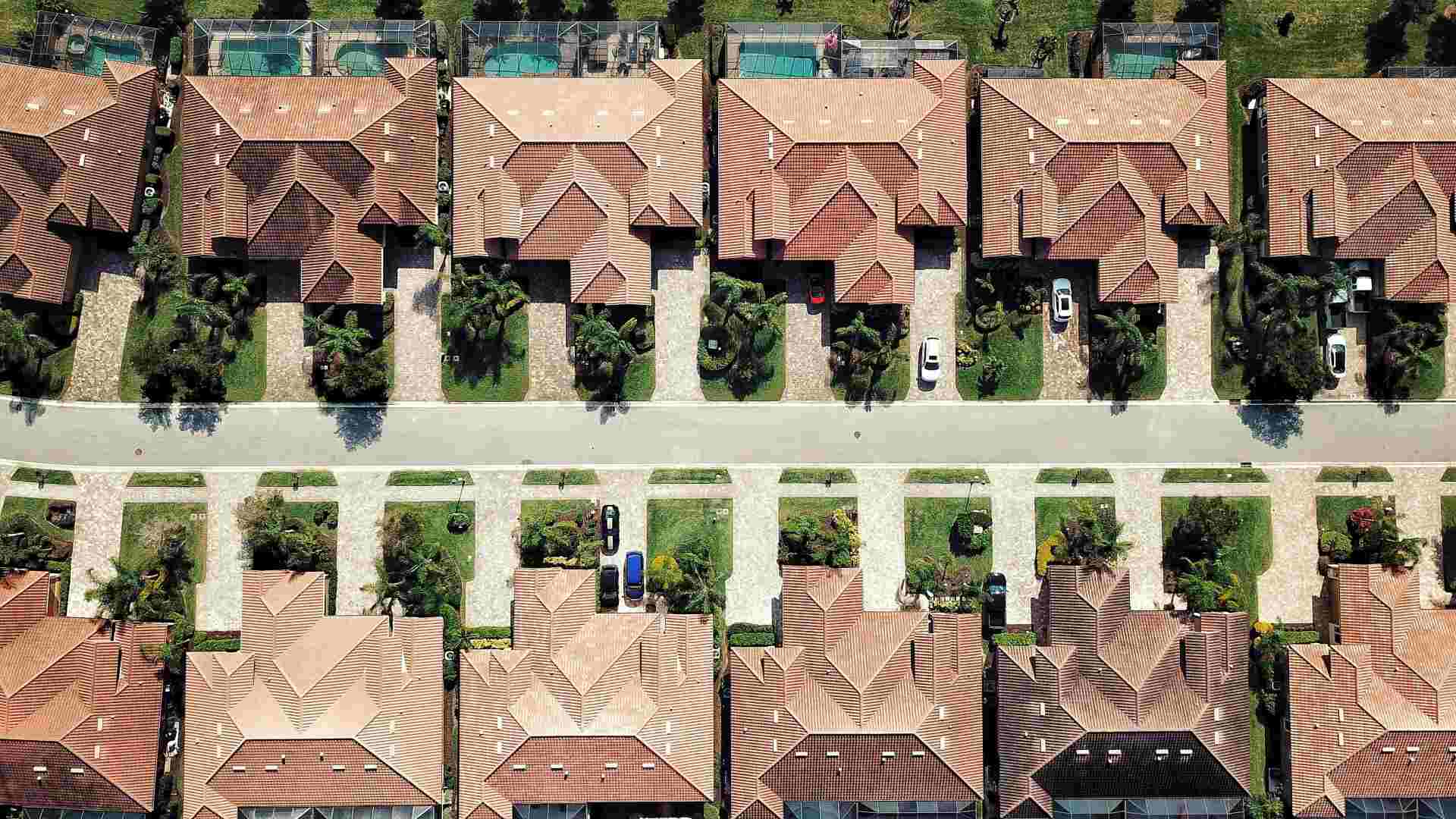

In places like Florida that are seeing record natural disaster events, insurance companies are finding it increasingly difficult to continue offering policies amid the rising financial risk.

