and has an INSANE amount of publicity behind it. Again, this company has no value. Or I guess better to say that whatever value it may have is premised on the say so of Donald Trump.”

More Users Needed

A professor of political science in University of Nottingham in the UK, Todd Landman, is of the opinion, despite not being widely popular among social media users, Truth Social’s value will only go up if it adds more users.

“The potential success of Truth Social (and the DJT stock) thus rests on attracting a much larger volume of users and providing an attractive blend of content, functionality, and services,” the professor said to Newsweek. ”Whether its offer proves attractive is very much an open question.”

End of the Line?

US account firm BF Borgers CPA PC questioned whether Trump Media could continue running under the losses it suffered from as it raised “substantial doubt about its ability.”

And with Trump’s own net worth also suffering by more than $1 billion thanks to the same loss, would anyone raise any doubt about his continued influence? No one knows yet, but we doubt Trump would care.