A new report released by Redfin shows that over 70% of Florida homeowners are struggling with rising insurance costs, with 12% saying they have been dropped by their insurer in the past year. This is higher than the national average in this survey, which found only 44% of Americans say they have been affected by rising home insurance costs or changes in coverage.

Redfin Report

This Redfin report published on April 17 released some unencouraging statistics for Florida residents. 70% of Florida homeowners reported difficulties with price increases or changes in coverage that threaten their policy. 76% of Florida homeowners who reported such a change said that it was a policy premium increase.

In the report, 70% of Florida homeowners reported difficulties with price increases or changes in coverage that threaten their policy. 76% of Florida homeowners who reported such a change said that it was a policy premium increase.

Florida Versus California

The Redfin report made a point to compare results between Florida homeowners and California homeowners.

10% of California respondents in the survey said that their insurer had stopped offering coverage for their homes while 12% of Florida survey respondents reported having been dropped by their insurance company. Compared to the 70% of Florida homeowners who reported policy changes, 51% of California homeowners said the same.

Future Worries

This survey found that homeowners are also increasingly worried about being dropped by the insurer in the future. 27.7% of Florida residents surveyed said they were concerned that their insurance company may stop offering coverage for their home.

This number is much larger than the average in the rest of the country and even in California. 13.5% of California respondents reported feeling the same way, and only 8.9% of survey respondents as a whole felt this way.

Relocation

Some Florida residents are choosing to relocate amidst these insurance challenges. 11.9% of Florida respondents who said they plan to move in the next year said their reason was rising insurance costs. This is nearly double the national average of 6.2% in the report.

In California, 13.1% of residents who said they are relocating cited a risk of natural disasters or other climate risks.

Real Estate Agents

In its report, Redfin also publishes the results of a real estate agent survey. While 34% of real estate agents reported having an increase in insurance-related issues in the past year, that number in Florida was 73%.

The results for real estate agents came from a separate Redfind-commissioned survey conducted by Qualtrics in December. This survey examined the opinions of 500 real estate agents from a variety of brokerages in the United States.

Insurance Housing Crisis

In an April 17 news release on the report, Redfin described how the insurance crisis is taking hold in places like Florida and California.

“Insurance is top of mind for homeowners in Florida and California because those states are the epicenters of the insurance housing crisis,” the release said. “Many homeowners have seen their premiums skyrocket, and some have lost coverage altogether because intensifying natural disaster risk has prompted many insurers to stop doing business in Florida and California.”

Why Are Insurers Dropping Customers?

In places like California and Florida, insurers are having difficulty writing policies that can adequately cover the increasing risk of natural disasters.

According to Redfin, Seven of the largest property insurers in California have recently stopped offering new policies in the state. In Florida, 11 insurers have withdrawn while flood and storm damage risk increases.

Florida’s Storms

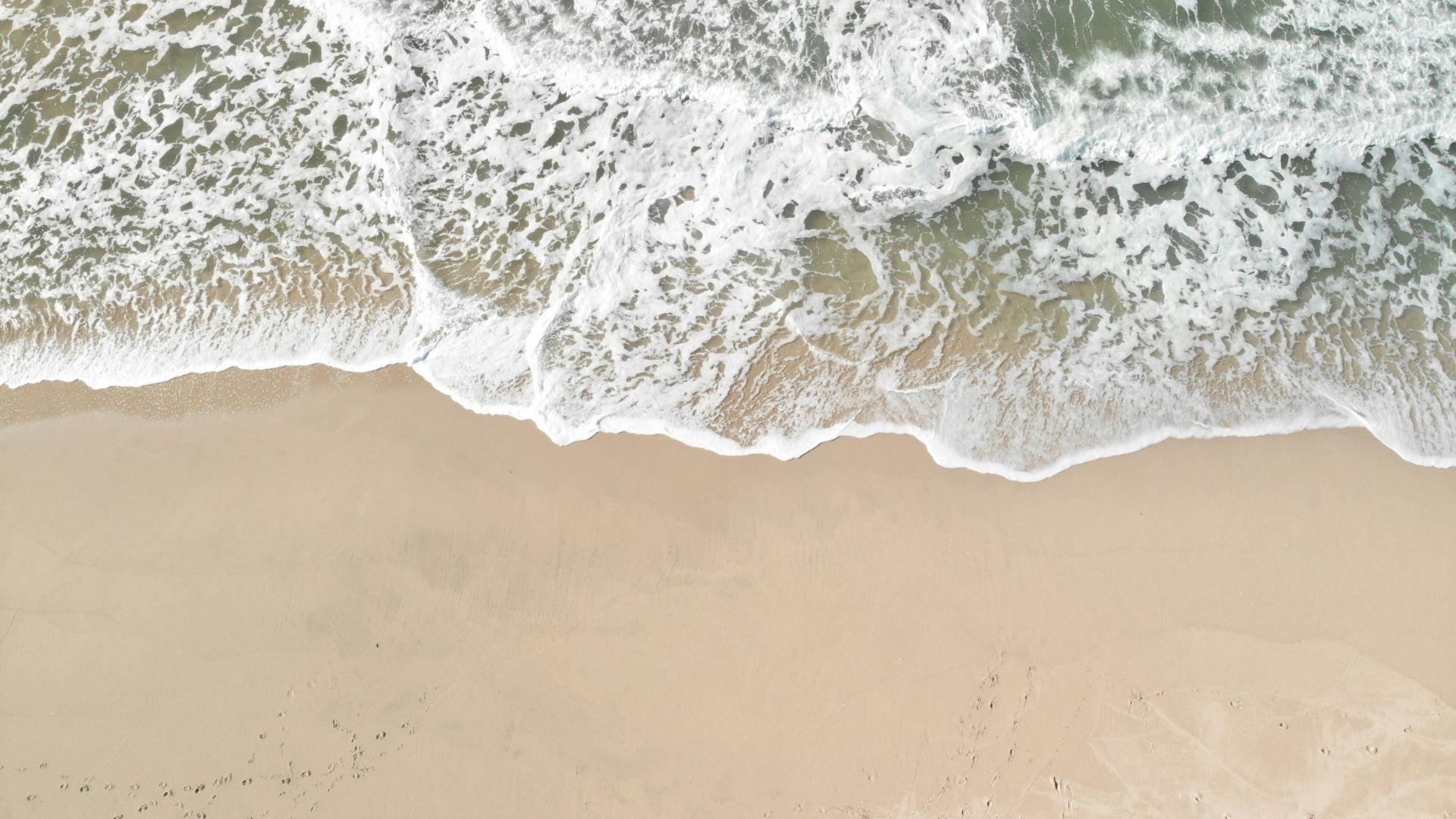

According to Climate Central, the effects of climate change have been increasing the risk in recent years of home flooding in Florida due to the increased intensity of storms, a retreating coastline, and a population crowded around the shore.

The EPA predicts that the ocean levels along the Florida coast will rise between one and four feet in the next 100 years and that tropical storms and hurricanes have become markedly more intense during the past twenty years.

Living By the Sea

According to the ICC in 2020, some 2.4 million people and 1.3 million homes live and sit within 4 feet on a local high tide line in Florida. Florida makes up about half the nation’s flood risk for homeowners by itself.

The ICC asserts “tropical storms, hurricanes and storm surge put more real estate and people at risk from sea level rise in Florida, than any other state by far.”

Eroding Shore

As the Florida coast is continually battered by high-intensity storms, it doesn’t just cause property damage in the short term. These storms cause the land near the ocean to continuously erode, causing water levels to rise and encroach on human real estate. In 2023, the Florida Department of Environmental Protection (DEP) identified massive areas on Florida’s coast that are “critically eroded.”

According to the DEP, these are areas where “natural processes or human activity have caused or contributed to erosion and recession of the beach or dune system to such a degree that upland development, recreational interests, wildlife habitat, or important cultural resources are threatened or lost.”

Vulnerable Coastline

Sea level rise is a more threatening problem in Florida because of the state’s average low-lying coastal topography and its coastline’s massive size. It’s much harder for people to construct proper barriers to protect the coastline amidst these challenges.

According to the Florida Climate Center at Florida State University, it is “virtually certain” that global sea levels will continue to rise, causing a greater risk for increased damage to Florida’s coast.